Fintech refers to the application of innovative technologies in different financial sectors, including banking, stock markets, insurance, and others.

Such technology makes financial services accessible to the public and much less costly than before. Thus, it has begun disrupting traditional methods in financial service deliveries typically provided by gigantic, prestigious financial institutions.

Undoubtedly, the disruption is real. As a result, all banks, brokerages, financial institutions, or real-sector companies have to reform their business model to compete with Fintech startups.

The most prominent examples are the reduction of stock trading commission to nil during recent years, usage of AI in financial trading, and the wide adoption of cryptocurrencies as financial assets.

The industry is ripe for potential. Analysts projected it to grow 25-30% per year for the next few years. Hence, no one could underestimate the power of Fintech anymore.

I think it is compelling to learn more about Fintech right now. The knowledge you learn can open up new lucrative career prospects in a thriving industry.

This post will introduce you to the best online Fintech courses that will help you understand the theory, structure, and application of financial technologies.

You can then freely choose the one that suits your preferences without risking your money on low-quality online courses or tutorials.

Affiliate Disclosure: This post from Victory Tale contains affiliate links. We will receive a small commission from course providers if you purchase Fintech courses through our links.

Nevertheless, we always value integrity and prioritize our audience’s interests. Therefore, you can rest assured that we will present these courses truthfully.

Things You Should Know About the Best Online Fintech Courses

Prerequisites

Most courses have no prerequisites, so everyone can start learning right away. However, a background in finance may also be beneficial.

Criteria

Below are the criteria for the best online fintech courses:

I will routinely review all Fintech courses on the list. If they fail to meet quality standards, I will delete them immediately.

1. Harvard Business School Fintech Program (Getsmarter)

Harvard University also has an excellent online Fintech program for executives on the Getsmarter platform. Students will grasp an overview of the Fintech industry and be able to respond to disruptions to their businesses.

Course Content

Below is a summary of what you will learn from the program

1. Reshaping the Banking and Payments Industry – The first module will primarily cover the impact of the rising Fintech industry on the traditional banking and payments industry.

You will perceive how the Fintech industry revolutionizes payment methods, helps us break away from the currency regime, and reshape financial institutions in the 21st century.

2. Raising Money with Fintech – The second module will discuss how the Fintech industry alters the traditional financing process by introducing crowdfunding and peer-to-peer lending.

3. Harnessing Data with Artificial Intelligence and Machine Learning – The third module essentially explains how AI, machine learning, and data science influence financial markets and trading.

4. Transforming Personal Finance with Fintech – This module will introduce you to robo-advising and how it revolutionizes personal finance. You will grasp how such innovative technology will change the industry in the long run.

5. Demystifying Blockchain and Cryptocurrency – The fifth module will explain the foundational knowledge of blockchain technology and cryptocurrencies. You will understand how several industries use them in business.

Finally, the instructor will analyze the potential and pitfalls that may or may not propel Bitcoin as an officially recognized form of currency.

6. Forging the Future of Fintech – The sixth module focuses on regulations and the clash between traditional financial institutions and rising Fintech startups. You will perceive who will benefit most from the emergence of the Fintech industry and be able to provide solutions to real-world problems.

Throughout the course, the instructors will utilize the Case Method Approach pioneered by HBS. In other words, you will be looking into various case studies that will help your understanding of core concepts.

At the end of the program, you will work on a capstone project that will offer opportunities for students to use all the knowledge they learned from previous modules.

The weekly commitment for this program is higher than most executive courses but still manageable. According to Getsmarter, you should spend 8-10 hours on the modules, and you will complete the program in 6 weeks.

The tuition for this program is $3600, which is costlier than other alternatives. However, all lessons and course materials are of high quality. The program also offers excellent opportunities to connect with executives around the world. I would say it is perfectly worth the price.

If you are still unsure, you should get the course prospectus by clicking on the button below.

Pros and Cons

Pros

- Learn from leading faculty members of HBS

- Excellent learning platform with innovative online campus

- Comprehensive Curriculum

- Manageable bite-sized modules with incremental deadlines

- Examine real-life challenges through the Case Method Approach pioneered by Harvard Business School (HBS)

- Informative lessons

- Changeable start date

- Provide networking opportunities

- Receive premier certificate from the university upon program completion

Cons

- Costlier than most alternatives

2. Fintech: Foundations & Applications of Financial Technology Specialization

This Coursera specialization from Wharton, a world-renowned business school, will teach learners the fundamentals of the Fintech industry and its real-world applications.

There is no prerequisite for this specialization. Everyone can start learning right away.

Course Content

The specialization comprises four minor Fintech online courses. Each of them will introduce you to different financial technologies.

1. Fintech: Foundations, Payments, and Regulations – The first course will discuss the role of Fintech in shaping the investment world and how it changes the structure of payment systems. You will also learn about new regulations that emerged after the rise of Fintech.

Best of all, you will understand how to develop the optimal fintech strategy for your business according to best practices.

2. Cryptocurrency and Blockchain: An Introduction to Digital Currencies – The second course will introduce you to the foundations of blockchain and cryptocurrencies

You will also learn how to assess risks regarding these assets and incorporate them into your investment portfolio prudently.

3. Leading, Crowdfunding, and Modern Investing – This online course will explain the theories behind popular investing and financing tools, including Robo-advising, crowdfunding, and marketplace lending.

You will grasp how your business and investment portfolio can benefit from these technologies and achieve a stellar return on your investments.

4. Application of AI, InsurTech, and Real Estate Technology – The final course will provide insights on the application of machine learning and AI in the insurance and real estate industry.

You will have a chance to look into how both industries develop after the implementation of the technology.

There are several case studies equipped with each course. Thus, you will clearly understand how real-world companies adapt to the change and finally be able to create a suitable strategy for your business ecosystems and investments.

You can audit the entire specialization for free. However, full access, which grants graded assignments, feedback, and a shareable certificate, costs $79 per month.

Since the course is mainly theoretical and has a minimal workload (1 hour per week), I don’t think full access is necessary.

However, you can start a 7-day free trial to assess them independently or subscribe to Coursera Plus (see below) for better value for money.

Pros and Cons

Pros

- Best Fintech courses for those new to the financial sector

- Informative, comprehensive, and straightforward lessons

- Learn with experts from a world-class university

- Several real-world case studies provided

- Best for those who want to understand the foundations behind new investing technologies or evaluate investment products for portfolio optimization.

Cons

- US-focused, thus may not be applicable for international learners (especially the regulation part)

- Some reviewers note that some of the readings are not very impressive.

- Expensive

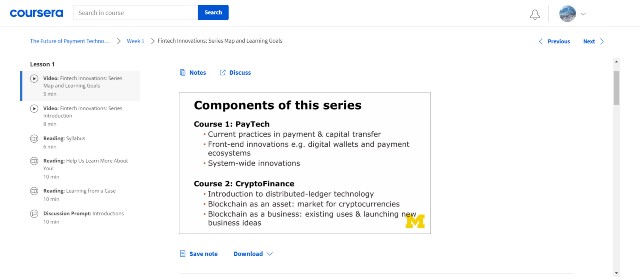

3. Financial Technology (Fintech) Innovations Specialization

This specialization from the University of Michigan is an excellent introductory course for those who want to be familiar with various innovative technologies in the financial industry.

You will perceive how “the old” and “the new” are different and how to adopt “the new” in your careers.

The only prerequisite for this course is basic statistics.

Course Content

This specialization comprises four online courses as follows.

1. The Future of Payment Technologies – The first course will provide an overview of revolutionary technologies that completely change how we make payments.

You will understand each payment technology’s strengths and weaknesses, its core infrastructure, and how we will benefit from digital finance and Fintech innovations such as tokenization, digital wallets, etc.

2. Blockchain and Cryptocurrency Explained – The second course will explain the core foundations of blockchain and cryptocurrency and then examine the development of several coins as financial assets.

Moreover, you will learn from multiple case studies, which will manifest how blockchain can be one of the essential fintech solutions for real-world companies.

3. Raising Capital: Credit Tech, Coin Offerings, and Crowdfunding – This Fintech course features some of the most disruptive innovations in the financial services industry.

You will understand how new financial technologies change how consumers and businesses raise capital and access credit markets. Subsequently, you will grasp the advantages and disadvantages of each Fintech innovation.

4. Innovations in Investment Technology: Artificial Intelligence – The fourth course will guide you on how AI emerges as a powerful tool for the investment and wealth management industry.

Upon course completion, you will realize all the benefits it brings and the remaining challenges AI users may have.

The course workload is 2 hours per week, which is manageable and not too minimal. In addition, auditing the entire specialization is free, while full access costs only $39 per month (a free 7-day trial is also available.)

This specialization covers almost the same content as the Wharton one, but the monthly subscription fees are much lower. Thus, I think UMich’s specialization is an excellent affordable alternative.

Pros and Cons

Pros

- Beginner-Friendly Online Fintech Course

- Learn from faculty members of a renowned university

- Provide a comprehensive overview of Fintech technologies

- Straightforward and informative explanations

- Affordable pricing

- Many reviewers note that the course has a good pace and a flawless balance between theories and applications.

Cons

- Some students pointed out that some minor references are missing from the course.

4. FinTech: Finance Industry Transformation and Regulation Specialization

This specialization from the Hong Kong University of Science and Technology focuses on Fintech disruptive innovations, business or career opportunities that come with them, and upcoming risks and regulations.

Unlike the first two specializations on this list, this Fintech course targets finance professionals. Therefore, the course content will undoubtedly be more in-depth. Nevertheless, no particular background knowledge is necessary.

Course Content

The specialization consists of four minor Fintech courses as follows.

1. Fintech Foundations and Overview – The first online course will help you understand Fintech fundamentals, its business applications, core technologies, and its impact on enterprises.

2. Fintech Security and Regulation (RegTech) – The second course will discuss the role of Fintech and RegTech technologies in transforming the financial industry.

You will also learn about government initiatives to regulate Fintech corporations, manage financial security, and reduce the risks of financial shenanigans.

Upon completion, you will be confident in responding to multiple regulatory changes concerning the Fintech industry.

3. Fintech Risk Management – The third course will provide insights on risk management and corporate governance in the financial sector after the emergence of Fintech firms.

You will learn how to analyze new risks in this changing environment and create suitable strategies to deal with them sustainably.

4. Fintech Disruptive Innovation: Implications for Society – This final course in the specialization will help learners identify real-world impacts from Fintech disruptions that may affect their business or financial career.

After completing the course, you will have a solid path to pursue your career and realize further opportunities in the rising industry.

This specialization has a moderate workload. You should spend 3 hours per week for five months on it.

You can choose to audit the specialization for free. However, subscribing for full access ($39 per month) is also an interesting idea, as the specialization has real-world projects for you to complete and enhance your understanding of the content.

You can experience the full course free for seven days

Pros and Cons

Pros

- Unarguably one of the best online Fintech courses for finance professionals

- Detailed and well-structured lectures

- Practical and useful course content

- Each lecturer has a different teaching style

- Every minor course has a hands-on project.

- Challenging quizzes

- Affordable

Cons

- Cover only general concepts and applications. No technical knowledge is explained.

- The transcripts are difficult to read.

5. Fintech: The Future of Finance

This edX program from UTAustinX (the University of Texas at Austin) is excellent for learning more about Fintech and its fundamental building blocks in detail.

Upon completion, you will understand how these innovative technologies impact traditional business models and how firms may build a competitive advantage in the new environment.

There are no prerequisites for the course.

Course Content

The program comprises four minor courses as follows:

1. Fintech: Overview of the Fintech Sector – The first course will introduce you to the Fintech sector and its associated technologies that are changing the financial industry.

You will learn about how financial institutions build competitive advantages and how emerging technologies can add value to them.

Instructors will also look into regulatory systems in the US and Europe designed to regulate Fintech firms.

2. Fintech: Blockchain for Business and Finance – The second course will tackle distributed ledgers, blockchain, and cryptocurrencies. You will fully understand the theories behind the technology and its diverse applications, such as digital wallets and exchanges.

Furthermore, you will also learn about enterprise blockchain solutions, financing blockchain ventures (Initial Coin Offerings or ICOs), and financial regulations of the technology.

3. Fintech: AI and Machine Learning in the Financial Industry – The third course will descriptively explain machine learning and deep learning concepts in financial contexts.

You will also have a chance to look into each practical machine learning application in finance, such as Robo-advising, social investing, and AI-assisted online peer-to-peer lending.

4. Fintech: IoT and APIs in the Financial Industry – The final course will discuss Internet-of-Things in Finance, APIs, Open Banking, and InsurTech. You will understand how these technologies can potentially reshape the entire financial industry.

The second part of the course will drill deep into our current flawed payment technologies and how Fintech firms are attempting to revolutionize them.

Throughout the program, the instructor will lead you to explore real-world business cases that help you understand the concepts. Some minor courses may include video interviews with prominent experts, which would broaden your insights and provide practical guidance.

The course content of this program is similar to the first two specializations on this list. However, the content will be more in-depth and thus require a more weekly commitment.

UTAustinX suggests spending 5-6 hours per work on the program, and you will complete it in approximately 4 months.

Unlike most edX courses, you cannot audit this program. If you are interested, you need to enroll in the course, which costs $2,790.

The course fees are very costly and to the same degree as advanced courses for executives (see below.) So even though I believe this program is undoubtedly one of the best online Fintech courses you could find, I don’t think it is worth the price.

Pros and Cons

Pros

- Comprehensive learning

- Detailed, Well-Structured, In-depth

- Excellent course material

- Learn at your own pace

- Several real-world business cases provided

- Moderate workload

- Potentially used for continuing education credits (some organizations only)

Cons

- Full access is costly.

- Free auditing is not available.

6. Digital Transformation in Financial Services Specialization

This specialization from Copenhagen Business School is intended for those interested in pursuing a career in Fintech, digital finance, and digital transformation. You will learn core concepts and use them to develop Fintech strategies of your own.

Hence, the specialization works best as a starting point to evaluate whether this field is suitable enough for you to pursue your future careers.

There are no prerequisites for this course.

Course Content

1. Digital Competition in Financial Services – The first course will provide insights into digitization and its power in transforming the financial services industry. You will learn about digital platforms and ecosystems essential to Fintech firms and other platform-based businesses.

2. FinTech and the Transformation in Financial Services – The second course will discuss the impact of the Fintech revolution that influences traditional financial institutions and the financial sector.

Subsequently, the course will examine the vital payment instruments, their functionalities, and the government’s attempts to regulate them.

3. Innovation Strategy: Developing Your FinTech Strategy – The third course will explain how to develop a sound business strategy for Fintech businesses. The instructors will also introduce helpful tools that can smoothen the process and eliminate potential problems.

4. Capstone Project – You will use all the knowledge from all three previous courses to work on the project. Your task is to comprehensively analyze a real-world company and create the most suitable digital transformation strategy for it.

From an overall perspective, the specialization is excellent if you want to learn about digital transformation strategy for the financial services industry.

I think it suits learners who have a general understanding of Fintech technologies and would like to drill deeper into the strategic level.

You should spend 3 hours a week for five months to complete the specialization. A free audit is available, while full access costs $49 per month.

I think the content of this specialization deserves paying full access. However, the second course has a severe problem with reference links and needs an update.

Hence, as of now, it might be best if you treat it as a free course and enjoy auditing.

Pros and Cons

Pros

- Well-Paced and Well-Structured

- Informative

- Excellent course material, especially several insightful case studies to learn from

- Practical hands-on projects

- Challenging quizzes

- Easy-to-read transcripts

Cons

- Lack of visual presentations in the lecture

- Many reference links on the second course are either aged or broken.

7. Fintech Startups in Emerging Markets Specialization

Unlike other Fintech courses on this list that focus on the European and US Fintech Industry, the University of Cape Town specialization provides insights on emerging markets’ financial sector.

Furthermore, this course aims toward those who want to become Fintech entrepreneurs. Undoubtedly, this specialization will provide a unique experience that no other courses can.

You don’t need to have any background knowledge for this course.

Course Content

The specialization comprises four courses as follows:

1. Financial Regulation in Emerging Markets and the Rise of Fintech Companies – The first course will discuss financial and banking regulations that emerged after the two financial crises. You will understand various factors that paved the way for the rise of the Fintech industry.

2. How Entrepreneurs in Emerging Markets Can Master the Blockchain Technology – The second course will carefully explain the technologies that are the fundamental building blocks of Fintech, including blockchain, distributed ledgers, and machine learning.

3. Building Fintech Startups in Emerging Markets – The third course will start by discussing basic entrepreneurship concepts. Subsequently, the instructors will provide valuable insights on Fintech business development, including stages, funding, intellectual property, and regulation.

This course will include interviews with several Fintech entrepreneurs for you to understand the development stages better.

4. Capstone – The final project will give you a chance to apply all knowledge learned from the first three courses. You will create a comprehensive business model and pitch for your Fintech startup.

After identifying existing opportunities, you will conduct a feasibility analysis by assessing the current regulatory environment and propose suitable Fintech technologies.

The workload for this specialization is 3 hours per week for four months. Free auditing is also available, but the learning experience will be significantly better if you subscribe to full access ($39 per month) to receive graded assignments and feedback.

The free 7-day free trial is also available for all students.

Pros and Cons

Pros

- Straightforward and Easy-to-understand lectures

- Well-organized and informative

- Excellent case studies from developing countries

- Practical final project

- Good for those who aspire to become Fintech entrepreneurs

- Affordable

- Unarguably one of the best online Fintech courses for emerging markets.

Cons

- Receiving feedback on some projects or assignments could take weeks.

Coursera Plus

If you want full access to more than one Fintech specialization from Coursera, you should subscribe to Coursera Plus.

At $399 per year (or $33.25 per month on average), you will gain access to all courses and specializations on the platform (more than 3,000 in total.) Therefore, you will not need to pay monthly fees to each anymore.

[sc name=”coursera” ][/sc]Emeritus

Emeritus is a platform that partners with top universities worldwide to offer the best online learning experience for students.

Similar to Getsmarter’s, Emeritus’ course is engaging and resembles an in-person executive program. The course also has excellent learning resources. All students will have full support from their professors along with a networking opportunity.

Upon course completion, you will receive a digital certificate directly from the university. Unfortunately, not everyone will receive it.

You have to do well on assignments and exams to graduate and receive the certificate. Therefore, your skills will be evaluated professionally as in college or graduate school.

You can then be sure that these Fintech courses offer a relatively similar learning experience to regular executive education programs many attended at the university.

8. Fintech Revolution: Transformative Financial Services and Strategies

This executive education program from Wharton will provide thorough insights into the Fintech Revolution and its influence on the financial sector.

In addition to understanding the Fintech ecosystem, you will learn how to formulate a transformation plan in your organization to assist in deploying financial technologies that can provide access to unexplored markets, improve profit margins, and heighten customer experience.

Course Content

This program consists of 6 minor modules as follows:

- Digital Transformation and Financial Services – exploring disruptions in the finance industry and identifying promising Fintech opportunities for your company

- Digital Payments and Marketplace Lending – looking back to learn about the current payment system to understand the obstacles that hinder the implementation of innovative online lending.

- Personal Banking and AI – gaining insights into how machine learning and AI can be used efficiently in Fintech and its popular applications, including Robo-advisors and peer-to-peer lending.

- InsurTech and Real Estate Tech – perceiving how Fintech solutions revolutionize the insurance and real estate industries and realizing the lasting benefits of digital transformation

- Blockchain and Cryptocurrency – learning how blockchain and cryptocurrency work and articulating a strategy to use them in the finance industry

- Regulation – grasping an overview of current banking and financial regulations

Each module will have excellent learning resources, including real-world examples, projects, assignments, crypto demos, and guest speaker sessions.

Since the program is entirely dedicated to digital transformation, it is most suitable for senior-level managers of traditional corporations, consultants, and business analysts.

However, if you are or want to become a Fintech entrepreneur or investor, you might want to consider other alternatives (see below.)

The workload of this course is 4-6 hours per week for six weeks, which is relatively light compared to Emeritus’ standards.

The entire program costs $2600 (flexible payment is available.) Also, if you click the button below, you will get a $260 discount immediately.

9. Berkeley Fintech: Frameworks, Applications, and Strategies

The program from Berkeley Haas will focus on explaining the Fintech foundation and training students to execute transformational maneuvers to digitize their company, build Fintech startups of their own, or make a successful Fintech investment.

Course Content

The program consists of 8 modules as follows:

- Introduction and Fintech Revolution – explaining factors that led to the Fintech emergence and how Fintech reduced financial costs for consumers and businesses

- The Fintech Ecosystem – exploring transformational strategies for traditional financial institutions and identifying rising trends in the Fintech industry

- Economic Foundations of Fintech – evaluating the value of Fintech corporations and explaining how financial products and services can benefit from rising blockchain systems.

- Data Science – utilizing data science and machine learning to enhance financial technologies

- Analytics Methods of Tools – using several data analytics tools to address real-world Fintech problems.

- Financial Statements – analyzing financial statements of Fintech corporations

- From Idea to Execution – understanding how to raise capital effectively and deal with potential challenges.

- Success Factors and Strategies – applying multiple strategies to add value to the Fintech application and creating a plan to start a new Fintech company

Besides the theories, you will learn from several case studies, including Ant Financial, Square, and Venmo, to obtain various practical insights.

From an overall perspective, this program is an all-in-one Fintech course where you will learn financial technology, business strategy, technology-driven financial strategies, and economic aspects of the Fintech industry at the managerial level.

Compared to Wharton’s program above, this one focuses more on finance and valuation and is more comprehensive overall. Hence, this program is best for Fintech entrepreneurs and investors who want to start a new Fintech business or invest in an existing one.

The workload for this program is 4-6 hours per week for two months. The program fees are $2,600 (flexible payments are available.) However, you can get a $260 discount if you click the button below.

You can also provide your contact information to request a complete course syllabus and other program details.

10. Fintech Innovation: Disrupting the Financial Landscape

This program from the University of Cambridge offers unique insights into data trading in the Fintech industry.

You will recognize the positive and negative sides of data usage and utilize suitable technologies to address and prevent information problems.

Course Content

The course syllabus is as indicated below:

- Information and Innovation – perceiving how Fintech emerged by studying the traditional roles of banks, the changing environment, and three major information problems that impact the financial services industry

- Imperfection Information and Big Data – understanding Big Data’s role in the shift of information access and how AI can create opportunities to optimize revenues and profits

- Trusting Your Counterparty – analyzing current and future uses of blockchain and smart contracts to enable trust even with anonymity and eliminate information problems

- Asymmetric Information – discussing the nature of asymmetric information, a major problem in the finance industry, and how online lending platforms could address or mitigate it.

- Behavioral Biases and Nudge Solutions – identifying how financial technology can address behavioral biases and using machine learning algorithms for portfolio optimization

- The Dark Side of Data – examining Fintech ethics and analyzing risks regarding innovations

The program has several case studies that you will explore extensively, including China’s social credit systems, Wells Fargo, and Kiva’s peer-to-peer lending models.

As the program covers mostly information problems in the financial industry, I think the program best suits Compliance consultants, government regulatory officials, and senior-level management of banks or financial institutions.

In contrast, other online Fintech courses or programs will be more helpful if you are not into banking.

You will spend 4-6 hours weekly for six weeks completing the program. The course fees are $2000 (no discounts are available.)

Pros and Cons of Emeritus Fintech Courses

Pros

- Learn from world-class instructors

- In-depth and comprehensive

- Excellent learning resources (case studies, assignments, projects, exams)

- Good Student Support

- Robust evaluation system

- Receive a creditable digital certificate from top universities after course completion

- Provide networking opportunities

Cons

- Costly

- Not always available. All programs are instructor-led, so they will have a fixed starting date.

- Limited seats (You should attend early)

Other Alternatives

Professional Certificate in FinTech by the University of Hong Kong – This edX course from the University of Hong Kong features the Fintech world and its applications and limitations.

The content of this course is similar to different Coursera specializations but with less content.

If you are interested, you can undoubtedly audit this course for free. However, if you want full access, I think a Coursera specialization by the University of Michigan is a better alternative.