As Artificial Intelligence (AI) develops rapidly, AI has gradually become a significant force in the financial markets.

Still, many might wonder how traders can utilize the power of AI in stock trading.

The possibilities are endless. Traders and investors can use AI in price prediction, decision-making, portfolio management, and many others. Many top financial institutions, such as Goldman Sachs, have been using AI for several years.

Some may believe the usage of AI in stock trading is limited to professionals or high net-worth investors. However, it is not.

Currently, retail traders can access the technology through stock trading software products that utilize the power of artificial intelligence.

Thus, in this post, I have listed the three affordable and excellent AI stock trading software that yields excellent trading results. You can freely choose the one that fits your trading style the most.

Disclosure: This post from Victory Tale contains affiliate links. We will receive a small commission if you subscribe to these services.

Nevertheless, as we always value integrity and prioritize your interests, you can rest assured that all products in this post are presented truthfully.

Things You Should Know

Before proceeding with AI trading tools, these are essential points that you need to know beforehand.

First, although all the tools in this list are AI-powered, they are essentially different.

Some software works best for day traders, who profit from daily fluctuations on the stock market, while others may be more helpful if you invest in a longer timeframe.

Hence, no AI trading tool works universally for everyone. It is then vital that traders and investors select one that suits their trading style and risk level.

Secondly, using AI does not mean your trades will always be profitable. Although AI is powerful in analyzing immense amounts of data, it is still far from perfect. It does make mistakes in providing trade signals.

Furthermore, the stock market is volatile and can be completely unpredictable (i.e., black-swan-like market conditions or adverse events). Thus, you will inevitably incur some losses in your portfolio.

I believe the strength of AI trading software lies in these facts as follows.

- AI can spot trends and changes much faster, more comprehensively, and accurately than humans. Moreover, its recommendations are based totally on market data and evidence.

- It eliminates human emotion from the entire decision-making process. Fear and greed cannot cause your trades to be irrational. As a result, huge losses from these two sins will be out of the question.

Finally, you may or may not need any background knowledge to start using these AIs to trade stocks. This varies for each tool. It is essential to read the instructions or watch the tutorials before risking your capital.

1. Trade Ideas

Trade Ideas is unarguably one of the best stock trading bots accessible to retail traders. The platform has been used to find opportunities for day traders since 2003.

Undoubtedly, besides AI, the platform has various features that can help you analyze stocks on your own.

Artificial Intelligence (named Holly)

Every evening (after the market closes), Holly will use dozens of algorithms to analyze and evaluate thousands of stocks in the US market to find trading opportunities (thus, millions of scenarios in total.)

AI will score these scenarios, and only the top ones that pass the quantitative benchmark will be implemented the following day.

When AI implements the strategy, you will see all the details, including the winning rates, profits, status (long or short), execution time, and many more.

Take a look at the video below from Trade Ideas for further clarification.

I personally like its transparency, as I can see all the details relevant to the trades before, during, and after implementation, so I do not worry about unexplained losses.

As of April 2021, there are three versions of Holly that can assist you in trading:

Holly Grail – The flagship AI that utilizes dozens of strategies for traders. These include popular ones such as Breakout, Bullish Pullback, Not a Double Bottom, Selling Strength, Engulfing, and many others.

This AI is suitable for those who use technical analysis in trading, so you will not miss stocks that are forming tradable chart patterns.

Holly NEO – This AI is different from others as it uses only two strategies. It focuses on stocks with unusually high volume and in the news, thus excellent for event-driven traders.

Holly 2.0 – The latest AI that utilizes unique strategies based on data that Trade Ideas has accumulated via machine learning over the years.

For example, it will help traders profit from a “falling knife” by buying those stocks before they bounce.

I think this AI is helpful for unconventional traders or risk-takers. If you want to trade stocks based on something else besides regular chart patterns, Holly 2.0 may be your best companion.

Other Key Features

Apart from its robust AI trading system, Trade Ideas also has additional features that make it an excellent stock trading platform. These include the following:

Brokerage Plus – You can create a market scanner to find stock trading opportunities and build your own trading strategy from scratch.

Furthermore, you can connect your Interactive Brokers account to automate the execution of your strategy. Hence, you can trade stocks efficiently without the need to sit in front of the monitor all the time.

OddsMaker Window – This feature is essentially a backtesting tool. It plays a role in helping you test the strategy over recent history to evaluate it empirically.

However, what makes it different from other tools is that Trade Ideas can provide suggestions based on data so that the strategy can generate more returns. You don’t need to guess blindly on how to improve it anymore.

Simulated Trading – Trade Ideas allows traders to test their new strategies using a simulated platform. Thus, both novice and professional traders can learn from their mistakes and correct them without losing a cent.

News & Alert – Trade Ideas streams, displays, and sends you alerts about real-time stock market events. You can set the filters according to your preference to ensure all news is relevant to your stock trades.

Chart Windows – This feature functions as excellent chart software. You can follow and analyze the stock charts without leaving the platform.

Performance

Since late 2021, Trade Ideas has stopped providing public data on the performance of each AI. Hence, all the data below may not accurately reflect long-term trading performance.

According to Trade Ideas, below are the performance of its three AIs. The timeframe is 01/01/2019 to 04/25/2021. The starting capital is $50,000.

Slippages and commissions are ignored in all calculations. Thus, it is very likely that the actual performance is worse than indicated below.

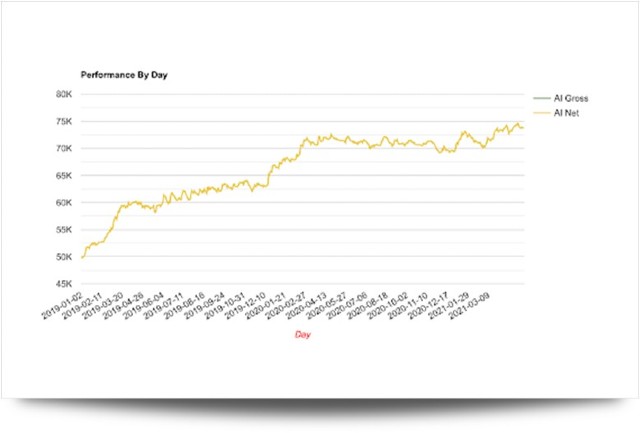

Holly Grail

Analysis: On the surface, the results for this timeframe are not very impressive, as Holly Grail’s performance lags the S&P 500 by almost 20%.

Nevertheless, if we drill deeper into the results, Holly Grail has an astounding Sharpe ratio. Thus, it proves that an AI investor achieves excellent returns without taking too much risk.

This has been confirmed on the performance chart that the AI lost less than 5% during March 2020, while the S&P 500 crashed by almost 30%.

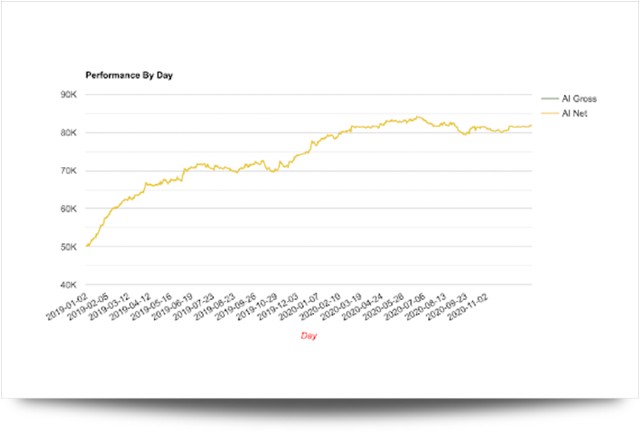

Holly 2.0

Analysis: Holly 2.0 performs better than Holly Grail in this timeframe. It achieves much better results in terms of net profit, profit factor, and Sharpe ratio. However, it still lagged the S&P 500 by 6.1%.

In fact, Holly 2.0 outperformed the S&P 500 from Jan 2019 to May 2020. However, its strategies have not worked well in the last 12 months, as the returns were negative, while the large-cap index rallied more than 40%.

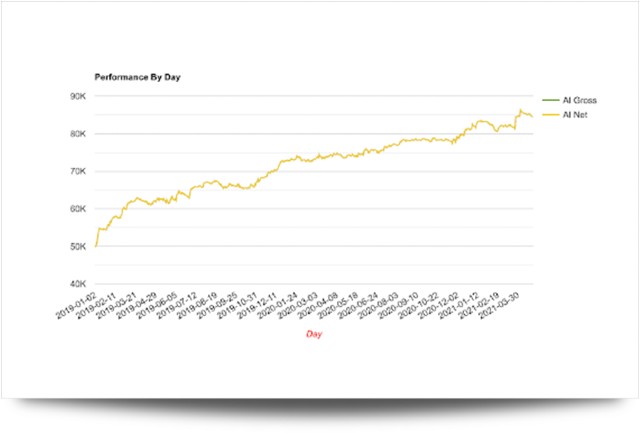

Holly Neo

Analysis: Holly Neo is the AI that uses the fewest strategies among the three. However, both strategies seem to work well during this timeframe, as it performs the best compared to other AIs.

This is the only Trade Ideas AI that manages to beat the S&P 500. Nevertheless, it still slightly underperformed the S&P 500 if we consider slippages and commissions.

By the way, I appreciate its low volatility, as the AI managed to keep the capital safe during the time of the crisis. In March 2020, losses on the portfolio were minimal, while the general market crashed.

Important Notice: This analysis only shows how the AIs perform relative to the S&P 500 during the last 2.5-year timeframe.

However, in a much longer period (i.e., 10 years), the results could be significantly different, as past performance is not always an indicator of future performance.

Moreover, all the performances shown above are from the general bull market. Although AIs performed well in the short-lived bear market of March 2020, we never know how AI performs during the secular bear market that lasted several years.

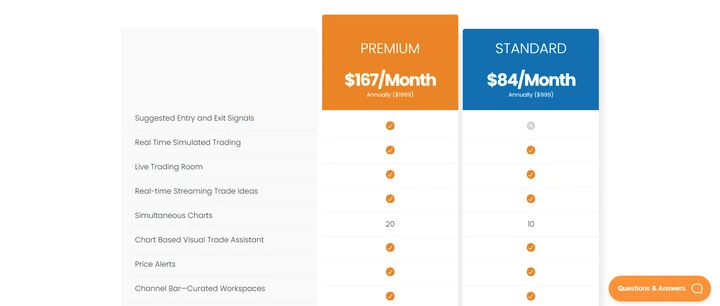

Pricing

Trade Ideas has two pricing options. However, standard plan users cannot access all of the Holly AIs. Thus, you will need to subscribe to the Premium plan.

The premium plan costs $2268 per year (or $167 per month), which is much more expensive than most stock trading platforms.

However, as Trade Ideas has all the essential features necessary for successful trading, you don’t need to subscribe to any other charting or stock research tools. Thus, it will instead help you save costs you used to spend on other software.

Pros & Cons

Pros

- Best AI Stock Trading Software and stock trading platform for day traders, trend followers, or essentially every short-term or day trader who utilizes technical analysis

- Top-tier AI trading bots that evaluate millions of trading scenarios

- AI-assisted trades seem to have an excellent risk-reward ratio

- AIs handle the crisis, or when the stock market has extreme volatility very well.

- Highly transparent as all trade details are shown on the platform

- Built-in charts, news streaming, and real-time quotes: Trade Ideas thus functioning as an all-in-one technical stock research tool. You do not need to pay extra for other tools such as Benzinga Pro or Tradingview.

- Excellent free training and educational resources for novice traders to learn how to invest and use AI.

- Simulated account provided to test strategy, gain confidence, and test all features

- Automated trading is available after connecting to brokerage accounts.

Cons

- 2 out of 3 AIs lagged behind S&P 500.

- No Free Trials

- There is a bit of a learning curve to use AI efficiently

- Old-school user interface

Is Trade Ideas Worth Subscribing to?

Many traders may wonder if Trade Ideas is worth subscribing to, as the results from its AI systems could not outperform the benchmark.

In my opinion, the answer is YES!

I appreciate how AIs provide returns at an excellent risk-reward ratio over time and sustain the short-lived bear market in March 2020 very well.

Thus, traders can comfortably use margins to increase their total returns significantly without worrying excessively about risks.

In addition to AI trading robots, Trade Ideas has many excellent features that could help you improve your trading decisions, including backtesting, strategy testers, charts, news streaming, and many more.

2. Tickeron

Tickeron is another stock trading tool that embraces the power of artificial intelligence. Although some of its features are similar to those of Trade Ideas, Tickeron has its own unique approach, which provides an entirely different user experience.

Key Features

In essence, all you need to do is simply buy and sell according to Tickeron’s AI recommendations. Therefore, Tickeron is much easier to use than Trade Ideas.

Tickeron has dozens of AI stock trading bots for users as follows:

AI Robots

Ai Robots is Tickeron’s flagship product. It will evaluate stocks in real-time and make trades according to the assigned strategies.

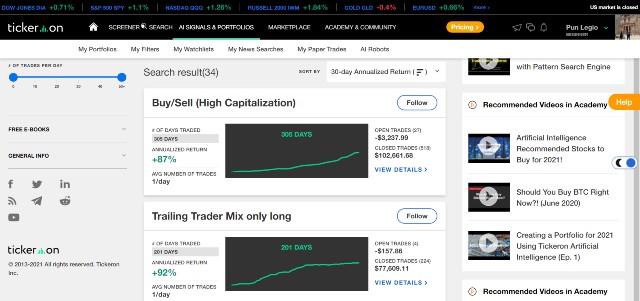

As of now, there are 34 AI robots in total. Each AI Robot has its own strategy, such as Trend Following, Gap Trading, Swing Trading, Day Trader < $50, and many more.

All you need to do here is select the one that fits your trading style most and subscribe to it.

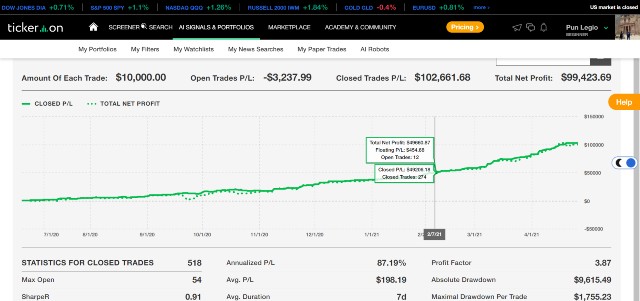

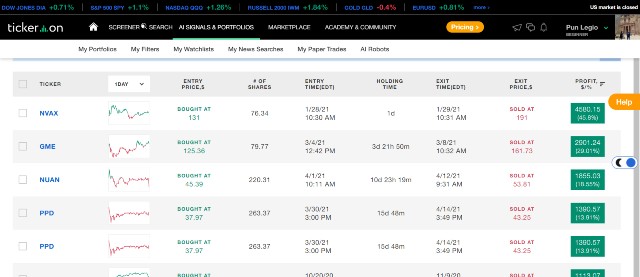

Apart from a description of the strategy, Tickeron has provided detailed data on the performance of each robot, including the annualized return, Sharpe ratio, individual trade execution, maximum drawdown, and many more.

Hence, I think Tickeron is very transparent in this part, as you could check all the trades to see whether they are profitable as Tickeron claimed.

After you subscribe, you will be able to access each AI Robot’s trading room and view its real-time trades. You can then buy and sell according to its recommendations.

Interestingly, you can customize the list of stocks that each AI Robot covers, thus eliminating any recommendations on stocks that you don’t want to trade.

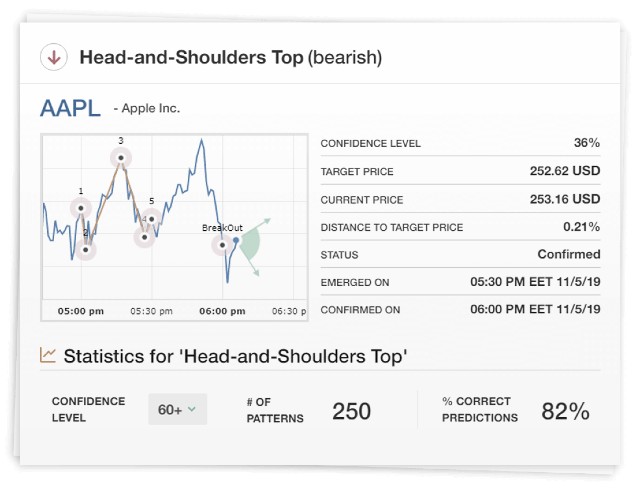

AI Real Time Patterns

AI Real Time Patterns function very differently from AI Robots. AIs will scan the market and automatically detect trading patterns.

For example, Tickeron can help you find stocks that are forming a head-and-shoulders pattern and send you an alert when there is one. Hence, you can buy or sell short those stocks immediately when they break out from the base, and never miss the significant gains again.

I like this feature because it not only sends me trading signals but also provides complete statistical information to help me consider, including confidence interval, target price, percentage of correct predictions, and many others.

As of now, AI can detect dozens of trading patterns, bullish or bearish alike. Thus, the tools can help you trade freely on both sides.

In addition to stocks, Tickeron can find real-time patterns for ETF, Forex, and crypto asset trading as well.

AI Pattern Search Engine

This feature is essentially similar to AI Real-Time Patterns, but it will scan the market at the end of the day instead of in real-time.

AI Trend Prediction Engine

AIs will provide you with their opinion on the trends of each particular stock, whether it is bullish, bearish, or moving sideways. This would be helpful for day traders or swing traders.

Like the Pattern Search Engine, this engine will evaluate the stock at the end of the day.

You might want to watch the video to understand how it works.

Other Key Features

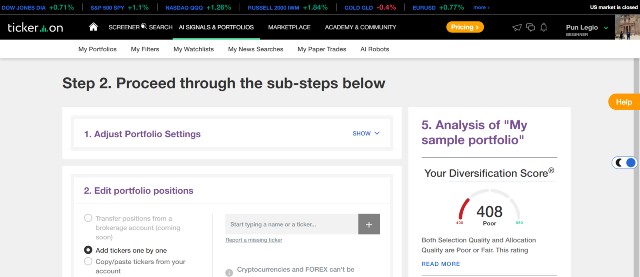

AI Portfolio Wizard – AI will automatically help you structure an optimized portfolio based on your risk profile.

Scanner Search – You can search for individual stocks based on various fundamental and technical metrics. Tickeron will provide ratings on outlook, price growth, valuation, and many more.

I like how the scanner displays all the data points, as it is straightforward to understand.

Performance

Tickeron provides information on 30-day annualized returns for each AI robot. Based on my observations, AI Robots’ performance varies wildly. Some posts a return of more than 100%, while a few post as many as a 16% loss.

The results also show that most AI robots have an impressive or even a too-good-to-be-true winning percentage of 60%-80% and a profit factor of 2-3.

However, as the returns provided are just a measure of annual returns based on the last 30-day period and Tickeron does not come up with any more information on a longer timeframe, I don’t think we can properly compare them with the S&P 500.

According to my observations of past trades, AI Robots make a profit of 2.5%-4% for each trade on average (Some did make huge gains of 40%+, but those are very rare.)

Because the percentage gains are small, and the AI does make numerous trades, your nominal returns will be eaten up by slippages and commissions. This would make the actual returns much lower than it seems.

I also found out that each AI robot’s Sharpe Ratio is less than 1.0, which is a suboptimal risk-reward ratio. This may indicate that each strategy executed by AI stock trading bots involves a significant risk per one unit of volatility.

Generally speaking, I think the preliminary results from the AI are good, but not as superb as it initially seems.

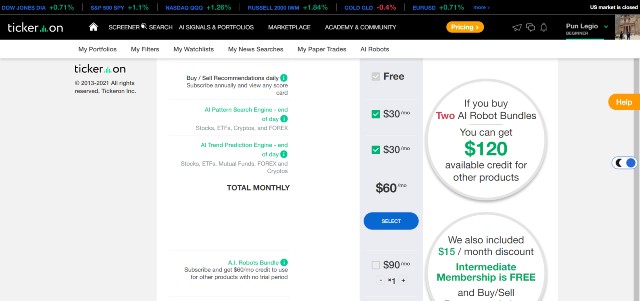

Pricing

Tickeron’s pricing is super complicated. Many traders are confused. In this section, I will try my best to explain it.

Essentially, Tickeron’s pricing structure is pay-as-you-go. You don’t need to pay for things you won’t use.

If you want to use AI, you have to subscribe to the Intermediate plan. You can then select to purchase each feature above separately. This will cost $20-$40 per month for each.

For example, if you want both the Pattern Search Engine and Trend Prediction Engine, this will cost $30+$30 = $60 per month.

However, the option above does not include AI Robots.

AI Robots are priced differently from the rest as follows:

- 1 robot bundle costs $90 per month

- 2 robot bundles cost $180 per month

- all robot bundles cost $270 per month.

If you purchase the robot bundle (allowing you to follow the live trades of one AI Robot), you will also receive monthly credits to subscribe to other features. Thus, you don’t have to spend more money on them.

For example, after buying 1 robot bundle, you will receive $60 worth of monthly credits. You can then use them to subscribe to the Pattern Search Engine and Trend Prediction Engine without further payments.

However, if you want all robot bundles, you should subscribe to the Expert plan, which costs $250 per month, but you will gain access to everything on the platform, including all AI robots.

This option is cheaper and has more features than the Intermediate plan with all robot bundles. Hence, if you want access to more than 2 robots, don’t hesitate to upgrade to the Expert plan.

You can start a 14-day free trial to try all the features (except AI Robots.)

Pros and Cons

Pros

- Utilize advanced deep learning to send trade recommendations to users

- Effortless to use (without the learning curve)

- Beautiful and clean user interface

- Fairly transparent

- AI Robots provide a decent portfolio return with excellent winning rates and profit factors.

- AI Real-Time Patterns are excellent for day trading and swing trading.

- Superb Stock Market Scanner

- Receive AI assistance in stocks, ETFs, FX, and crypto asset trading

- 14-day free trial for all features except AI Robots

Cons

- AI Robot trades have suboptimal Sharpe ratios.

- Extremely complicated pricing structure

- Actual returns can be much lower than displayed

- Expensive

- Need human interaction, no automated trading

- The free trial requires a credit card

3. TrendSpider

TrendSpider is not a specialized AI stock trading software like Trade Ideas or Tickeron that provides direct recommendations for stock trading.

In contrast, TrendSpider is an excellent chart tool equipped with robust machine learning features that help smoothen and ease the analytical processes.

In other words, you will still analyze and make your own trading decisions, but AI will be a virtual assistant that makes the entire process much faster and easier.

Automated Technical Analysis

Automated Technical Analysis is a flagship feature of TrendSpider and what makes them shine among other competitors.

This feature will help you with the following:

- Automatic Trendline Detection/Fibonacci – AI will automatically draw the trendlines and calculate the Fibonacci retracement. Users don’t need to redraw them over and over anymore.

- Support and Resistance Detection – AI will calculate support and resistance levels within seconds.

- Breakout Detection – TrendSpider will scan the markets and accumulate all stocks that are breaking out in real-time.

- Candlestick Pattern Recognition – AI will instantly detect candlestick patterns and identify trading opportunities automatically.

You can view the video below to understand how it works.

I find this feature particularly helpful as it helps verify trading signals, eliminates human errors, and reduces repetitive tasks.

Therefore, you will have more confidence and come up with a trading decision faster, which is vital in many trading scenarios.

Other Key Features

Apart from its AI, TrendSpider has various other features that assist in stock trading as follows:

Chart Tools – A professional, ready-to-use chart tool with hundreds of indicators and visualizations that help traders conduct a thorough analysis within minutes

Stock Scanner – You can independently search for stocks that match your trading rules in any timeframe. This is excellent for finding new trading opportunities, backtesting, or conducting specific research.

Asset Insights – This feature will inform traders about non-technical data such as news, fundamental data, analyst actions, and many others. This is particularly beneficial for techno-fundamental traders who need to find the relationship between stock price and events.

Backtesting/Strategy Tester – Similar to Trade Ideas, you can formulate an entire stock trading strategy and test them with historical data on the TrendSpider platform.

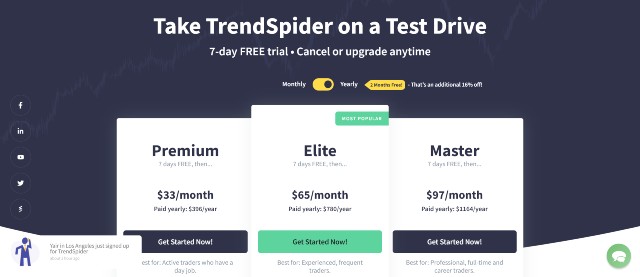

Pricing

TrendSpider has a three-tier pricing plan as follows (all pricing below is for annual plans):

- Premium – $33 per month

- Elite – $65 per month

- Master – $97 per month

All plans have access to automated technical analysis and all essential features. I think most solo traders will be satisfied with this plan.

However, if you want a backtesting feature and more resources (i.e., workspaces and alerts), the Elite plan will be your solution.

As an individual trader, subscribing to the Master plan is entirely unnecessary as all features are the same as the Elite plan. You will only receive more workspaces and alerts.

You can try TrendSpider for free for 7 days

[sc name=”tspider” ][/sc]Pros and Cons

Pros

- Excellent technical analysis software for sophisticated traders who want to make their own trading decisions

- Various beneficial tools for traders or investors with a longer timeframe

- Beautiful and clean user interfaces and visualizations

- Fully customizable charts with robust indicators

- AI can help you save time, eliminate mistakes, and make better trading decisions

- Web-based, thus there is no need to install the software on your computer.

- In-depth market scanners to search for the right stocks to trade

- Built-in asset insights features to track non-technical data

- Complete backtesting system

- 7-day free trial (credit card required)

- Inexpensive

Cons

- Slightly difficult to use at the beginning

- No Automated Trading System

- AI does not directly provide buy or sell recommendations