Mergers and Acquisitions (M&A) are business transactions in corporate finance where two or more companies become one.

Undoubtedly, M&A is an integral part of modern businesses of any size. Startups, SMBs, and Enterprises worldwide use it as a strategy to expand their services in specific markets, eliminate competitors, change business nature entirely, or even downsize to avoid bankruptcy.

In some cases, startup founders use it as an exit strategy by selling their companies to enterprises or private equity funds.

Although decision-makers may rely on financial analysts when making M&A decisions, they still need profound knowledge of M&A to ensure that all the negotiations are favorable for their party.

Based on my experience, M&A is not difficult to learn. You can grasp all the critical concepts by taking high-quality online courses or programs.

Upon course completion, you will understand all the processes and even perform most of the tasks handily, like investment banking or M&A professionals.

This article will outline the best M&A courses along with their pros and cons. Thus, you can select the right one that suits your preferences and start learning right away.

Affiliate Disclosure: This blog post from Victory Tale contains affiliate links. We will receive a small commission from our partners if you purchase or enroll in M&A courses.

Nevertheless, we always value integrity and prioritize our audience’s interests. You can then rest assured that we will present each program truthfully.

Things You Should Know

Who Are They For?

Courses and programs on this list will have different target groups.

Some target college or MBA students who want to pursue a career in investment banking, management consulting, or private equity. Others will target executives or entrepreneurs.

Undoubtedly, the job-seeker curriculum is generally narrower since it focuses more on M&A technicals, particularly financial modeling and financial analysis.

On the other hand, the executive curriculum will be broader, covering extensive aspects of the M&A process, which may include human resources and legal issues.

Hence, I decided to separate this article into two parts. Part I will outline the best M&A courses for those who aspire to become financial professionals, while Part II will discuss the best training programs for senior-level executives and entrepreneurs.

Prerequisites

Most mergers and acquisitions courses have no prerequisites. However, few executive programs may require participants to have a bachelor’s degree OR hold at least one professional designation (CFA, CPA, CAIA.)

Criteria

Below are the criteria for the best M&A courses:

Best M&A Courses for Future Finance Professionals

As mentioned above, courses in this section will be for college and graduate students who want to become investment bankers, management consultants, private equity analysts, or pursue other career paths in finance.

In addition, entry-level or junior analysts can also benefit from these courses as well.

1. Become a Certified Financial Modeling & Valuation Analyst (FMVA)®

The FMVA program by the Corporate Finance Institute is unarguably the best choice to learn about the M&A process from the very beginning.

Unlike college courses that focus on the theoretical, this program will delve into practical financial modeling and valuation. Both are central to the M&A process that every M&A professional must master.

Upon program completion, you will confidently ace job interviews for entry-level M&A positions.

Course Content

The FMVA consists of 29 courses in three steps as follows:

Step 1: Prep Courses – This part consists of 7 prep courses, covering the fundamentals required for the program, such as basic accounting, corporate finance, Excel, and many more.

Students who master these topics can skip this part entirely. However, I suggest going over them quickly to ensure that your knowledge is sufficient for the core courses.

Step 2: Core Courses – The core courses (11 in total) are where you will learn the essential M&A process: financial modeling and valuation.

However, the approach will be different from university courses. The curriculum will instead focus on developing and strengthening your job-ready skills.

You will get your hands dirty building financial models and creating compelling financial reports and presentations. These are the tasks that junior M&A analysts are responsible for in real life.

Besides, you will learn tips and techniques that help improve the quality of your work (models, visualization dashboards, presentations) to match those created by finance professionals. This will help impress your interviewers or future bosses and make an excellent first impression.

Step 3: Elective Courses – These are courses (11 in total) that will drill deep into advanced topics or case studies tailored to specific industries. The latter will equip you with crucial industry knowledge to help you get an edge in interviews for industry-specific M&A positions.

The following are some of the courses that I find compelling.

1. Mergers & Acquisitions (M&A) Modeling – In essence, this 8-hour course will explain how to create an M&A model professionally. You will learn to structure the model efficiently and grasp all the crucial steps to integrate the acquirer’s financial statements and the target company’s.

Subsequently, you will perform a sensitivity analysis and assess the impact of the transaction.

2. Leveraged Buyout LBO Modeling – You will build a leveraged buyout model from scratch in this course.

You will start by setting up a model in Excel and linking the financial statements. Later, you will create a transaction balance sheet, model debt schedule & credit metrics, and finish by performing a DCF analysis.

3. Corporate & Business Strategy – This course will drill deep into corporate strategy and various analytics processes, including internal and external analysis. You will also learn to select optimal strategic alternatives that suit the company’s mission, vision, and goals.

4. Startup / e-Commerce Financial Model & Valuation – This course will delve into the financial modeling of startup and eCommerce companies.

You will first learn about startup and eCommerce industries and later create a DCF model to find a fair value for a hypothetical startup company.

5. Real Estate Financial Modeling – In this course, you will work on modeling for a real estate development project. You will grasp basic terms and definitions and build a dynamic model to evaluate the investment return of the project.

6. The Amazon Case Study (New Edition) – In this large-scale project, you will use real-world data from Capital IQ to create a DCF model to value Amazon shares. Subsequently, you will create a dashboard to report your results.

Important Note: Subscribers can take all elective courses at will. These courses are known as “electives” because you only need to take three of them (out of 11) to get the FMVA certification.

However, due to the excellent quality of each course, I recommend taking them all to extend your corporate finance understanding. This knowledge will prove highly beneficial in your M&A interviews.

Apart from the video lessons, the program offers the following learning resources as follows:

- Guided Case Studies

- Downloadable guides, slides, and solutions

- Quizzes, Assignments, and Tests for each lesson

- Final Exam to get the certification (score 80% or above)

All of which are of high quality. Thus, you have excellent resources for self-studying and gradually developing your skills.

If you are still unsure whether the FMVA program is right for you, I suggest creating an account to try the free lessons (prep courses).

Pricing

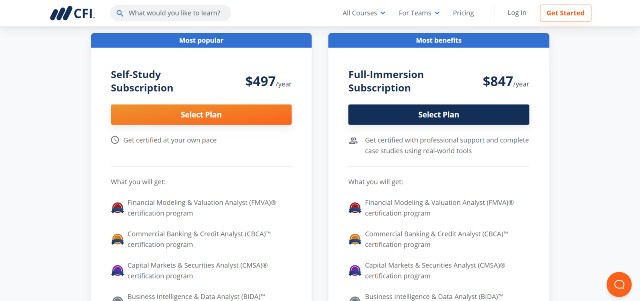

You will need a subscription to access core and elective courses. Below are the two current pricing plans.

- Self-Study – $497 per year

- Full Immersion – $847 per year

Both plans grant access to all courses and essential resources on the CFI platform, including those on other certifications (business analytics, capital markets, credit analyst). Thus, you can acquire as many as four certifications in one go.

The Self-Study plan is sufficient for most students. However, if you want even more assistance and learning resources, you can opt for the Full Immersion plan, which adds

- Additional case studies

- Weekly model review and feedback

- Resume and Cover Letter Review

- 3-6 month access to professional tools, including Capital IQ, Macabacus, Refinitiv Workspace

These resources are beneficial but unnecessary since the former plan’s resources are abundant and well-made for self-studying.

Considering both the quality and price tag, I think FMVA is a mergers and acquisitions program that offers the best value for money, especially if you are students who have no professional experience.

This is because FMVA courses will eliminate your skill gaps and help you kickstart your journey in the financial services industry with confidence. The program also costs only $497 per year, which is cheaper than most other programs.

[sc name=”cfiint” ][/sc]Pros & Cons

Pros

- The program is recognized by NASBA. You can earn as many as 87 CPE credits if you complete all courses (Prep/Core/Elective.)

- Beginner-friendly curriculum

- Self-paced learning

- Offer numerous case studies to learn from

- Provide a comprehensive set of learning resources.

- All-inclusive pricing: You can take all courses on the platform, including those on other programs.

- The program is actively updated. New lessons are also added regularly. Thus, all of its content is up-to-date and resonates with the current environment of the financial industry.

- Free courses are available.

Cons

- No monthly plans

- No job application guides beyond resume and cover letter review

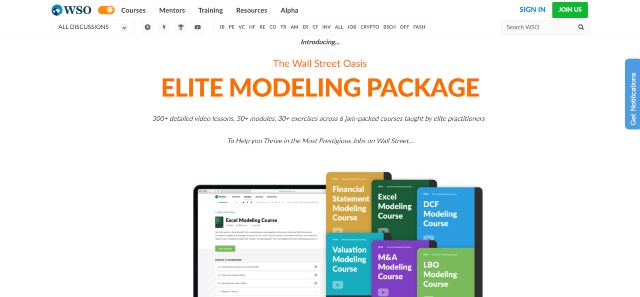

2. Wall Street Oasis (WSO)’s Elite Modeling Package

This package from Wall Street Oasis is a reliable option to learn about the M&A process and an excellent alternative to CFI’s FMVA program. You will learn from a team of instructors who work at bulge bracket firms, investment banks, and private equity funds.

Course Content

There are six core courses in the package, comprising the following

1. Excel Modeling – This course equips learners with the fundamental Excel skills to create financial models professionally. You will learn to use functions, data tables, Pivot Tables, and many other features to perform data analysis.

2. Financial Statement Modeling – The second course will discuss the steps, tips, and techniques to build a fully-functional financial statement model and calculate all the results.

3. LBO Modeling – The third course will delve into building a complex LBO model. You will learn how to project P&L changes and make valuation and transaction assumptions of an LBO project.

Subsequently, you will build a debt schedule on Excel and evaluate the impact of taxes on LBO.

4. Valuation Modeling – The fourth course will drill deep into comparable analysis and transaction analysis and explain how to calculate transaction outputs such as the company’s enterprise value.

5. M&A Modeling – The fifth course is where you will learn the essence of M&A transactions. You will understand purchase accounting and grasp all the M&A processes (Buyside/Sellside).

Subsequently, you will learn how to evaluate the impact of M&A transactions on financial statements, debt schedule, shareholder value, and many more.

6. DCF Modeling – The final course will detail the entire process of creating a discounted cash flow model. You will calculate the free cash flow and the appropriate Weighted Average Cost of Capital (WACC) and use them to find the intrinsic value of the company’s stock.

Instead of providing numerous case studies, WSO will use a single large-scale case study (Nike) to elucidate the abstract concepts in all courses. Hence, all content will be connected through this case study.

Thus, you will be able to integrate key concepts to grasp how an enterprise or large company functions financially in real life.

Apart from the video lessons, you will gain access to the following learning resources:

- Slides and Presentations

- Exercises and assignments

- Technical Support (WSO guarantees that you will receive a response within 48 hours.)

- 12-month risk-free guarantee

- Lifetime access to mini-courses, such as video training for sales & trading, wealth management, and equity research

- 12-month access to WSO Company Database, comprising interview insights, exclusive salary data points, and company reviews

- 6-month Macabacus Access

Pricing

The price tag of this package is $497. Considering the immense resources you will get, this package provides an excellent value for money.

Alternatively, you can purchase only the M&A modeling program for $197. However, this path is not recommended for students with no professional investment banking experience.

The reason is that this course alone will not include other foundational knowledge that an M&A analyst should also master. Investing in an entire package is thus a far better option.

Pros & Cons

Pros

- All courses in the curriculum are connected through a case study. Students can then understand the concepts from a holistic view.

- Provide numerous exercises and assignments

- Study at your own pace

- WSO database add-ons and mini-courses are a big plus for job seekers.

- Offer a generous 12-month risk-free guarantee

Cons

- All courses will be centered on the Nike case study. Hence, you will not learn about industry-specific terms or valuation methods.

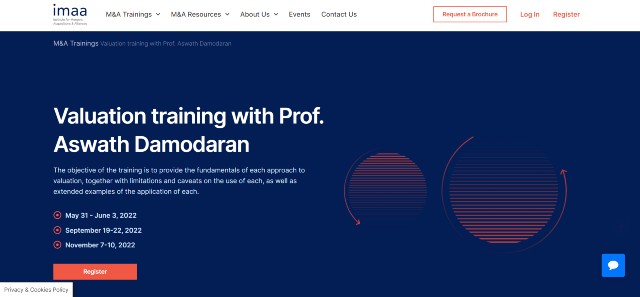

3. Valuation Training with Prof. Aswath Damodaran

Valuation is central to the entire M&A process. Thus, it would be optimal to learn all the stuff from the best.

In this training program by the IMAA (Institute for Mergers, Acquisitions, and Alliances), you will learn from Professor Aswath Damodaran, who wrote several best-selling valuation books used by business schools worldwide.

I personally read some of these must-read books and appreciate all of them. Thus, I don’t hesitate to recommend his course to you.

Course Content

This program is 12-hour long, consisting of four sections as follows:

- Deep dive into Discounted Cash Flow Model (DCF)

- Discount Rates, Risk Premiums, and the Cost of Debt

- Cash Flow, Growth Rate, and Growth Pattern Estimations

- Valuation of other assets (Cash, Stock Options, Control & Synergy Value)

- Challenges in Valuation

- Methods to value various types of companies, such as growth, mature, distressed, cyclical, commodities, financial services, and many more

- Valuation of private businesses

- Relative Valuation and Multiples

- Comparable Company Valuation

In essence, you will learn all fundamental valuation methods and various approaches to value different company types. Upon completion, you will be well-versed in valuation, which will help you answer technical M&A interview questions comfortably.

The format of this program is live online. You will attend live sessions through the video conference platform. Therefore, you can interact with the professor and even ask him questions.

Besides, this program will provide students with excellent networking opportunities. You can connect with your classmates and even past training participants and develop a long-lasting relationship.

Finally, you can access the following learning resources for three months:

- Recorded Sessions

- Presentation Slides

- e-Library free access

Upon program completion, you will earn a certificate of attendance signed by the professor, a digital seal for LinkedIn, and 10 CPE credits.

Pricing and Dates

The training costs $990 one-time.

Unlike CFI and WSO programs, this IMAA training is not always available. Currently, there are three sessions left: June, September, and November.

All of which are likely to be fully booked months before the session starts. Hence, you should book the training in advance if you are interested.

Pros & Cons

Pros

- Taught by a world-renowned educator on valuation topics

- Straightforward and comprehensive curriculum, featuring all valuation methods and techniques

- Live online instructions, allowing students to ask questions to the professor

- Offer excellent networking opportunities with classmates worldwide

- Earn 10 CPE credits upon program completion

Cons

- Available only on specific dates. Prior booking is thus necessary.

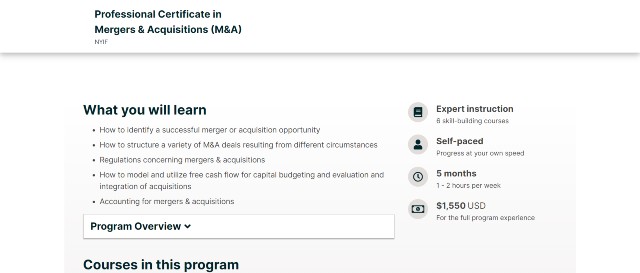

4. Professional Certificate in Mergers & Acquisitions (M&A)

This edX program is another excellent option to learn about mergers and acquisitions. You will learn from a team of experts at the New York Institute of Finance (NYIF), a financial continuing education institute with a century of history training professionals.

Course Content & Pricing

This program consists of five minor courses and a final exam as follows:

1. Concepts and Theories – The first course will introduce the fundamental concepts of M&A from the acquirer’s perspective. You will learn how M&A is instrumental in corporate development and find out about effective acquisition strategies.

2. Advanced Topics – The second course will first discuss M&A accounting and financing concepts. In essence, you will grasp how the acquiring company finances a deal.

Subsequently, the instructor will detail the sale process and drill deep into the seller’s viewpoint in a deal. You will also learn how a target company can fend off hostile takeovers.

3. Structuring the Deal – The third course will explain how most M&A deals are structured and explore essential corporate documents involved in them.

In the second part, you will also explore three M&A legal structures and accounting & tax considerations that can help create a strong acquisitions strategy and potentially curb expenses.

4. Free Cash Flow (FCF) Modeling – The fourth course will detail the process of building a free cash flow model to evaluate the target company’s financial performance. Later, you will learn about capital budgeting and relevant guidelines.

5. Accounting Principles for M&A – The final course in the program will delve into accounting and tax principles relevant to a deal and apply them to project earnings and cash flows of a consolidated company after a post-merger integration.

6. Certificate Examination – This online exam will test your knowledge from all previous courses. You need to score at least 80% to get a digital certificate from NYIF.

NYIF recommends spending 1-2 hours on the course, and you will complete it in five months.

Unlike other edX courses, you cannot audit all minor courses in this program. You need to enroll in the verified track, which costs $1550. However, you will get comprehensive learning experience (with graded assignments and a final exam).

Pros & Cons

Pros

- Beginner-friendly mergers and acquisitions course

- Well-structured curriculum

- Cover general aspects of due diligence

- Include multiple case studies

- Self-paced learning

Cons

- Costly compared to other alternatives

- No free auditing

5. Finance of Mergers and Acquisitions

This series of Coursera courses is an affordable option for students to learn about crucial M & M&A processes.

You will learn from Professor Heitor Almeida of UIUC, a renowned researcher in corporate finance, corporate governance, and business ownership structure, whose works are cited by WSJ and other prestigious newspaper publications worldwide.

5.1) Valuation & Pricing

Below is a summary of topics that you will learn in this 25-hour course:

- M&A transactions pros & cons, M&A history, Value creation from M&A deals

- Private Equity LBOs, Restructuring Tools, Hostile Takeovers

- M&A Regulation

- Company valuation (Expected Return, Financial projection, CAPM, WACC, Enterprise Value, Comparable Analysis, Sensitivity Analysis, etc.)

- Target vs. Acquirer Valuation and Transaction Multiples

- Synergies Valuation

- Takeover defenses

5.2) Designing an M&A Deal

The following are the topics you will learn in the second course of the series.

- M&A Accounting

- Taxation of M&A deals

- Ownership Structure

- M&A Financing (Debt or Equity)

- Private Equity and Leveraged Buyouts

- Asset Sales & Spinoffs

Unlike most Coursera courses, both are packed with video content and real-world examples. The curriculum is also beginner-friendly, starting from the elementary and proceeding step-by-step to more advanced concepts.

The drawback is that the overall content of this series is not in-depth. In other words, it provides information on all crucial M&A processes but barely touches advanced, practical aspects (no projects for students to complete.)

Hence, I think this program is suitable for college students who want to learn some basics to make a career choice or review essential concepts for the upcoming entry-level interviews.

You can audit this series for free. However, if you want your assignments to be graded and receive a certificate of completion, you need to buy each course, which costs $79.

Pros & Cons

Pros

- Learn from a renowned professor

- Beginner-friendly curriculum

- Clear explanations of concepts

- Feature several real-world examples

- Affordable M&A course

- Free auditing

Cons

- No large-scale projects for students to work on to gain hands-on experience

- Transcripts are not organized, thus extremely difficult to read.

Coursera Plus

Since I have covered two Coursera courses in this article, you may be interested in taking both of them. If so, I suggest subscribing to Coursera Plus instead.

Coursera Plus costs $399 per year (or $33.25 per month) and provides full access (not just audit) to more than 3000 courses and programs on the platform. Thus, you don’t need to pay subscription or one-time fees to individual programs anymore.

If you are a diligent learner or an avid digital certificate collector, it is a no-brainer to subscribe to Coursera Plus.

[sc name=”coursera” ][/sc]Best M&A Training Programs for Executives and Entrepreneurs

6. Mergers & Acquisitions Professional (M&AP)

Created by M&A experts, this program from IMAA encompasses all aspects of the transaction and even provides insights on best practices and offers strategies for running a successful boutique.

Thus, if you are looking for all-in-one M&A training, the M&AP program is unarguably one of the best options you could find.

Program Details

This program has four modules, consisting of the following:

1. Essentials of M&A – The first module will go over M&A fundamentals. You will learn about deal types and how to approach them from buy-side and sell-side perspective.

The second part of the module will delve into various M&A strategies, including divestiture, equity alliance, and takeover & defense. In the end, you will also learn how to perform essential due diligence and evaluate different factors that impact the success rate of the transaction.

2. Due Diligence – The second module will discuss all areas of due diligence in detail. This includes finance, tax, legal, human resources, and other miscellaneous areas.

3. Valuation – The third module will first explore various valuation techniques for M&A, including discounted cash flow model and trading multiple analysis.

Subsequently, you will learn how to value private equity and startup businesses and structure an M&A deal financially.

4. Running A Successful M&A Practice – The last module will provide in-depth insights into managing an M&A firm along with its projects and portfolios.

Below are some topics that you will learn in this section:

- Business Strategy and Firm Positioning

- Mid-Market Advisory – Market environment, ownership lifecycle, corporate finance for mid-market, and many more

- Sale and Purchase Agreements (SPAs)

- Tax Restructuring

- M&A Insurance

Based on my observations, this module covers topics that most others rarely do. Such insights can be valuable if you aspire to become a managing partner or even open a boutique M&A firm of your own.

Course Formats, Learning Resources, and Pricing

This program is available in three formats as follows.

- Online Program – $2990

- Onsite/In Person – $4990

Both of which follow the same curriculum and provide access to the following:

- Lifetime access to all lessons (60 hours long), plus all future updates

- Course materials – Presentations, Exercises, Assignments

- E-Library

- Networking channels of experts – Private Forums, Groups, etc.

- Designation upon completion

If you are interested in virtual live and onsite programs, I suggest booking your seat beforehand.

This is because the programs are only offered once per month. Hence, it is highly likely to be fully booked months before the first session. You will be left with the online option if the rest are fully booked.

Other IMAA programs

Besides this program, IMAA also offers three other convincing programs, which cover even more advanced topics of the specific M&A aspect.

- Certified Post Merger Integration Expert – This program will dig into the post-merger integration process. You will learn to set up the integration and seamlessly execute it.

- Legal Mergers and Acquisitions Expert – This program is all about legal issues. You will delve into legal aspects surrounding an M&A transaction, including its impact on both the acquirer and the target company and their future business development.

- HR Mergers and Acquisitions Expert – Once the acquisitions happen, there will be numerous management and workforce issues. This course will guide you through all the challenges and recommend actionable strategies to help you deal with them.

Pros & Cons

Pros

- Taught by M&A veterans with decades of professional experience

- One of the very few programs that includes a module on M&A boutique firm management

- Easy-to-follow, comprehensive curriculum

- In-depth, informative lessons with numerous case studies

- IMAA updates the course content regularly. Hence, the content is always up-to-date and matches the current environment in the financial services industry.

- Offer excellent networking opportunities

- Flexible course formats

Cons

- Prior booking is necessary for live online and onsite programs.

7. The Law and Economics of Mergers and Acquisitions

This Getsmarter program created by LSE (The London School of Economics and Political Science) provides insights into the deal structure and various challenges that an M&A specialist must face in real life.

Upon completion, you will have the knowledge, insight, and confidence to tackle them and ensure smooth transactions for your clients.

Course Content

The program comprises six weekly modules as follows:

1. The Law and Economics of Corporate Transactions – The first module will go over the structure of corporations and explain the key drivers of corporate transactions.

Furthermore, you will also learn about transaction cost economics and apply them to real-world corporate transactions.

2. Hedge Fund Activist Attacks – Hedge fund activists (Ackman, Icahn, etc.) play a significant role in today’s M&A transactions. You will learn about the nature of hedge fund activism and its effect on board decision-making and accountability.

In the second part, you will grasp how corporate law and regulations affect the activists’ strategies and how to leverage them in negotiations.

3. Private M&A Transaction Structures and Contracts – The third module will delve into an M&A deal structure (public or private) and contracts. You will then perceive how to use risk allocations to address obstacles in transactions.

4. Private Equity Transactions – The fourth course will navigate the nature of private equity funds. You will learn about their incentives along with their structure and governance.

5. Making a Public Offer – The fifth course mainly discusses “public M&A deals.” You will explore the notion of the market for corporate control and regulatory aspects of public M&A transactions.

6. Defenses in Hostile Takeovers – Hostile takeovers are rare (at least in the US). However, no one can guarantee that you never need to deal with them.

Therefore, in this module, you will learn everything about takeover defenses, including types, their relationship with corporate law, pros & cons, and the strategies that hostile acquirers can use to overcome them.

Generally speaking, this program offers the most comprehensive and informative training for M&A challenges. ํAll modules are also applicable to the current M&A landscape. Thus, you will comfortably find the solution if you encounter such challenges in your career.

Regarding the pace, LSE recommends spending 7-10 hours weekly on each module, and you will complete the program in 6 weeks.

Course Materials & Pricing

Besides video lessons, you will gain access to the following course materials and activities:

- Infographics and other interactive content

- Real-world problems and datasets

- Quizzes and assignments

- Other downloadable instructional material

- Weekly class forums and small group discussions

The pricing tag for this program is $3055 in total. However, Getsmarter offers flexible payment options, including a split payment plan.

Note: This program has a fixed start date. Thus, you should register for it in advance.

Pros & Cons

Pros

- Earn a certificate of completion from LSE upon completion

- Informative, in-depth lessons

- Feature various case studies

- Offer excellent networking opportunities

- Self-paced learning

- Flexible payment options

Cons

- Not always available (Fixed Start Date)

8. Mergers and Acquisitions (Online) Strategize and Execute Successful Deals

This program from Columbia University on the Emeritus platform offers another top-notch executive training for senior executives to be familiar with M&A strategies and execute successful deals.

Its curriculum covers all M&A processes from the very beginning, thus extremely helpful for those new to corporate finance.

Course Content

Below is a summary of topics that you will learn from this program

- Introduction to M&A – 5-point framework, key terminologies, etc.

- Strategic and Practical Considerations – Pro-forma analysis, synergies, interloper analysis, tactical approach

- Valuation

- Mathematical calculation for M&A deals

- Financial, legal, and commercial due diligence

- Deal Documentation and Transaction Structures

- Takeover Defenses

- Roles of involved stakeholders

Final Project – Once you complete all the modules, you will work on a final project, which will require you to bring together the knowledge you have learned and apply it to the real-world case study.

Columbia suggests spending 4-6 hours on the lessons, and you will complete them all in eight weeks.

Course Materials & Pricing

In addition to lectures and a final project, you will be able to access the following learning resources

- Quizzes and assignments

- Peer discussion group

- Live sessions with faculty experts

- Mobile learning app

Regarding pricing, this program costs $3500. You can choose to pay in full or in installments. However, if you click the link below. You will get $350 off your tuition fees.

Pros & Cons

Pros

- Taught by a Columbia professor who is also a faculty leader of a leading US-based investment management firm

- Comprehensive, beginner-friendly curriculum

- Feature various real-world case studies with financial documents

- Include a final project for students to get hands-on experience

- Offer plentiful networking activities

- Flexible payment options

Cons

- Fixed start date; thus, the program is only available on specific dates.

Other Alternatives

Mergers & Acquisitions – M&A, Valuation & Selling a Company – This Udemy course probably provides the most affordable M&A training. You will learn from John Colley, an investment banker with years of professional experience.

However, this course will not cover in-depth concepts like those on the list. Thus, it only works well as a course for learners to test the waters before proceeding to more comprehensive training programs.

Related Programs and Courses

Investment Banking Training – Coming Soon

Negotiation Skills – Coming Soon