Credit analysis is essential for financial institutions (commercial and investment banks alike) since it helps identify and evaluate the risks for loans and debt securities.

After the Great Recession and the economic consequences of the pandemic, banks need to be prudent in providing loans more than ever. Hence, they need talented credit analysts to assess the creditworthiness of existing and potential clients. Otherwise, banks will soon swim in a sea of NPLs themselves.

A great credit analyst needs to possess various skill sets, including but not limited to the following:

- Financial Accounting / Financial Statement Analysis

- Data Analytics (particularly predictive analytics)

- Data Mining

- Thorough knowledge of various industries

- Soft Skills (Attention to detail, communication, organization, problem-solving skills)

These skills also need to be “career-ready,” which are significantly different from what you have learned in college.

Banks also tend to set the bar extremely high for their new credit analysts. Candidates must possess such skills and be able to showcase them promisingly. Otherwise, they will not get an internship or full-time offer.

Thus, getting hired as a credit analyst can be highly challenging, especially if you do not have those “right” skills. Fortunately, there are numerous ways to develop and strengthen them, notably through online courses.

This article will walk you through the best online courses for that task. You can then select the one that suits your preferences and budget and start learning right away.

Affiliate Disclosure: This article from Victory Tale contains affiliate links. We will receive a small commission from the providers if you purchase courses through them.

Nevertheless, we always value integrity and prioritize our audience’s interests. You can then rest assured that we will present each course truthfully.

Things You Should Know

Prerequisites

All credit analyst courses featured on this list have prerequisites as follows:

Note: Prior knowledge of financial instruments is not required but could be helpful.

Criteria

Below are the criteria for the best credit analyst courses

1. Commercial Banking & Credit Analyst (CBCA)™

The CBCA (Commercial banking & Credit Analyst) program by the CFI (Corporate Finance Institute) is unarguably one of the best options for learning all the skill sets required for a credit analyst role.

Unlike college courses that focus on theories, this CFI program aims to equip you with career-ready skills.

In essence, the instructor will guide you through all the tasks professional credit analysts perform in real life. Subsequently, you will work on assignments and case studies to gain practical hands-on experience.

Upon program completion, you will be comfortable showcasing your skills during the interviews and handily impressing your future supervisors.

Course Content

The CBCA curriculum is separated into four sections as follows:

- Prep Courses (6 in total)

- Core Courses (16 in total)

- Elective Courses (13 in total)

- Guided Case Studies (4 in total)

Note: Based on my observations, the curriculum will be updated over time with new content for each course. CFI may even add a brand new course altogether. Thus, the number of courses may increase significantly in the future.

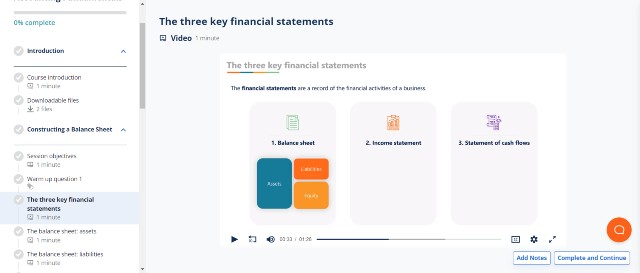

The prep courses will go over the fundamentals. Throughout a series of six brief video courses, you will learn the basics of financial accounting, banking products, business structure, and credits.

Suppose you already have prior knowledge of those. In this case, you can choose to skip them all.

Nevertheless, I find these courses well-structured, and the explanations are far more concise and practical than college courses. If possible, you should at least skim through the videos to ensure you are ready for the core courses.

The core courses will cover all crucial knowledge and skills that credit professionals need to possess, including

- Reading Business Financial Information

- Business Analysis (Assessing Drivers of Business Growth, Evaluating a Business Plan, Assessing Management)

- Financial Analysis for Credit Analysts (Cash Flow Analysis, Financial Statements Analysis, etc.)

- Deep dive into loans (Loan Security, Loan Covenants, Loan Pricing, etc.)

- Other topics (Account Management, Warning Signs, Business Writing, Professional Ethics, etc.)

The elective courses are for students who want to explore advanced topics on credit and risk assessment and more specified lending, including the following topics:

- Venture Debt

- Private Banking

- Real Estate Fundamentals and Commercial Mortgages

- Construction and Equipment Finance

- Syndicated Lending

- Leading to retail, restaurant, and franchise businesses

- Asset-based Lending

- and many more

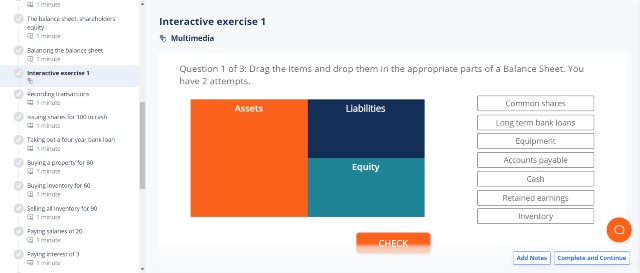

The structure of each CBCA course is straightforward. You will first learn from video lectures and complete the interactive assignments. The latter are available in every few chapters. Thus, you will be tested frequently, which will help you grasp the concepts much quicker.

If you want to pursue CBCA certification, you will need to complete all core courses and choose three elective courses to take. Once you are done with them, you will be eligible to take a final exam. You will then need to score at least 70% to become certified.

However, I highly recommend taking the rest of the elective courses as well. Taking them will not cost extra tuition fees, but they will equip you with vast industry knowledge, which can be extremely helpful in tackling the most challenging interview questions and showcasing your insights.

Finally, once you complete the courses, you can work on one of the four case studies. In essence, you will play the role of a professional credit risk analyst and perform the assigned tasks.

Those tasks will resemble real-life ones. Therefore, these case studies will provide ample opportunities to gain hands-on experience. Again, you should also complete them all to get the most out of the program.

The average program completion time is six months. However, I have seen many complete it faster since the program is 100% self-paced.

Bottom Line:

Pricing

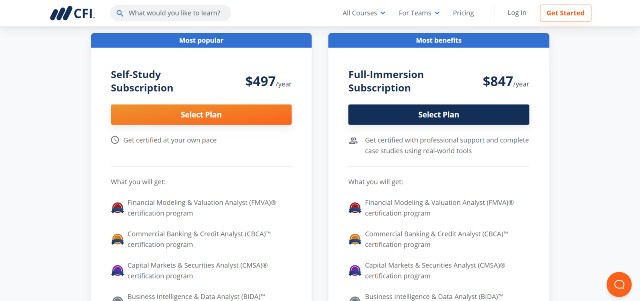

Currently, the CFI now uses a subscription-based model for its pricing structure. You will need to opt for one of the two following plans:

- Self-Study – $497 annually

- Full-Immersion – $847 annually

Both plans grant access to all courses on the platform. In other words, you can take courses available not only on the CBCA program but also other three programs (Financial Modeling, Capital Markets, Business Intelligence) as well.

The content you can access is massive. Apart from 300+ hours of video lessons, there are dozens of assignments and case studies that you can work on to supercharge your skills.

Therefore, if you are an enthusiastic learner, you can learn all crucial financial-related knowledge and obtain as many as four certifications in one go.

The Full-Immersion plan will add the following to the top of the self-study option:

- Premium Email Support – You can ask five questions per week to professional financial analysts through email.

- Model Review & Feedback – You can ask experts to review your project and provide feedback once per week

- Additional case studies

- Resume & Cover Letter Review

- 2-12 month access to financial services tools: Macabacus, Capital IQ, Refinitiv Workspace, PitchBook, and Vertical IQ

Premium email support and model review can be highly beneficial if you struggle with some challenging concepts or get stuck on the project. Hence, you do not need to waste hours figuring out the solution on your own.

In addition, resume & cover letter support can enhance your job applications and may single-handedly help you land multiple interviews.

Although the added features are helpful, I don’t think most students need them. This is because CFI course materials are of high quality. You can use them to learn all stuff with ease.

If you are unsure whether the CBCA program is for you, I suggest creating an account to try the free lessons before deciding.

[sc name=”cfiint” ][/sc]Pros & Cons

Pros

- Beginner-friendly: Unarguably the best option for college students or new grads

- Well-structured and comprehensive curriculum covering all concepts and skills required for a credit analyst career

- In-depth but bite-sized lessons

- 100% self-paced learning

- Downloadable course materials (Excel, PPT, PDF files)

- Excellent assessment system

- All-inclusive pricing: You can access all other certification programs besides CBCA, thus providing excellent value for money

- All CFI courses are accredited by the US NASBA (National Association of State Boards of Accountancy). Hence, students can earn CPE credits upon course completion.

Cons

- High entry price

- Scoring above 70% on the final exam to get certified can be challenging for some students.

Is the CBCA Certification Worth it?

The quick answer is Yes. Generally speaking, I appreciate the CBCA curriculum’s comprehensiveness and hands-on approach. If you are looking for a reliable credit analyst training program, the CBCA program is unarguably one you should seriously consider.

Furthermore, I can confidently say that what you learn will be exceptionally helpful. Upon completion, you will be able to perform tasks like a professional and handily impress your interviewers or supervisors.

However, unlike an MBA, I do not think having the CBCA certification would significantly strengthen your resume. It would indicate that you have prepared well or have a genuine interest in this career path.

2. Professional Certificate in Credit Risk and Credit Analysis

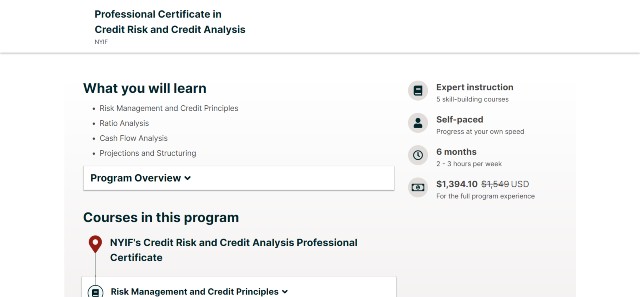

This edX program from the New York Institute of Finance (NYIF) will guide you through credit risk analysis and risk management. If you struggle with both topics, I highly suggest you take this course.

Course Content and Pricing

This professional certificate program consists of four courses and one examination as follows:

1. Risk Management and Credit Principles – The first course will introduce you to credits and debts. You will learn about debt, debt forms, its financing role, and all the risks associated with it.

The second part of the course will delve into business risks. You will perceive the factors behind them, such as business models and competition, and learn how to measure, evaluate, and mitigate these risks from impacting the company’s operating performance.

Finally, the course will discuss the role of credit rating agencies and other valuable metrics in risk management.

2. Ratio Analysis – In essence, the second course will delve into financial statement analysis. You will learn how financial ratios are useful to assess the borrower’s financial health, which can, in turn, be a reliable indicator of creditworthiness.

Later, you will learn steps to evaluate the organization structure and management strategy through the analysis of the capital structure and gain insights on potential off-balance sheet risks.

3. Cash Flow Analysis – The third course will drill deep into the cash flow statement. You will learn to calculate every cash flow element, such as cash flow from operations and Free Cash Flow (FCF).

Later, you will perceive how a persistent and stable cash flow can help the company meet debt obligations and learn about methods that companies can implement to “hedge” cash flows.

4. Projections and Structuring – The fourth course will focus on financial projections. You will learn about signs and warnings that may indicate a financial deterioration of the company.

Later, the course will delve into various methodologies and approaches used to project future financial results and capital structure. Also, you will learn how to provide suitable recommendations on financing structures based on the projections.

The second part of the course will be all about structuring. You will learn to analyze the borrower’s financing needs, recommend new-debt financing, and structure new debt facilities based on projections and credit risk assessments.

5. Examination – Once you have completed all four courses, you will be eligible to take the certification exam. You will need to score 70% or higher to get the professional certificate from NYIF.

Overall, this program is undoubtedly one of the most comprehensive courses on credit analysis available online. You will learn all the fundamental credit analysis processes and later work on assignments to sharpen your skills.

NYIF recommends spending 2-3 hours per week on the program, and you will complete it in six months.

Regarding pricing, you can audit all the courses for free. However, if you want to access graded assignments, an examination, and a digital certificate, you need to subscribe to a verified track, which costs $1394 one-time.

Pros & Cons

Pros

- One of the most comprehensive courses on the credit analysis process

- Straightforward curriculum

- Learn from various real-world case studies

- 100% self-paced learning

- In-depth and informative lessons

- A final exam to test your skills

- Free auditing

Cons

- The verified track (entire course) is far costlier than other alternatives.

3. Moody’s Analytics Credit Analyst Courses

Suppose you are looking for absolutely in-depth training. I don’t think you should look elsewhere besides the courses offered by Moody’s Analytics. The company is a sister company of Moody’s Investor Services, one of the Big Three credit rating agencies.

Course Content

Currently, Moody’s Analytics offers dozens of various online training and certification programs related to credit and lending. Most of them are either self-paced online or live online through virtual classrooms.

Below are some of the programs that I found compelling:

Commercial Lending ($1350)– This self-paced course will go over the basics of commercial lending. You will learn how to analyze the financial performance of borrowers, evaluate risks associated with various factors, and build effective loan structures to mitigate them.

Business Lending ($850) – This course aims to equip new credit analysts with skills to explore borrowing needs and find credit solutions for small businesses. You will learn to assess critical business information and evaluate loan requests.

Advanced Corporate Credit Analysis ($3995)– This 3-day live online program aims to uplift your knowledge of advanced corporate credit analysis to a professional level. You will learn to evaluate credit risk in complex group structures, assess complicated capital structures, and identify early warning signs of financial distress.

Problem Loans ($395) – Preventing non-performing loans is essential for every financial institution. This 10-hour course will provide a detailed guide on spotting financial deterioration and implementing techniques and strategies to handle the risks to ensure repayment.

Compared to other alternatives, training programs from Moody’s Analytics are expensive. However, it delves into advanced topics that others do not cover.

If you are a beginner, I suggest starting with a CFI subscription (see #1), which is far more affordable. Once you complete the program and would like to drill deeper into advanced concepts, taking some of Moody’s Analytics courses would prove a worthy investment.

Pros & Cons

Pros

- Learn from leading experts at Moody’s Analytics, a sister company of the leader in the credit analysis space

- Offer the most in-depth courses on corporate and retail lending. Some of the topics are not taught elsewhere.

- Well-structured curriculum

- Various interactive quizzes for students to complete

Cons

- Costly: Moody’s Analytics programs are far more expensive than other alternatives.

Other Alternatives

An Introduction to Credit Risk Management – This edX course from the Delft University of Technology is an excellent option to consider if you want to learn more about credit risk management. However, as of January 2022, the course is archived. You can only access the course materials.

Related Courses

Resources for investment banking and finance interviews – Coming Soon

Financial Modeling Courses – An excellent course to take if you want to pursue a career in investment banking, consulting, equity research, and many other careers in the financial services industry.

Capital Markets Courses – Best for those who want to break into Sales & Trading and other market-related roles. Anyone who wants to learn about financial and capital markets can take them as well.