Options trading continues to be a popular way for traders to navigate the markets and profit from them. Though options are riskier than stocks in nature, they can be highly lucrative, mainly if you can spot ripe opportunities before most traders do.

Typically, insiders and high net-worth investors will overwhelmingly buy or unload options on a specific stock if they grasp new, game-changing information that may completely change perspectives of the underlying stock.

Hence, an unusual options activity usually precedes a sharp, upcoming move in both options and stock prices, potentially allowing traders to reap huge profits.

However, with thousands of options in the US market, searching for options with such an activity can be tedious and time-consuming. You can practically get lost in a sea of data. Hence, you will miss other trading alternatives that can make you thousands or even millions.

To avoid that pitfall, you should use options screeners. These tools are highly beneficial in spotting fresh opportunities, particularly on options with unusual activity, so you are far more likely to find suitable securities to trade at the right time.

This article features a list of the best options screeners available based on my research. You can then select the tool that suits your needs and preferences and subscribe right away. If you are a steadfast trader, I highly recommend subscribing to at least one of them.

Affiliate Disclosure: This article from Victory Tale contains affiliate links. We will receive a small commission from software providers if you subscribe to their tools.

Nonetheless, we always value integrity and prioritize our audience’s interests. You can rest assured that we will present each software truthfully.

Things You Should Know

There is no Guarantee of Success

Like any financial market tool, option screeners cannot be 100% accurate. Although all tools are powered by machine learning or equipped with the most innovative algorithms, they can still make mistakes.

It is thus essential to evaluate each opportunity manually before making trading decisions. This process will increase your success rate significantly.

Criteria

Below are the criteria for the best option screeners.

1. FDScanner

FDScanner is an ultimate options screener. This brand-new platform is entirely dedicated to assisting traders in finding lucrative trade ideas in the options market.

Therefore, if you are looking for a reliable tool that helps you search for additional opportunities apart from unusual options activity, you may want to consider FDScanner.

Key Features

Unlike most other options screeners that focus on finding options with unusual activities, FDScanner provides a set of tools that help you screen the market for other hidden opportunities that are available.

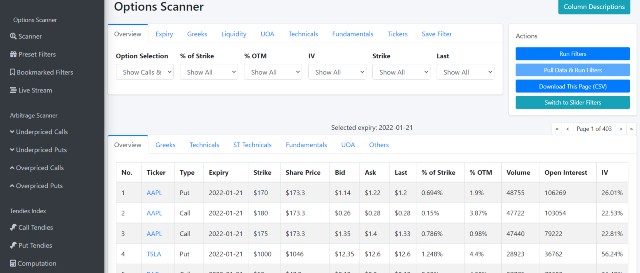

Options Scanner – This options scanner is the best of its kind. With this feature, you can search for options of your liking.

You can add numerous custom filters at will, including option price, strike price, expiry dates, %OTM, greeks (delta, gamma, vega), UOA, or even fundamental and technical criteria of the underlying stock.

The best part is that you can customize the filters like a standard stock screener. For example, you can search for call options with over 10% OTM that will expire on 2/11/22.

Your results will be ready in seconds. FDScanner will display essential data that you can view with ease.

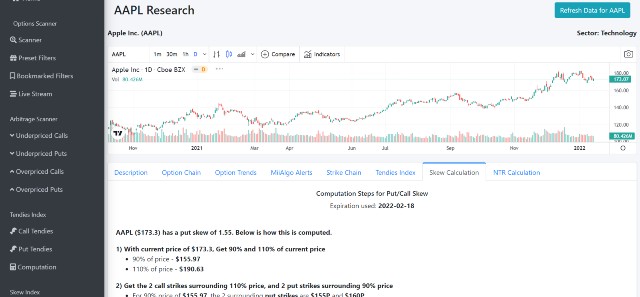

Ticker Research– Each result also comes with a link that you can click on to visit the underlying stock page. On this page, you can read more about the fundamental data of that stock and view its stock chart.

This chart is Tradingview’s. Thus, if required, you can add various technical indicators to the chart to analyze stock price trends.

However, the best thing here is that each page will provide more beneficial options-related data about a particular stock. Specifically, you can view the option chain, strike chain, call/put trends, skew calculation, and many more.

Therefore, you will have more than sufficient information to execute a trade confidently.

Arbitrage Scanner – As its name suggests, this feature scans the market for options whose price deviates sharply from their theoretical value (as determined by option pricing models such as Black-Scholes).

The scanners will show calls and puts whose asks are below (for underpriced options) or their bids are above (for overpriced options) the theoretical value. Hence, you can profit from potential market inefficiencies by buying or selling these options.

MAX Tendies Index – Are you looking for options that can yield incredibly high profits in a single trade? This feature is designed exclusively to serve that purpose.

First, FDScanner will calculate a price target (based on past 10-days volatility) for every stock in the US market. Subsequently, it will rank all options by prospective gains, assuming a price target is reached. You can then have numerous options with lucrative potential to choose from.

Important Note: After using this scanner, you should not make trading decisions without further analysis. This is because many things can go wrong with it.

For example, the actual price may move opposite to the price target. Therefore, you will end up with a significant or even total loss of your trading capital.

Put/Call Skew – This feature will display all options with put or call skew. Since equally out-of-the-money puts and calls should be at the same price, this condition may indicate demand and supply imbalances and thus potentially presents profitable trading opportunities.

For example, suppose you are a contrarian options trader. You can bet against the skew since it yields better risk/reward ratios.

I like how FDScanner clearly explains how they calculate the output in detail. You can read it by clicking on this link.

Also, all options that are on the list pass liquidity checks. Hence, you can be confident that they are tradable.

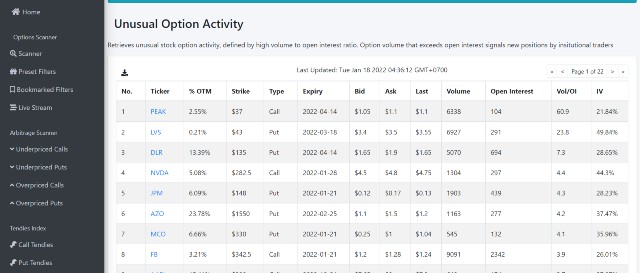

Unusual Options Activity – Like other tools, FDScanner can also spot options with unusual activity. This feature will retrieve options with a high volume to open interest ratio, possibly indicating that insiders and institutional investors like hedge funds have just opened their positions.

The screener provides essential information that will help you assess the option further, such as bid and ask, the strike price, Expiry Date, % Out The Money, Open Interest, Volume per Interest, and Implied volatility.

I find the data is well-structured. You will grasp the essential information in no time. Furthermore, you can also download this data for further analysis.

Pricing

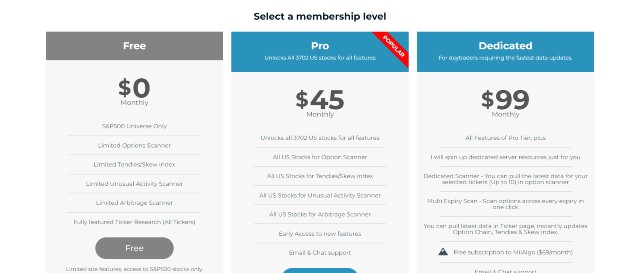

Currently, FDScanner offers three pricing plans as follows:

- Free

- Pro – $45 per month

- Dedicated – $99 per month

Free plan users can access all the features on the platform. However, they can use them only for stocks in the S&P500 index. This plan will be adequate if you mainly trade puts and calls of large-cap stocks.

However, if you want to find more opportunities, you should opt for one of the paid plans.

The Pro plan provides access to all core features on the platform. However, users of this plan cannot use the latest data in the scanners (your data will be updated once every hour). You will need to subscribe to the Dedicated plan if you want it.

I think the Pro plan will be a reasonable choice for most traders with a longer perspective. However, if you are a day trader, the Dedicated plan will be the only option.

If you are unsure whether FDScanner is the right tool for you, I suggest visiting the website and clicking “Scanner” to test all the features.

Pros & Cons

Pros

- With various screening features, FDScanner is one of the few software that offers full-fledged option screeners that go beyond unusual activities.

- Beginner-Friendly: FDScanner supplies users with guides, tips, and even cautions that are beneficial for new options traders to make more reasonable options trading decisions.

- Absolute Transparency: FDScanner guides users through all the calculations. Hence, you can be confident that the software will not make baseless recommendations.

- Suitable for all options trading strategies

- All data are downloadable.

- Lower entry prices than other alternatives

- The free version is available. You can use it for life (albeit with minimal site features).

Cons

- The user interface should be more interactive.

- Unless you subscribe to the Dedicated plan, the pricing data will not be up-to-date.

- Provide less in-depth information regarding unusual activity than other alternatives (does not include dark pool orders, etc.)

2. Optionsonar

Optionsonar is another excellent screener for options traders. However, unlike FDScanner, Optionsonar focuses on assisting individual traders following the smart money.

Therefore, if you want in-depth information regarding the unusual options activity of a particular stock, Optionsonar is unarguably one of the best tools available.

Key Features

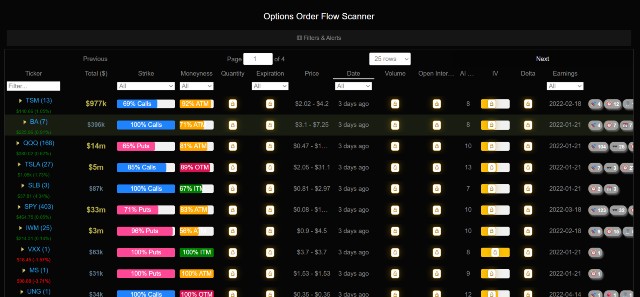

Unusual Option Activity Screeners – Powered by AI, this feature will spot these activities on the market and allow you to profit from them.

Using the screener is straightforward. Just open the screening page, and everything is all set.

This page will provide tickers whose options have unusual activities along with essential details, including trading volume, implied volatility, expiration date, percentage of calls and puts, and many more.

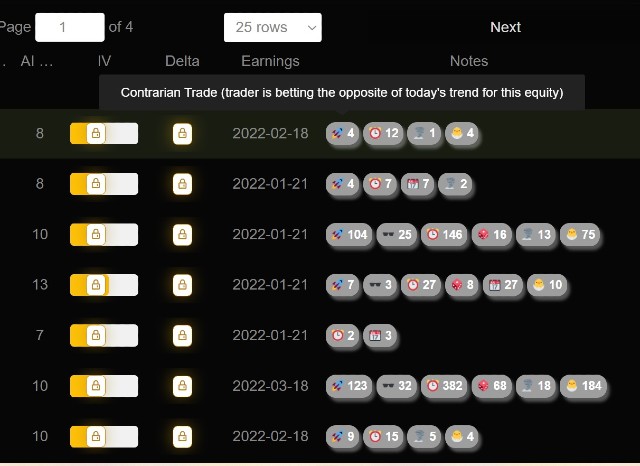

Additionally, you can view the notes on each ticker, which will inform you about several events and warnings regarding the options and their underlying stock, including but not limited to

- The options contract will expire soon.

- The earnings release is upcoming.

- Speculative Trade (The option is out of the money and has a very low probability of being in the money.)

- Volume exceeds open interest.

This information can be beneficial. It can help you prevent a loss that may result from a careless mistake.

Furthermore, if needed, you can even expand the ticker to delve into each specific unusual activity one by one. This is beneficial if you want to conduct in-depth research.

Suppose you are unsatisfied with the default search. In this case, you can fully adjust the filters so the screeners will display results that suit your preferences. For example, you can add dark pool trades, modify the filter’s expiration date, or limit open interest.

New & Opening Activity – You can search for new contracts with considerable unusual options activity, which may indicate ground-breaking perspectives on the stock.

Option Sweeps – This screener will find all Sweep Orders or large trades intentionally broken into small orders to escape external detection.

Large Action Alerts – You can set up custom alerts that will be sent via email and SMS when an action that suits your options trading style appears.

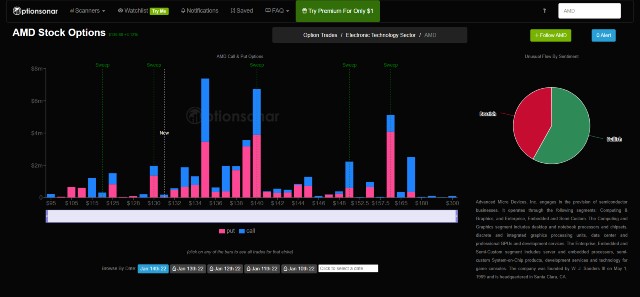

Quick Summaries – Like FDScanner, each ticker will have a specific page. This page will unveil a summary of option-related information regarding the underlying stock through various interactive charts.

For example, the uppermost chart will show all the calls and puts for each strike price of an underlying price, while the one besides will display the sentiment of all participants of the unusual flow.

In addition, you can view the essential information of top-ranked unusual options activities through the interactive table, which is the same one as those on the screeners. However, this page will also display the stock price when those option trades were executed.

Overall, I appreciate the interface of the platform. It is colorful and intuitive, allowing traders to perceive crucial information easily.

Pricing

Currently, Optionsonar offers three pricing plans as follows:

- Basic – $35 per month

- Advanced – $75 per month

- Professional – $109 per month

You may want to skip the Basic plan, mainly because you cannot set up alerts and use the Sweep/New & Opening Scanners, which will significantly deprive the tool of its usefulness.

I suggest you proceed with the Advanced plan. This plan will provide access to all features and allow you to set up a browser alert that will send push notifications to your computer and mobile devices.

The Professional plan does not offer more features besides receiving alerts through email and SMS, which I think are unnecessary for most traders.

You can use the basic features for free without even creating an account. If you find that the tool is helpful, you should subscribe to the annual plan to save up to $400 per year.

Pros & Cons

Pros

- One of the most in-depth unusual options activity screeners

- Modern, interactive user interface

- Colorful data visualizations

- Track Sweep Orders and Dark Pool Orders

- Offer detailed notes that help prevent human errors

- Low entry price

Cons

- Unlike FDScanner, Optionscanner does not offer features that allow you to scan for other options trading ideas besides those with unusual activities.

3. Benzinga Pro

Benzinga Pro is an excellent tool numerous traders use to track the stock market and grasp the latest news. However, traders can also use its platform to find options with unusual activities.

Key Features

Unusual Options Activity Signals – This feature will alert users about large, unusual options trades traded near the bid. Furthermore, like Optionscanner, it can track Sweep Orders as well.

Unlike other options screeners, Benzinga Pro will not report these activities in tables or charts. Instead, they will be in concise sentences. Still, it may not be optimal if you dislike grasping information through a wall of text.

Calendar – This feature functions as a calendar that collects all historical data regarding unusual options activities. Hence, you can always use this feature to look back in time to conduct personal research.

If required, you can filter by different metrics, such as strike price, open interest, options volume, and many more.

Real-time Data – Unlike other options screeners that the data may be too delayed to be valid, Benzinga Pro offers the latest data in the fastest manner, which matches those of institutional investors.

In other words, you will notice the unusual options activity almost immediately after the trades are executed. This feature will grant a significant first-mover advantage to users. Therefore, if you are an avid options day trader, Benzinga Pro will be your best companion.

Stock Research – As one of the best stock research tools, Benzinga Pro provides in-depth information on each particular stock. Hence, you can handily use the platform to grasp pricing data, fundamental data, and news on the underlying asset of your options.

Alerts – With Benzinga Pro, you can set up three types of alerts that will be sent through email, SMS, and browser. Hence, you will be notified instantly when an unusual trade occurs.

Audio Squawk – Audio Squawk is an audio news broadcast that will promptly deliver market-moving news to Benzinga Pro users. This feature is available for both stocks and options of your own choice.

Thus, you can snatch the first-mover advantage to buy and sell options at a favorable price.

Note: Benzinga Pro is a premium software product with many other valuable features, including the best stock screener and market pulse tracker available for individual traders.

However, most of these features are unrelated to options screeners. Hence, I chose not to write about those in this section. Feel free to read more about it on its website by clicking the button below.

Create an account to try all Benzinga Pro features free for 14 days (no credit card required)

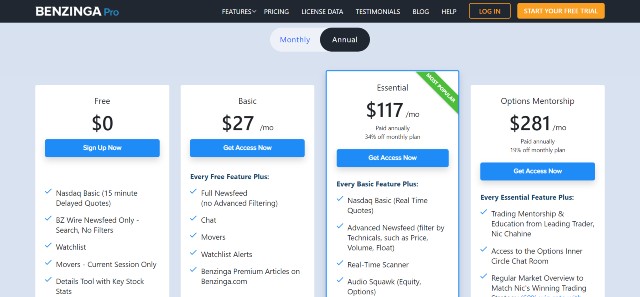

Pricing

For those who want to use all options-related features of Benzinga Pro, there are two alternatives to choose from as follows:

First, you can opt for a”Benzinga Options Mentorship” plan, costing $281 per month (billed annually). This plan provides access to all the features on the platform, plus access to an exclusive chat room, regular market overview, and trading mentorship from Nic Chahine.

Alternatively, you can subscribe to the Essential plan ($117 per month) and an add-on for unusual options activity ($27.97). This alternative will cost $145 monthly in total.

If you are new to options trading and financial markets in general, I think you should start with the mentorship to learn the basics and receive guidance from veteran traders. You can downgrade to the latter alternative once you are more experienced.

On the other hand, if you are a veteran trader, you should choose the second alternative and pay far lower subscription fees.

[sc name=”bgpro” ][/sc]Pros & Cons

Pros

- Best unusual options activity screener for day traders

- Straightforward to use

- Modern, interactive user interface

- Provide the most “real-time” data

- Offer the most timely stocks and options news through Audio Squawk

- The subscription will grant access to all other trading features on the platform.

Cons

- High entry price + Far more expensive than other alternatives

- Do not offer options screeners that can search for other trading opportunities besides those with unusual activities.

4. InvestorsObserver

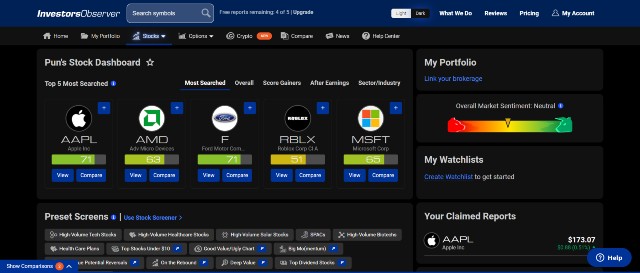

InvestorsObserver is another top-rated investment research platform. Besides options, you can use the tool to research stocks and cryptocurrencies. Hence, if you are looking for a solid, all-in-one tool, InvestorsObserver is the one that you may want to consider.

Key Features

Options News – This tool will send a detailed report regarding unusual options activity, daily options news, trade alerts, and all other information that you need to know.

Compared to Optionsonar, this tool will provide you with less in-depth information on unusual options activities. However, it offers other relevant information that can support your decision-making.

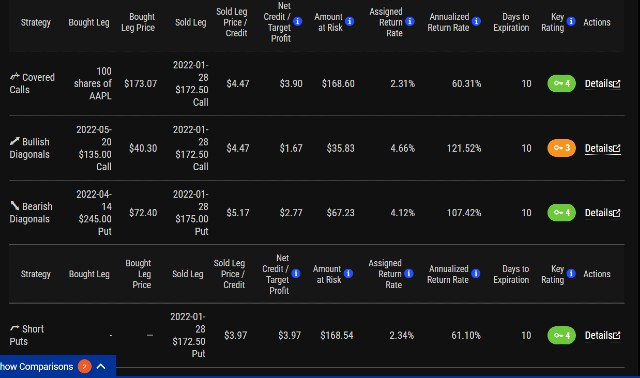

Option Trade Screener – This feature functions similarly to that of FDScanner. You can search for options trading opportunities through filtering by your personalized criteria.

Alternatively, just input the symbol (like I did with AAPL below). InvestorsObservers will then come up with seven options trading ideas. Each will utilize different strategies such as covered calls, iron condors, short puts, etc.

The screener will display all vital aspects of the trade idea, including risk rating, target profits, potential return rates, and buy/sell legs.

You can also click “Details” for the platform to show more information that you can use for further analysis.

Based on my observation, these trade ideas are perfectly reasonable or even well-crafted. However, I still recommend reviewing each prudently since it may not suit your risk profile.

Brokerage Integration and Managed Options Trading – You can integrate your brokerage account with InvestorsObservers. Hence, the latter will help manage your portfolios.

Nevertheless, I am still unsure whether it will work in the long run since InvestorsObservers does not release audited performance data. I suggest that you avoid it for now.

Overall, I appreciate InvestorsObserver’s user interface. It appears to be modern, clean, colorful, interactive. If needed, you can switch between light and dark mode. Navigation through all the features is also straightforward.

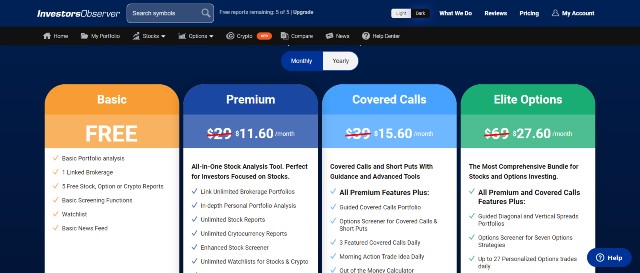

Pricing

Currently, InvestorsObserver offers three pricing plans as follows:

- Premium – $11.60 per month

- Covered Calls – $15.60 per month

- Elite Options – $27.6 per month

The only plan that you should subscribe to is the Elite Options plan. This is because the Premium plan will not grant access to option-related features, while the Covered calls plan will provide trade ideas only for covered calls and short puts strategies.

Compared to other tools, InvestorsObserver is exceptionally affordable. I suggest you create a free account to find trade ideas for five stocks for free.

Pros & Cons

Pros

- An options screener that users can use to search for promising trade ideas

- Clean and intuitive user interface

- Equipped with numerous features that help you track and analyze the financial markets (Options, Stocks, Cryptos)

- You can link your InvestorsObservers account directly to your brokerage

- Affordable pricing + 14-day money-back guarantee

- A mobile app for iOS devices is available.

Cons

- InvestorsObserver never releases audited performance data. Thus, we cannot be sure how the options strategies recommended by the InvestorsObserver perform.

5. TrendSpider

TrendSpider is a leading AI-powered stock chart tool. However, the platform also offers a top-notch options screener that allows you to track unusual options activity in real-time.

Key Features

Real-time Tracking – With TrendSpider, you can track unusual option flows in real-time. You can grasp key information such as options volume, trade size, and strike price and make profitable decisions.

Visualizations – Unlike some other platforms that may report only numerical and raw data, TrendSpider will visualize them for you through its colorful data visualization tools such as scatterplot charts and bar charts. Therefore, you can benefit from any fleeting trading opportunity that arises.

Complete Customization – You can filter any options contract based on any criteria you are interested in. Hence, you can always find the right options that suit your trading strategies.

Block and Sweep Trades Tracking – TrendSpider can track both options block and sweep trades.

Charting Platform – You can use all options features with TrendSpider’s powerful charting platform. Therefore, as a trader, you can handily integrate options tracking with other trading tools without the need to use multiple trading software products.

The benefit of having such an “advantage” is significant since it effectively smoothens your decision-making process and eliminates human errors and distractions. Your trading decisions will be more accurate and lucrative.

User Interface – Like InvestorsObserver, Trendspider’s platform is clean and modern. I never spot any hint of clunkiness. Navigating through all available features is also effortless.

The only drawback is that using Trendspider can be overwhelming at first for newcomers. This is because the features available are numerous, and some of them are NOT self-explanatory, especially for new traders.

Hence, you will need to read Trendspider’s user manual or watch tutorial videos to use the platform at its full potential.

You can visit the feature page or watch the video below to better understand how these features work.

Pricing

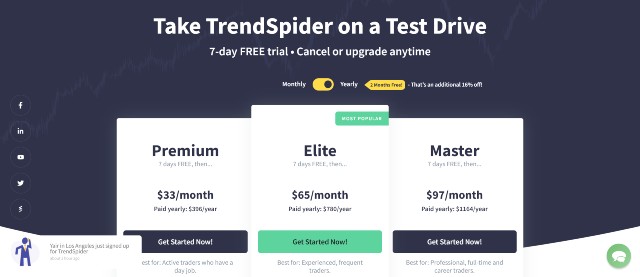

Currently, TrendSpider has three pricing plans as follows:

- Premium – $44 per month

- Elite -$87 per month

- Advanced – $131 per month

You will get two months free if you opt for an annual subscription.

All three plans provide full access to real-time option flows and other relevant features. The differences lie in other charting features. For example, Premium plan users cannot access backtesting, intraday scanning (for stocks), and multi-factor alerts.

Since these features do not impact unusual options activity tracking, you can freely choose the plan that suits your trading strategy. I believe the Premium plan is more than adequate for most traders.

You can start a 7-day free trial to try all the features (requires a credit card.)

[sc name=”tspider” ][/sc]Pros & Cons

Pros

- Real-time option flows are available for all subscribers.

- Clean and modern user interface

- Exceptional data visualizations

- Robust built-in charting platform

- Provide excellent user manual, documentation, tutorial videos, and even a 1-on-1 training session to help you get on board.

Cons

- Cannot search for other options opportunities besides unusual activities

- Starting a free trial requires a credit card.

Other Alternatives for Best Options Screeners

Trade Ideas – Trade Ideas is an AI stock trading software. However, it also provides users with an unusual options activity tracker on its platform. I decided not to include it in the list because the software does not offer additional features that support options trading.

Market Charmeleon – This website supplies traders with a solid options screener. Unfortunately, the user interface is clunky, and the appearance looks aged (as if it is from the 2000s). The font size is also too small to read. Thus, I think you will be better off with those tools on the above list.

Related Tools

AI Stock Trading Software – An excellent addition for options traders who also trade stocks. These AI-powered software products will provide various recommendations to optimize your stock trading performance.

Best Stock Screeners – Stock traders may frequently run out of trading opportunities. These screeners will help you solve that problem forever.

Mutual Funds Screener – Coming Soon