Finance is a subject that comprises numerous aspects. To be the best in it, you need to know about the most up-to-date subjects like Artificial intelligence (AI), which is rapidly transforming the entire finance industry.

Many financial institutions have replaced many jobs with AI. It is possible that one of those could be yours, especially if you lack AI-related skills. Hence, you may want to enhance your skills to prepare for the inevitable rise of AI.

For this reason, many course providers are offering online courses taught by professional trainers and qualified experts. However, not all courses are of high quality. You still have to find the best one that suits your preferences from a pile of many others.

I decided to do the heavy lifting for you. This post will only feature the best courses that I believe are worth taking. You can then find the one that suits your learning style and start learning right away.

Affiliate Disclosure: This post from Victory Tale contains affiliate links. We will receive a small commission from the course providers if you purchase the courses through our links.

Nevertheless, we always value integrity and prioritize our audience’s interests. Therefore, you can rest assured that we will present all courses truthfully.

Things You Should Know

Victory Tale never ranks courses sequentially. In other words, the first course is not always better than the 3rd.

This is because I believe each student has their preferred learning style, budget, and needs. Thus, no course fits all. I thus suggest you read through the details I provided and make decisions prudently.

Criteria

Below are my criteria for the best AI in Finance courses.

- Taught by credible instructors

- Available on a user-friendly learning platform

- Offer excellent course materials

- Provide good value for money

- Receive mostly positive reviews from real students

- My personal experience with the course, instructor, and learning platform (if any) must be positive.

I will review this post quarterly. If I find out that any course fails to meet the criteria. I will remove it from the list immediately.

1. Fintech: AI & Machine Learning in the Financial Industry

This edX course from the University of Texas at Austin will explain AI and machine learning concepts and apply them to Finance in detail.

If you are looking for a robust introductory course with no computer science prerequisites, this one is likely to suit your needs.

Course Content

The course content will mostly cover the fundamental knowledge of AI & machine learning and its practical applications as follows:

- Crowdfunding market (Equity crowdfunding, marketplace lending)

- Overview of Artificial Intelligence (Linear machine learning models, overfitting, accuracy)

- Non-linear machine learning models, deep learning, credit modeling

- Applications in Finance – Robo-Advising, Social Investing, and Quantitative Investing

In essence, you will learn some technical aspects of AI and machine learning. However, you should not expect that you will build a complex machine learning model in this course.

You will only learn about theories and how the financial services industry applies these technologies in the real world.

The course is self-paced. Since the recommended weekly workload is approximately 5-6 hours, and you will complete the course in 4 weeks.

Unlike typical edX courses, you cannot audit the course for free. If you are interested, you will need to buy a full course, in which you will receive graded assignments and instructor support. Furthermore, upon successful completion, you will receive a certificate.

The tuition fee for the full course is $850. However, if you choose to enroll in the entire Fintech program from the University of Texas at Austin, you can access this course and other Fintech courses at a 10% discount.

Pros and Cons

Pros

- Comprehensive course to grasp an overview of AI & machine learning

- Manageable weekly workload, thus excellent for full-time financial professionals (asset managers, investment bankers, or accountants)

- Self-paced learning

- Well-structured curriculum

- Beginner-friendly

- Great course for learners who don’t want to code much.

Cons

- Cannot audit the course for free.

- The cost to enroll is much higher than peers.

- Not very in-depth (the course barely touches technicals.)

2. Machine Learning with Python for Finance Professionals

This edX course from ACCA (the Association of Chartered Certified Accountants) is designed to provide accountants and other finance professionals with technical training.

If you are searching for a course that teaches you the necessary coding skills for implementing machine learning and AI, you don’t need to look elsewhere. You will learn everything you need from this course.

This course has no prerequisites, so everyone can start learning right away.

Course Content

Below is a summary of what you will learn from the course.

- Python Programming (Data Types, Variables, Flow Control, Functions, etc.)

- Python for Data Analysis

- The Pandas library for data manipulation/data preprocessing

- Automating Excel and workflows using Python

- Essentials of real-world AI projects

- Machine learning theories and their relationship to big data, AI, and data science

- Basic machine learning algorithms, how to prevent overfitting, etc.

Upon course completion, you will have a solid foundation of programming skills required for more advanced AI and machine learning courses. You can then enroll in those immediately.

The workload for this course is 4-5 hours per week for 5 weeks, which is totally manageable for full-time finance professionals.

This course is free to audit. However, based on my experience, the full experience, which costs $199, is a much better option.

Since you are very new to programming, it would be best to receive feedback on your projects and access the instructor to ask questions so that you can be certain you are on the right track.

Pros and Cons

Pros

- Provide excellent technical training for accounting, banking, finance professionals or business leaders

- Well-structured

- Beginner-friendly

- Free to audit

- Manageable workload

- Learn from real-world examples from the financial world

Cons

- Cover only the essentials. The course will not help you become an AI expert. Those serious about seeking a future career in an AI-related field will need to take more solid Python and machine learning courses.

3. Professional Certificate in Machine Learning and Finance

This edX program from the New York University is an excellent alternative for those who want to learn more technical aspects of AI and machine learning and build a real-world machine learning model to solve numerous problems in the financial sector.

Unlike the first course, this program has several prerequisites, including solid programming background (Python is preferred), probability, statistics, calculus, and linear algebra. Therefore, you should understand all these topics before enrolling.

Course Content

The program comprises two courses as follows.

1. Classical Machine Learning for Financial Engineering – The first course will provide an overview of classical machine learning algorithms, including linear regression, logistic regression, decision trees, support vector machines, supervised learning, and unsupervised learning.

Furthermore, you will apply these concepts to finance by using them to optimize portfolios, control risks, and make financial-related predictions.

2. Deep Learning and Neural Networks for Financial Engineering – The second course will explore advanced machine learning topics. These include deep learning, neural networks, RNNs, CNNs, natural language processing, and many more.

You will then use the knowledge you learn to optimize your investment portfolios, control risks, and perform other financial engineering tasks.

Upon program completion, students will understand the concepts and tools and manage to build advanced ML models of their own.

I think the program best suits quantitative analysts. Still, any finance professionals with a programming background will also find this program highly beneficial, especially for those who pursue a new career at Fintech startups or financial technology firms.

The workload for this program is manageable. You should spend 4-6 hours per week on the program, and you will complete it in 4 months.

Similar to the first course, you cannot audit the program for free. Instead, the tuition for the entire program is $1,438.

Pros and Cons

Pros

- Comprehensive program to learn all ML methods and tools and understand how to construct practical models to solve problems in Finance

- Highly detailed with a technical focus and thus excellent for quantitative analysts.

- Learn from top-notch experts from the world-class university

- Self-paced learning with manageable workload

- In-depth and well-structured curriculum

Cons

- Expensive

- No free audits

4. Python Machine Learning Bundle

CFI or Corporate Finance Institute has provided several great courses for new grads and finance professionals to enhance their job-ready skills.

Regarding AI in Finance, the institute offers the Python Machine Learning Bundle that will teach the fundamentals of machine learning skills required for your career progress in the evolving financial industry.

You don’t need any background knowledge for the course, as the instructors will start from the very beginning.

Course Content

The bundle consists of two courses as follows:

Machine Learning for Finance – Python Fundamentals – The first course will help you gain the Python programming skills required to progress in the machine learning curriculum.

Essentially, you will learn how to code in Python from the beginning, starting from data types and conditionals to loops and functions. Subsequently, you will start your data analysis journey by learning about NumPy and Pandas libraries.

Applied Machine Learning Algorithms – The second course will tackle machine learning algorithms. You will use Python to build a machine learning classifier.

Throughout the building process, you will learn several concepts and skills, including regression algorithms, identifying overfit regression models, data preprocessing, etc.

Like other CFI courses, you will have several resources that support your learning, such as quizzes and final assignments.

The bundle costs $249 for lifetime access. In addition, you will receive all the following updates that the CFI provided.

Compared to other alternatives on the list, the bundle covers the basic concepts and implementations that finance professionals would find useful in their careers.

However, the courses will not take a deep dive into advanced concepts such as deep learning or reinforcement learning. The content in the bundle is hence similar to the 2nd course by ACCA.

I think you can choose freely between the two, though I personally prefer CFI courses, as I always appreciate the quality of learning resources they provide.

The big advantage that CFI courses have over others is that they are officially accredited in the US (by the NASBA) and Canada. Thus, you can earn as many as 8.5 CPE credits completing all courses in the bundle.

Undoubtedly, this bundle is a superior alternative to other AI in Finance courses for CPA accountants.

If you are interested, you can preview some parts of the course without charges. I suggest you do so before purchasing to ensure that you appreciate the teaching style.

[sc name=”cfiint” ][/sc]Pros and Cons

Pros

- Well-structured and beginner-friendly course

- Excellent learning resources

- Learn from numerous real case studies

- Lifetime access

- Final assessment to test your skill sets

- Officially Accredited in the US and Canada

Cons

- Not the best for finance professionals who want to switch careers to the AI industry or seek AI-based roles in financial institutions, as the courses do not cover advanced concepts

5. Artificial Intelligence for Trading

The AI revolution has completely transformed many businesses of financial institutions, particularly sales and trading.

All banks and financial services firms now utilize the power of artificial intelligence to provide better trading signals (i.e., pattern recognition), manage risks, and optimize portfolios.

Inevitably firms will demand that their traders on the team develop AI skills to perform better than competitors. Hence, you must develop AI skillsets beforehand to ensure job security.

This online program from Udacity is one of the very few courses that provide training to build such skills.

Still, this program has several prerequisites. You need background knowledge in Python and the NumPy library, intermediate statistics, calculus, and linear algebra before taking the course.

Course Content

The course content focuses on AI-powered quantitative trading. You will use Python to develop lucrative trading strategies and construct a multi-factor model for building well-optimized portfolios.

The program comprises as many as 8 courses as follows.

- Basic Quantitative Trading – The first course will provide an introduction to quantitative trading. You will understand how to find trading signals with historical data.

- Advanced Quantitative Trading – The second course will discuss quant workflow for trading signal generation and apply popular quantitative methods.

- Stocks, Indices, and ETFs – You will understand the fundamentals of portfolio optimization and financial securities that comprise the portfolio.

- Factor Investing and Alpha Research – You will learn about alpha, risk factors, and how to build a perfectly optimized portfolio with advanced techniques.

- Sentiment Analysis and Natural Language Processing – This course will deep dive into natural language processing. You will use NLP to analyze corporate filings or financial data to find sentiment-based trade signals.

- Advanced Natural Language Processing with Deep Learning – You will apply deep learning to quantitative analysis and use RNNs to find trade signals.

- Combining Multiple Signals – This course will teach you to select, compare, and compare the factors you have generated from the data.

- Simulating Trades with Historical Data – This final course will teach you how to refine trade signals based on backtesting. You will track your gains and losses as AI trades.

In addition to video lectures, you will gain access to many learning resources. The best of all are numerous projects.

You will complete one real-world project for each course, which is equivalent to 8 in total, providing sufficient hands-on experience that you can leverage further in your professional career or personal trading.

Unlike other AI in Finance courses, you will gain access to Udacity’s bootcamp-like support. You can ask any questions to your mentor at any time, receive unlimited project reviews, and access career services.

Nevertheless, the workload of this program is intense. You should expect to spend 10 hours per week for 6 months on the program. Therefore, full-time finance professionals should make sure that you have adequate study time before enrolling.

Pricing

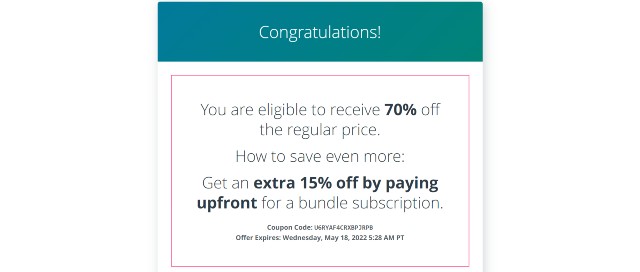

The tuition of this course is $399 per month or $339 (if you pay for all 6 months at once.) Still, Udacity frequently provides discounts, which could save as many as 75%. This will help you gain access to this excellent program as inexpensive as $100 per month.

As a trader myself, I believe this course is beneficial not only for those who aspire to become professional quantitative traders but also for retail traders.

To be specific, you can use the knowledge from this program to utilize AI trading software products effectively and make more profits. Thus, I would say the course is 100% worth the price.

[sc name=”udacity” ][/sc]Pros and Cons

Pros

- Comprehensive program on quantitative trading strategies, algorithmic trading, AI implementations in trading

- 8 real-world projects to complete

- Fast, Bootcamp-like support

- Unlimited project reviews are highly beneficial.

- Excellent program materials

- Flexible Pricing

Cons

- High monthly workload

Other AI in Finance Courses

Artificial intelligence is a nascent industry, which is still under significant development. As AI technology progresses, I believe there will be more great AI in Finance courses available in the recent future.

I will update this post with more information when I have found one.