It’s no surprise that the stock market is getting more attention than ever. Since the end of the Great Recession in 2009, stocks have become one of the most popular investment assets amongst investors and traders worldwide. All major indexes all skyrocket to new highs.

With thousands of stocks in the market, finding the right one to purchase at the right time can be troublesome. Hence, numerous investors and traders alike miss such lucrative opportunities that can grow their money in many folds.

An excellent stock screener is much needed.

A stock screener works as a search engine that filters the stock with the necessary conditions. It increases the efficiency of search and reduces the time and labor needed to scan the entire stock market manually.

Unsurprisingly, stock screeners are a boon for traders and investors, as they save hours of their valuable time in the research process.

Currently, many companies have created several tools and applications for that purpose. Thus, there are tons of paid stock screeners available in the market.

However, finding an excellent tool or an application from such a colossal marketplace becomes highly challenging.

I decided to do the heavy lifting for you. This post will feature the best paid stock screeners available in the market. Thus, all stock market participants can handily choose the one that suits their investing or trading style.

Affiliate Disclosure: This post from Victory Tale contains affiliate links. If you subscribe to stock screening software, we will receive a small commission from its providers.

However, since we always value integrity and prioritize your audience’s interests, you can rest assured that we will present all the tools truthfully.

Things You Should Know

Below are essential points that I believe you should know before choosing a suitable stock screener for your trading and investing career.

Free vs. Paid Stock Screeners

If you are new to stock screening, you may not know which one is the most suitable tool for your investment strategy. You may choose to keep using the free stock scanner, and avoid investing your money in paid tools.

As a techno-fundamental investor, I have used numerous tools from both categories. I could say using free stock screeners is not optimal.

I am not against using them. However, all free stock screeners have significant limitations and drawbacks, including but not limited to the following:

- Very few data points and filter criteria for effective stock screening

- Their stock universe is too small. For example, some free screeners only cover large-cap stocks, not small ones in the Russell 2000 index.

- Free stock screeners never provide real-time data. Thus, the data is not tradable (not usable for day traders)

- Provide insufficient features to support comprehensive research

- The platform is not user-friendly.

- and many more

Premium stock screeners have very few or none of these limitations. This is why paid stock screeners are always superior.

Certainly, you will need to invest some money, but the benefits far outweigh the expenses. These top-notch tools can help you make money from the market many times the subscription fees.

Hence, I would say paid stock screeners are 100% worth it.

Are Brokerage Stock Screeners Good Enough to Use?

Some premium brokerages provide built-in stock screeners on their trading platform. All my brokerages: Interactive Brokers, Saxo Bank, and Charles Schwab, provide decent tools to screen stocks for free.

However, I found these tools fail to match premium third-party tools, especially if you have a specific strategy based on technical analysis.

This is because they don’t offer sufficient technical screening criteria to choose from. Thus, these screeners are of no use to me, as they cannot find the stocks I need for my trading strategy.

Criteria

All stock screeners in this post will be sorted into two groups: Fundamental and Technical. Fundamental stock screeners will be best for value investors, GARP investors, dividend investors, and other investors who are willing to hold stocks for the medium to long term.

On the other hand, technical stock screeners are optional for day traders, swing traders, trend followers, breakout traders, and others who use charts and tend to hold stock only for the short term.

Hence, as this post features two types of stock screeners, each will have different criteria.

Below are the criteria for the best fundamental stock scanners.

- Sufficient fundamental screening criteria (50+ or above)

- Massive coverage of US stocks of all sizes

- User-friendly platform

- Frequent data update

- Easy/Straightforward to use

- Provide years of historical data

- Equipped with various tools that you can use for stock analysis

- Beautiful and interactive data visualization

- Mostly positive reviews from real users (if applicable)

- My personal experience with the tool must be positive.

- Excellent value for money

- Innovative usage of AI and machine learning is a plus.

Below are the criteria for the best technical stock scanners.

- Offer real-time data on stock prices from the stock exchange

- Colossal coverage of US stocks of all sizes

- User-friendly platform

- Sufficient technical screening criteria

- Beautiful charts with adequate historical pricing data and technical indicators

- Effective alert system

- Mostly positive reviews from real users (if applicable)

- My personal experience with the tool must be positive.

- Excellent value for money

- Innovative usage of AI and machine learning is a plus.

- The ability to find stocks in tradable patterns (i.e., hammer, cup-with-handle, flags) is a big plus.

Important Notice #1: I never rank the software on the list sequentially. Thus, this does not imply that the first product is the best of its kind.

I understand that every product has its strengths and weaknesses. Furthermore, all readers have their preferences. With that many factors, I cannot rank products in that way.

I hope that all readers will read through the information we present carefully and select the stock scanner that suits their trading or investing style.

Important Notice #2: Most tools on the list aim toward investors and traders in the US stock market. However, you can use some of these tools to screen global stocks as well.

Important Notice #3: This post will include only tools that are accessible and affordable for individual traders and investors. Therefore, those used by institutional investors such as Bloomberg Terminal, Reuters’ Eikon, and Factset will NOT be on the list.

Fundamental Stock Screeners

We will start with stock screeners that provide various criteria based on fundamental analysis.

1. Gurufocus

Gurufocus is an investment platform that I have been using for almost ten years. The platform offers an excellent stock scanner and numerous tools to help you find the right stocks based on the value investing philosophy.

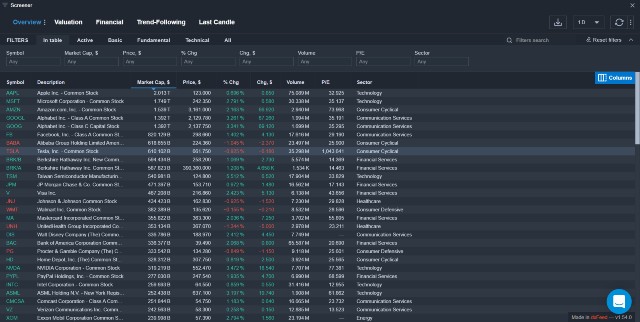

Gurufocus’ Stock Screener

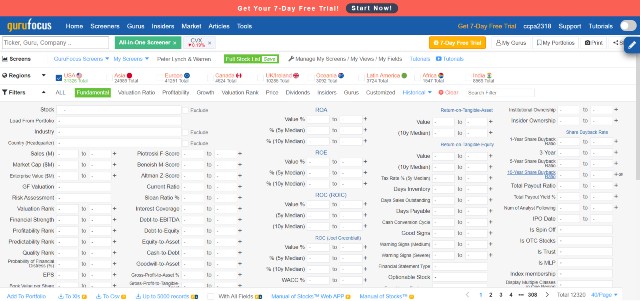

All-in-one Screener – Gurufocus allows users to screen global stocks using hundreds of fundamental criteria ranging from growth rates, valuation ratios, profitability, institutional ownership, and many more.

Compared to other fundamental stock screeners, Gurufocus is unarguably the one that provides the most filter criteria.

The screening criteria are abundant and can be highly specific. In addition, you can even screen stocks based on historical data. Thus, it works perfectly for advanced investors who want to conduct in-depth research.

This stock scanner is easy to use and allows complete customization. As a web-based platform, you do not need to download and install any software on your computer. You just need to understand the accounting terms and input your preferred numbers into the screener.

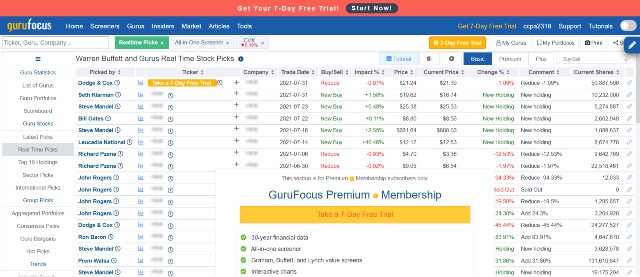

Guru Screener – Do you want to find stocks that investment gurus such as Warren Buffett would buy? The Guru screener can provide those stocks for you within a second.

The platform will automatically input stock selection rules that those gurus recommend and scan the data for the right stock. Thus, you can find such stocks without the need to input any rule on your own.

Real-time Guru Picks – Gurufocus will drill deep into each real-time guru pick (i.e., Hedge Fund Managers) based on their official reports. Thus, you can quickly grasp their views on specific stocks and even obtain more stocks to research on.

Other Stock Screeners – Gurufocus also has other pre-built stock screeners that you can use to find the stock that fulfills multiple quality metrics such as high dividend growth, fast growers, and high quality.

Value Screens – This stock screener is designed exclusively for value investors. It will provide various stock lists that fulfill value-based criteria, including historical low P/E , high short interest, and 52-week lows.

Stock Research Tools – You can click on the results to view Gurufocus’s excellent stock research tools, including 30-year financial data, DCF calculator (extremely simplified financial modeling tool), and interactive charts.

The data that Gurufocus offers is significantly more in-depth than any other tool I have found. Furthermore, I also like its colorful data visualization as it helps me find actionable insights faster.

Data Export – You can export all results that the stock scanner provides in XLS or CSV files

The only drawback for Gurufocus is that its user interface is old and clunky. All elements of the platform are cluttered. This has not changed at all since I first used it back in 2011.

I understand that many will not tolerate such a clunky user interface. However, I hope you will give Gurufocus a try, as it is undoubtedly one of the best fundamental screeners that many other tools cannot compete with.

As Gurufocus is a freemium tool, you can use some of its features for free. However, if you want to use the tool to its full potential, you will need to start a 7-day free trial (credit card required.)

Pricing

Gurufocus has a unique pricing model. The price of the subscription depends on the membership level and the regions you need.

First, you need to select the region you need. Each region is priced differently as follows:

- US – $449 per year (or $37.5 per month)

- Canada – $289 per year

- Europe (excluding the UK and Ireland) – $399 per year

- UK and Ireland – $269 per year

- Asia (excluding India and Pakistan) – $399 per year

- India and Pakistan – $249 per year

- Latin America – $289 per year

- Africa – $249 per year

- All regions – $2081 per year

Above is the pricing for the Premium plan. The plan provides access to most features, including stock scanners, stock research tools, interactive charts, real-time guru picks, and many more.

This plan is more than adequate for all users who want a premium stock screener. However, if you want even better features for stock research, you can subscribe to the PremiumPlus plan, which costs an extra $849 per year and access the following features.

- Backtesting

- 13F, 13D, 13G for all institutional investors

- Gurufocus API

- and many more

These features will add depth to your stock research. However, I don’t think these are necessary for most investors. The Premium plan is enough for high-quality stock screening.

Pros and Cons

Pros

- The best stock screener for fundamental-based investors, particularly value investors or conservative investors interested in dividend stocks.

- Feature gigantic coverage of global stocks from all regions, including more than 15000 U.S. stocks, 34000 European stocks, and 21000 Asian stocks.

- Provide the highest number of screening criteria with full customization

- Various pre-built stock screeners to save time and simplify the stock screening process

- Real-time Guru picks to track high net-worth and hedge fund managers

- In-depth stock research tool with colorful data visualization and detailed historical data

- Straightforward to use

Cons

- The platform is extremely clunky. The user interface is old and dated.

- At $449 per year for US Stocks (or $37.5 per month), the pricing is more expensive than most stock screeners.

- No monthly billing. You will need to subscribe to Gurufocus Premium for a year.

2. Stock Rover

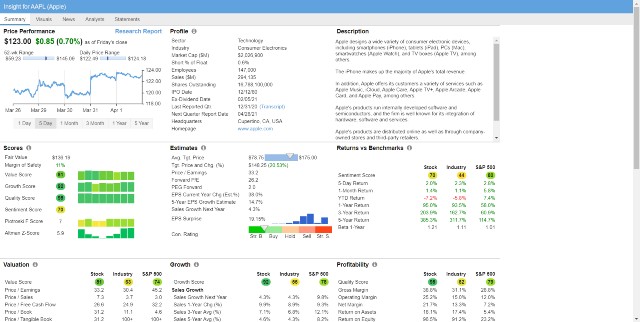

Stock Rover is another investment research platform for small investors who want to earn big in the stock market. The platform offers an excellent stock screener, allowing users to find the right stocks in less than a minute.

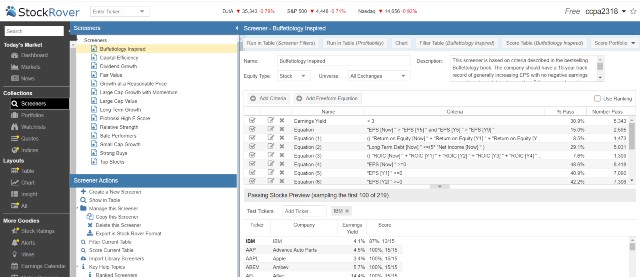

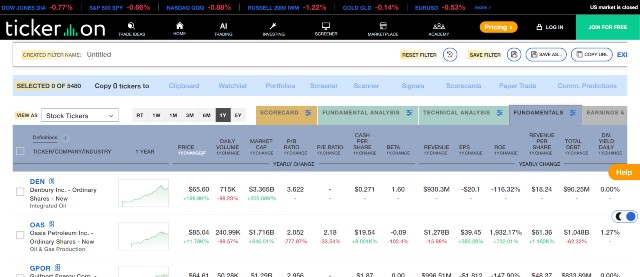

Stock Rover’s Screener

Stock Rover’s screener is a comprehensive tool that can search for the right stocks, ETFs, and mutual funds for your portfolio.

Pre-built Templates – Like Gurufocus, Stock Rover has prepared several valuable templates that allow users to find stocks that fulfill particular conditions in one click. Below are some of the popular templates.

- Buffetology Inspired

- Growth at a Reasonable Price

- Relative Strength

- Small-Cap Growth

Using pre-built templates is the easiest way to scan for the right stocks on the Stock Rover platform since you don’t need to input anything. You can then use Stock Rover’s stock research tool to evaluate further whether it is the right candidate to buy.

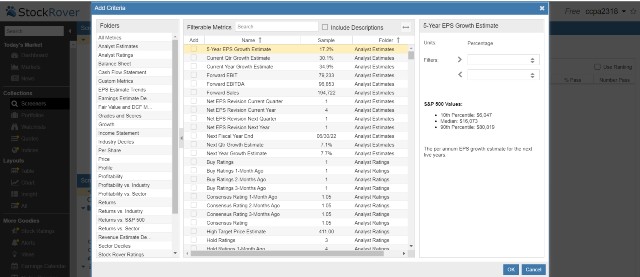

Create Your Own Scanner – Advanced users can also create personalized scanners. Currently, you can create it by adding both criteria or free-form equations. The latter would be more complex, but you will need them if you have specific conditions for your filters.

You can fully customize your criteria by inputting the desired values. What I like about this part is that Stock Rover provides the S&P 500 values of that particular criteria (if applicable).

Thus, you will perceive clearly whether your desired values make sense, which will save you the frustration that the scanner gives out no results.

As of August 2021, Stock Rover offers 558 criteria you can add to the screener, including those regarding financial health, growth, valuation, profitability, analyst estimates, and many others.

Ranked Screener – Ranked screener is an excellent feature unique to Stock Rover that I find extremely beneficial. With this feature, you can assign a weight to particular criteria so that Stock Rover will display the results according to your preference.

Hence, the first results would be the top candidates that best fulfill your defined conditions, reducing hours of research time in the process.

ETF Screener – Similar to stocks, you can use Stock Rover to screen ETFs to add them to your portfolio.

Stock Research Tools – Like other tools, Stock Rover offers a full suite of investment research tools, including ten years of detailed financial data, stock reports, interactive charts, and many more.

Pricing

Currently, Stock Rover has three pricing plans as follows:

- Essentials – $7.99 per month or $79.99 per year

- Premium – $17.99 per month or $179.99 per year

- Premium Plus – $27.99 per month or $279.99 per year

I recommend skipping the first two and subscribing to the Premium Plus plan. This is because the first two do not grant access to vital stock screening features, such as equation screeners, pre-built screeners, ranked screeners, and historical screening.

Suppose you use the first two plans. I don’t think the screeners will be very different from the best free stock screeners. You will need the Premium Plus features to enhance the screener’s capability.

Besides the full stock screening features, the Premium Plus plan grants access to all other features on the platform, including stock fair value & margin of safety (eliminating the need to create a financial model on your own), investor warnings, and stock ratings.

Such additional features are highly beneficial. They will help you conduct improved research on stocks that pass the screening and make better investment decisions at the end.

Thus, I would say that Premium Plus is definitely the plan you should seriously consider subscribing to.

Pros and Cons

Pros

- Excellent stock market scanner for both beginners and advanced users

- Massive coverage of US stocks, ETFs, and mutual funds

- Allow complete customization of stock screeners

- More than 500 fundamental and technical screening criteria to choose from

- Pre-built stock screeners to find stocks in one click

- Ranked screener to optimize your results

- In-depth and up-to-date financial data (up to 10 years)

- Additional stock research tools can be beneficial for analyzing stock picks

Cons

- With various sophisticated features, new users could feel overwhelmed at the beginning.

- Some features, such as equation screeners, are also not self-explanatory. Thus, you will need to read the guide or ask the support team for help.

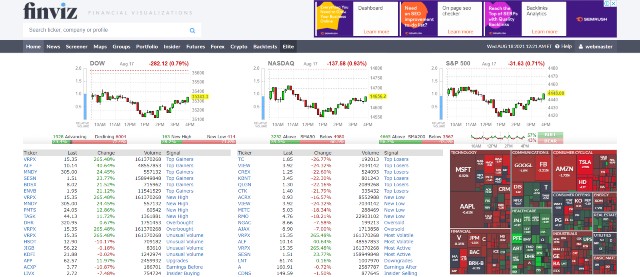

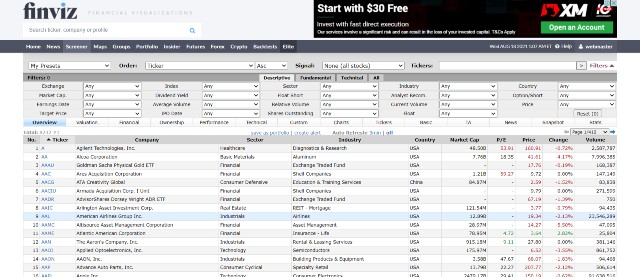

3. Finviz

Finviz is a freemium platform that aims to provide financial visualizations for retail investors. Equipped on the platform is a top-notch stock scanner that anyone can use to find the right stock for their portfolio.

Finviz’s Screener

Finviz’s stock scanner is straightforward. You just need to input the screening criteria with your desired values.

The platform now provides various groups of screening criteria, including valuation, financial, growth, technical, and many more. Still, the criteria are not as in-depth and varied as Gurufocus’.

As a Freemium tool, you can use Finviz’s stock scanner for free. However, you will not be able to insert custom values or export the data. You will need a Finviz Elite subscription if you want to do so.

The best thing about Finviz’s stock screener is that it is beginner-friendly and much more simplified than Gurufocus. However, if you want to use distinct screening criteria, I don’t think Finviz will perform. You will need to consider other stock screeners.

Stock Research Tools – Like Gurufocus and Stock Rover, Finviz offers various tools to help you with stock research. These include detailed financial data, insider trading data, interactive charts, and many more.

Pricing

Finviz offers only one premium subscription, the Finviz Elite, which costs $24.95 per month.

An upgrade to Finviz Elite will provide advanced features to your stock scanner and other tools, including the following:

Custom Values – Instead of using pre-made values (i.e., top 15% EPS growth) for the screening filters, you can input your own (i.e., EPS growth = 20%)

Data export – You can export data freely from the Finviz platform and use it for further research anywhere.

Improved Financial Data – Finviz Elite users can access up to 8 years of financial data instead of 3 years for the free version.

Real-time data – All Finviz Elite users can access real-time stock quotes with all stock features, including your stock scanner. Thus, all the financial data the platform provides will be fresh.

Technical Analysis features – Finviz Elite also grants improved technical analysis features such as advanced charts and backtesting of technical indicators.

From an overall perspective, Finviz’s features are fewer than those of competitors. However, its platform is much easier to use. It is also equipped with real-time data that many fundamental stock screeners do not provide.

If you are new to stock investing, using a simplified financial platform at the beginning of your investment journey would be a wise decision because you will never be overwhelmed by stuff you never know.

Furthermore, as you can cancel your Finviz Elite subscription at any time, you can always opt-out for more advanced stock screeners when you are more knowledgeable.

Pros and Cons

Pros

- Massive coverage of US stocks

- Straightforward to use + Beginner-friendly

- Simplified stock screener and financial data

- Real-time data provided

- Freemium pricing structure

Cons

- Fewer screening criteria and stock research features than other alternatives, thus not optimal for advanced investors.

- The platform is a bit clunky.

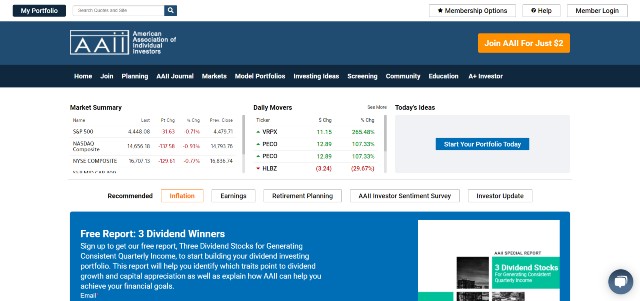

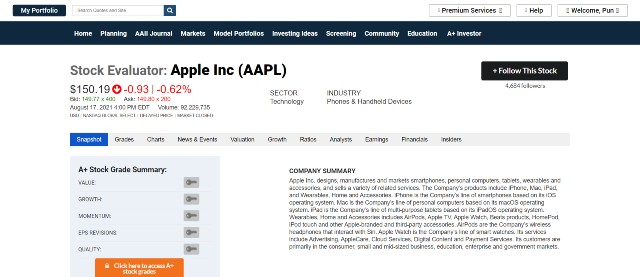

4. AAII

AAII, or the American Association of Individual Investors, is a non-profit corporation that aims to assist individual investors in managing their own assets.

The platform now offers different stock screens that are straightforward to use. If you are a beginner, I believe the AAII platform is one of the best stock screeners you may want to consider.

A+ Investor

A+ Investor is AAII’s membership that grants access to all of its powerful stock screening tools. Besides these tools, all members can also use other investment toolkits to select and manage investible assets for their portfolios.

Below are the major tools that the AAII has yet to offer.

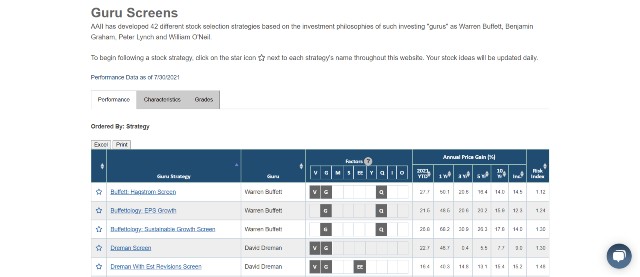

Premium Stock Screens – Premium stock screens provide exclusive model portfolios based on various strategies. Some are those popularized by legendary investors such as John Neff, David Dreman, and William O’Neil.

Guru/Factor Screens – This stock screener builds portfolios based on guru strategies and factors (i.e., high dividend yield, high EPS growth, low P/E) that are proven to generate exceptional returns.

There are more than 60 portfolios in total. Members can evaluate each portfolio’s performance and financial characteristics, along with access to each stock in the portfolio.

These two features would be beneficial to build a portfolio or find stocks that pass all the criteria based on these popular strategies.

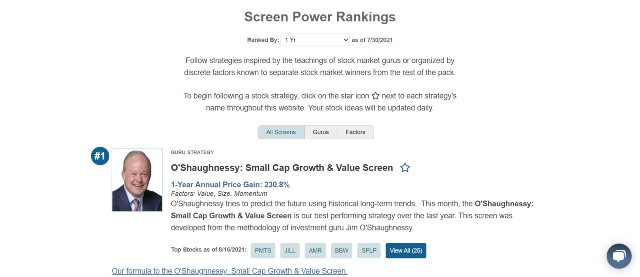

Screen Power Rankings – This feature compares popular investment strategies over time (up to 20 years or at inception). These strategies are both from gurus and factors. Thus, you can realize which strategy performs best in the short term and the long term.

Furthermore, it will show all current stocks that pass the screening (all stock ideas are updated daily.) You can also follow any strategy and receive a notification when a new stock idea appears.

Custom Stock Screener – Like other stock screeners, you can customize the screener to find the right stock for your portfolio. However, this is a new feature that AAII has just introduced. Thus, it may not work as well as other alternatives.

Research tools – A+ Investor membership also provides access to robust research tools, such as stock grader, interactive price charts, mutual fund & ETF screener, analyst ratings, and numerous reports on individual stocks, industries, trends, which you can leverage in investment selection.

Bottom Line: Compared to other fundamental stock screeners, AAII has a different approach. It heavily focuses on providing model portfolios based on popular strategies. Thus, you can access the right stocks and build a top-performing portfolio without hassles.

However, you cannot customize the screeners at all, so it would be better for advanced investors or those with a unique strategy to consider other best stock screeners elsewhere.

Pricing

The pricing for A+ Investor membership is $199 per year or $16.5 per month on average, which is much more affordable than most tools on this list. All members can access every stock screen without limits.

Pros and Cons

Pros

- Best paid stock screener to build a portfolio that follows popular strategy from gurus

- Beginner-friendly + Straightforward

- Choose the right stock pick from the portfolio that performs well over time

- Provide detailed financial data and relevant information regarding each stock

- The membership includes numerous fundamental stock reports that could be useful in further research of stock picks.

- Affordable pricing

Cons

- Very few features are available for customized stock screens, thus not the best for stock investors with a personalized strategy.

- The platform’s load time is quite slow.

Technical Stock Screeners

Below are the best technical stock screeners. You can use the screener for day trading and any other trading styles that involve charts or short-term price prediction.

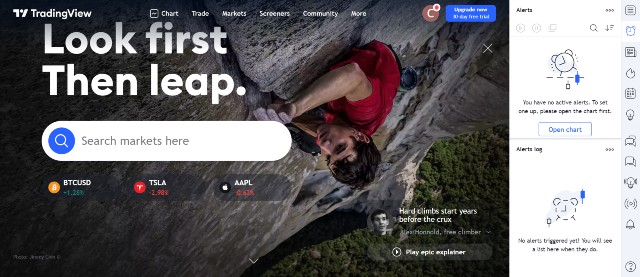

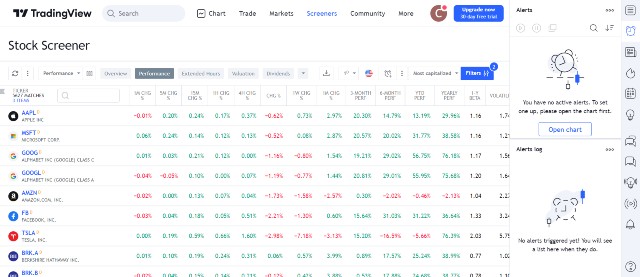

5. TradingView

TradingView is a market leader in financial charting technology. Its interactive and easy-to-use charts have won over the hearts of numerous traders.

In addition, the platform offers a reliable stock screener that helps you find the right stocks to trade as well. Thus, if you are already a Tradingview subscriber, you might not need to look elsewhere.

Stock Screener

TradingView’s stock screener complements its high-quality chart drawing tools. The tool has dozens of popular screeners you can select from, including the following:

- Market Cap

- All-time high/low

- Most Volatile/Unusual Volume

- Volume Leaders

- Overbought/Oversold

You can also add filters to screen out those you don’t need. Currently, there are more than 50 fundamental and technical filters to choose from. You can then input your desired value and everything will be all set.

Tradingview allows its users to adjust the time interval of the screener freely. Thus, day traders can use a 1-minute or 5-minute timeframe to find the right trading candidate.

Once you find the right stocks to trade, you can use Tradingview’s interactive chart and its numerous indicators to help make trading decisions.

The drawback is that the screening criteria are too few (60 for both fundamentals and technicals). Thus, it is likely that some traders will not be able to find the criteria they want.

Pricing

As a freemium tool, you can permanently use Tradingview as a free stock screener.

However, it would be better if you choose to upgrade to paid plans, as it would provide access to more indicators per chart, the alert system to monitor stock trades, real-time quote support, and many more. These features will help improve your quality of life significantly.

Currently, Tradingview offers three pricing plans as follows:

- Pro – $14.95 per month or $155 per year

- Pro+ – $29.95 per month or $299 per year

- Premium – $59.95 per month or $599 per year

On average, if you choose the yearly option, you will get a 16% discount.

However, you will need to pay extra for real-time quotes as well. The pricing is $2 per month per market.

For example, if you want real-time quotes from NYSE, Nasdaq, and OTC, you will need to pay $6 per month (counted as three markets) and a Pro subscription from Tradingview ($14.95.) The total amount you need to pay is $14.95+$6 = $20.95.

You can try any of Tradingview paid plans for free for 30 days.

Pros and Cons

Pros

- Cover all global stocks

- Easy-to-use stock screener with full customization of filters and time interval

- Excellent built-in interactive charts and indicators to use with a stock screener

- Fast and clean user interface

- Access to real-time market data

- Reliable alert system

- Free use of stock scanner + Affordable pricing for paid plans

Cons

- No in-depth screening criteria as other tools

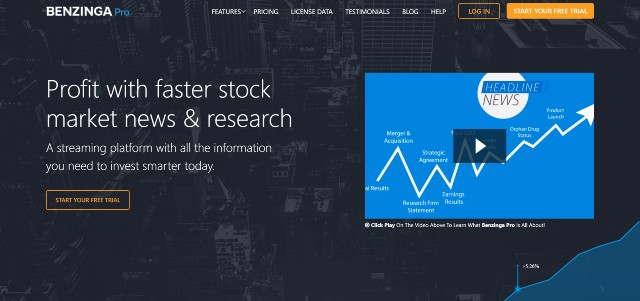

6. Benzinga Pro

Benzinga Pro is one of the most comprehensive stock research tools and unarguably the best considering the freshness of financial data.

The platform also offers a top-notch stock screener. You can then search and filter stocks by any attribute.

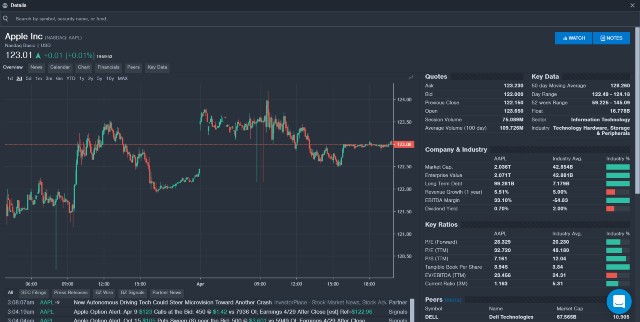

Premium Stock Screener and Real-time Scanner

Premium Stock Screener is one of the core features of the Benzinga Pro platform.

Using the tool is straightforward. Just select from various fundamental and technical screening criteria to find the right investing or trading candidate.

However, most criteria seem to lean toward the technical part. Thus, chartists and day traders would find more use from this stock screener.

Still, the best part of the platform is that its screener is user-friendly and super fast. I have never encountered any clunkiness.

Real-time Scanner – Furthermore, Benzinga Pro delivers real-time pricing data straight from the exchanges. Thus, you can even perform a real-time scan of the stock market.

For example, you can find large-cap stocks that go up sharply and trade many times their average volume in an instant. Thus, any day trader can snatch the first-mover advantage and profit from it.

Other Relevant Features

Below are additional features that are relevant and best complement stock screeners.

Stock Data – Like other platforms, Benzinga Pro provides comprehensive stock data that you can use for further research. The data is well-presented, thus effortless to understand.

Why Is It Moving (WIIM) – Stock traders are frequently dumbfounded over weird or counter-intuitive price movements. Since they fail to find a logical answer, they cannot act on time and make poor trading decisions.

Benzinga Pro always has answers to those. You will always perceive why the stock is moving in a peculiar direction.

Signals and News Platform – As a financial news platform, Benzinga unsurprisingly offers fresher financial data and faster breaking news than any platform that retail traders can access.

Therefore, traders who use Benzinga Pro can buy or sell positions before others can act. You can then profit handsomely from earnings season trades and “battleground” stocks.

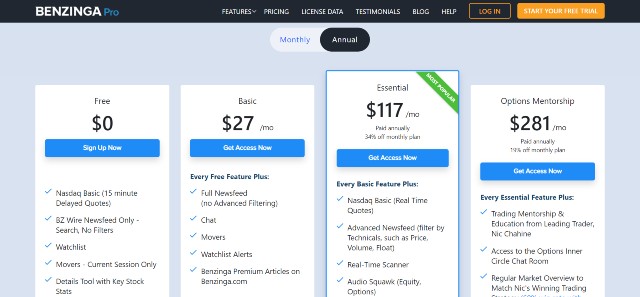

Pricing

Benzinga Pro currently offers two pricing plans as follows:

- Basic – $27 per month

- Essential – $177 per month or $117 per month (annual billing)

- Options Mentorship – $281 per month

I suggest you skip the Basic plan and subscribe to the Essential plan instead. This is because the Basic plan does not provide access to the stock screener and real-time quotes.

The Options plan would add options mentoring and an unusual options activity tracker on top of the Essential plan. However, these add-ons are unnecessary for most stock traders.

Suppose you are unsure whether Benzinga Pro is the right tool for you. I suggest starting a free trial to try all of its features for 14 days.

[sc name=”bgpro” ][/sc]Pros and Cons

Pros

- Excellent stock screener for day traders, trend followers, and all other chartists

- Real-time quotes included alongside high-quality chart drawing tools

- User-friendly, innovative platform with no clunkiness

- Effortless to use

- Provide the freshest financial data and fastest financial news

- WIIM can be extremely beneficial to help make trading or investing decisions on time.

- Excellent alert system

- 14-day free trial

Cons

- The screening criteria available on the Premium Stock Screener are not as varied and in-depth as other platforms, especially fundamental data filters.

- Much more expensive than competitors

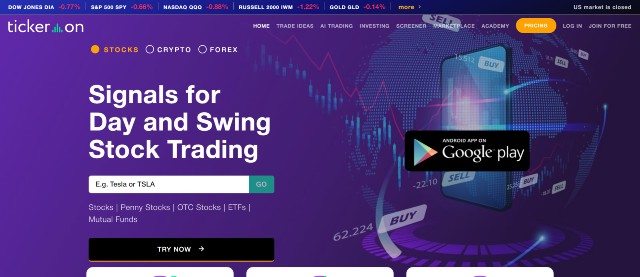

7. Tickeron

Tickeron is one of the AI stock trading tools that utilize the power of machine learning to optimize stock returns.

Apart from its AI portfolios, Tickeron can spot various stocks in tradable patterns and notify its users in real-time. Furthermore, it has a robust stock screener that considers fundamental and technical metrics and provides users with the best stocks available.

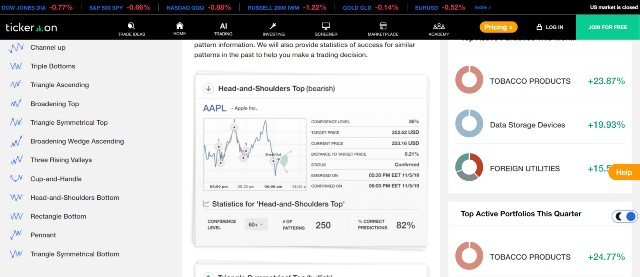

AI Real-Time Patterns

This screener uses AI to search the entire US market and find stock trading signals from various timeframes in real-time. These signals can be either bullish or bearish, such as cup-and-handle, flag, triple-tops, etc.

Upon discovery, AI will send you an alert along with the report, which includes the following:

- Confidence Level (You can order AI to filter out those with low confidence levels)

- Target Price

- % Correct Predictions

With this technology, you can handily find the stock that has just broken out from the pattern. You can then just follow the trend and book hefty profits. I found the AI to be quite accurate in recognizing the patterns.

However, this does not mean that you will never lose your money. In reality, you frequently will do so, as AI can still make mistakes.

It would be best to manually confirm the signal with interactive charts and evaluate the risks before initiating a trade. Also, keep in mind that you should never overtrade in any circumstances.

Tickeron Stock Screener

Tickeron Stock Screener is a simplified tool that allows users to use fundamental and technical criteria to screen for top stocks.

The selection of fundamental criteria is subpar compared to Gurufocus or Stock Rover. The filters are too few and oversimplified. Instead, it is the technical criteria that interest me.

Tickeron’s screening criteria are straightforward to use. However, what I like most is that users can use trending direction and popular indicators as criteria.

For example, you can customize the screener to find a stock that is trending downward, but its RSI is less than 30 (likely to be oversold). Within less than a minute, you will receive stocks that are potential candidates for day trading.

Best of all, each screening result comes with a detailed summary of the stock. On the fundamental side, you will get financial data and earnings history. In contrast, on the technical side, you will get the outlook and odds ratio according to popular indicators and AI predictions.

From an overall perspective, since Tickeron can quickly find stocks in tradable patterns, I believe both Tickeron tools complement Benzinga Pro or Tradingview perfectly.

To be specific, after you receive trade signals from Tickeron, you can manually confirm it by using charts on any of these two platforms. Subsequently, you can send an order on the brokerage platform to reap the profits.

Pricing

Tickeron has a highly complicated pricing structure as follows:

First of all, all paid users have to subscribe to the Intermediate plan, which costs $15 per month. The plan will grant access to Tickeron’s daily trade ideas and its built-in alert system.

The next step is to select the additional features you want to add to your plan. Below is the pricing for each feature.

- AI Real Time Patterns (RTP) – $20 per month

- Tickeron Stock Screener – $20 per month

- Time Machine (an additional feature that allows users to use historical data in the scanner) – $40 per month

The last feature is for educational purposes. Thus, I don’t think you will need it unless you want to backtest your trading strategy.

Thus, if you subscribe to only two features, the pricing will be $15+$20+$20 = $55 per month, which I believe is perfectly reasonable as you can use the sheer power of AI to your advantage.

Alternatively, you can subscribe to the all-inclusive Expert plan. You will need to pay extra for any features on the Tickeron platform.

You can try Tickeron for free for 14 days.

Pros and Cons

Pros

- Unarguably one of the most straightforward stock screening tools to use for day trading, swing trading, and trend following.

- Innovative use of AI to search for trade signals in real-time

- Intuitive, easy-to-use platform

- Simplified stock scanner with excellent data visualization

- Use multiple technical indicators as criteria

Cons

- AI can still make mistakes in recognizing stock patterns. Although the results are modestly accurate, you still need to confirm manually with the charts and evaluate the trading risks.

- Limited customization of stock screeners.

- Small number of criteria compared to other tools.

- Complex pricing structure

8. TrendSpider

TrendSpider is an exceptional stock chart tool and a formidable rival to TradingView. Its developers recently released a new feature called “Market Scanner,” which helps traders screen the US market for good trade ideas.

Market Scanner

TrendSpider’s Market Scanner functions as a technical analysis search engine. It will use technical indicators as criteria to search the US stock market for ripe trading opportunities.

Prebuilt Scans – TrendSpider has already created 20 pre-built scans that you can use immediately to find suitable investments (stocks, ETFs, Cryptocurrencies, FX, etc.).

Most of them are common strategies that you will be familiar with, such as Golden Cross, Death Cross, Moving Average Pullback, etc.

You can watch the video below to understand how it works.

Mix and Match – Unlike other technical stock scanners, TrendSpider allows users to mix and match any technical indicator and timeframe together to create a personal screener based on their trading strategy.

If your trading interests are limited to small caps, you can also specify the scanner to perform a scan only on those on small-cap indexes.

Backtesting: you can also use its compelling backtesting feature to improve the results as well. This feature can help you gain insights into whether the stock signals you receive from the scanners are lucrative by backtesting them with 20+ years of historical data.

Thus, you can rest assured that your strategy is in good shape.

Finally, technical traders can also benefit from other TrendSpider excellent features, including automated technical analysis tools or a dynamic alert system to find new trading opportunities and make timely decisions.

Pricing

As of August 2021, TrendSpider offers three pricing plans as follows:

- Premium – $39 per month or $33 for annual billing

- Elite – $79 per month or $65 for yearly billing

- Master – $119 per month or $97 for yearly billing

All plans provide access to all of TrendSpider’s stock scanning features. The only difference is that Premium plan users can set the minimum scanner timeframe to 1 hour, while those on Elite and Master can set it as low as 1 minute.

Thus, if you are a day trader, it would be best to subscribe to the Elite or Master plan. However, if you trade in a longer timeframe, the Premium plan may suffice. However, you will not gain access to backtesting or complex alerts at all.

In essence, the Master plan is better than the Elite plan only because it offers more resources (more results per scan, more workspaces, longer alert expiration time.) If you don’t need those, the Elite plan is more than adequate for most traders.

You can try TrendSpider without charges for 5 days.

[sc name=”tspider” ][/sc]Pros and Cons

Pros

- Real-time price data

- Extremely flexible scanning conditions based on technical analysis

- Backtest your stock signals with 20+ years of historical data

- High-quality interactive charts with machine learning assistance

- An excellent dynamic alert system

- User-friendly web and mobile platforms

- 7-day free trial to test all the features

Cons

- Expensive

- Starting a free trial requires a credit card.

- TrendSpider is not the easiest platform to use. New users will need to learn how to use the platform from video guides.

Other Alternatives

Below are other alternatives that may be the best stock screeners for some. However, as I have encountered some issues with them, I would leave them here just now.

Tykr – Tykr is a platform that aims toward value investors. Apart from its stock scanner, Tykr offers numerous features that you can use to manage your investments.

The platform is promising. Its customer support is extremely helpful. However, as the platform is extremely new at this point (months-old), I have encountered technical glitches. Its features are also meagre.

Hence, I would say the platform is not the best stock screener at this point, but has a strong potential to rival Gurufocus and Finviz in the future.

TC2000 – Recommended by several bloggers, TC2000 is a comprehensive tool comprising a stock and option screener, stock chart, paper trading, and even a full-fledged brokerage account.

Despite its usefulness, the platform is painfully slow, particularly its web platform. Benzinga Pro and Scanz are much more user-friendly at this point.

Scanz is a platform that aims to help prevent technical traders from being the “last one to the party” and missing huge gains from a particular stock because they failed to be aware of such stock earlier.

As of August 2021, Scanz still does not have a web or mobile platform. Users must download and install the software on their computers. Thus, the platform is not suitable for those who frequently trade by using mobile devices.

Still, Scanz offers various features that very few technical stock screeners provide, such as short squeeze and break-out scanners. Therefore, if you trade mainly through your desktop or laptop, you might want to give Scanz a try.

Mometic – Mometic is a newcomer in this highly competitive industry. Its innovative platform, MOMO, is a comprehensive trading tool that consists of a momentum scanner that finds breakout stocks, instant stock alerts, and a news stream.

The platform looks promising. However, its features are still fewer than competitors such as TrendSpider.