Options trading can be highly lucrative. Leading options traders can make a lot of money in a short period. This is due to the leveraged and volatile nature of the instrument itself.

However, making money from options can be challenging. In fact, most options traders lose money. In some extreme cases, they lose even more than their life savings.

Hence, if you want to get into options trading, I suggest starting with an online options trading course to ensure that you are on the right track and develop “the right” attitude and mindset for profitable trading.

Currently, there are numerous options trading courses available. Unfortunately, not all trading courses are created equal. Some are poorly created and are not worth your money and time.

This article will help you separate the wheat from the chaff. I will focus only on the best courses that are helpful in developing your options trading skills. You can select the one that suits your preferences and budget and start learning right away.

Affiliate Disclosure: This article from Victory Tale contains affiliate links. We will receive a small commission from our partners if you purchase options trading courses through those links.

Nonetheless, we always value integrity and prioritize our audience’s interests. Thus, you can rest assured that we will present each course truthfully.

Things You Should Know

Options Trading =/= Get Rich Quick

Before proceeding further, I would like to emphasize that options trading is never one of the “get rich quick” schemes.

Those who promise that you can make millions in no time from options are very likely to be scammers who aim to rip you off. If you encounter such promotional campaigns on social media, just avoid them at all costs.

You need to understand that profitable options trading requires a substantial commitment. You will gradually develop a sound strategy that fits your risk profile, put forward the right attitude and mindset, and learn from your mistakes.

Your Risk Profile

Everyone has a different risk profile. Some are more willing or have the ability to take risks than others. Since options are a leveraged financial instrument that a significant misstep can cost you everything (including your shirt), options trading is unfortunately not for everyone. As a trader myself, I am far more comfortable trading stocks.

Before investing your savings in any course, you should read this article from Merrill that explains the benefits and risks of options in detail. Next, you should evaluate your risk profile. If you cannot lose a substantial amount of your trading capital, you may want to avoid options trading altogether.

Criteria

Below are the criteria for the best options trading courses:

Prerequisites

All courses on the list have no prerequisites. You do not need to have prior trading experience. However, knowledge of financial markets would be helpful.

1. The Complete Options Course: Calls, Puts, Long, Short & More

This Udemy course from Chris Haroun is unarguably one of the most comprehensive options trading courses available. Based on my observations, it features almost everything that a knowledgeable options trader should know.

Therefore, if you are determined to become an options trader, buying this course would be an excellent investment.

Course Content

Below is a summary of topics that you will learn from this 29-hour course:

Introduction to Options Trading – The first section will go over options trading basics, including going long or short, calls and puts, options volatility, and the nature of options.

Options Terminologies and analysis – The second section will explain the key terminologies for options trading, including the Greek formulas, historical/implied volatility, open interest, etc.

Subsequently, you will grasp how to conduct options analysis by evaluating this information.

Options Valuation – In this section, the instructor will explain how to find the value of specific options by using three methods: Black-Scholes, Binomial Pricing, and Monte Carlo Simulation.

Upon section completion, you will be comfortable calculating the intrinsic value of each option like professional traders. This knowledge can be extremely useful in identifying mispriced options that can be lucrative trading opportunities.

Options Strategies – The final section will be devoted to options strategies. You will start with a basic single options strategy and proceed to a more advanced multiple (2-4) options strategy. Hence, you will understand how to implement them one by one.

This course, unlike most others, comes with numerous Excel exercises and quizzes that will test your understanding. Hence, you will gradually develop your skills and become a proficient options trader.

Reviews: 4.7/5.0, Students: 7900+

Pros & Cons

Pros

- Unarguably the best options trading course for determined learners

- Taught by an award-winning MBA professor who worked at top firms such as Goldman Sachs and Citadel

- Well-organized curriculum

- Bite-sized but informative video lessons, which are effortless for students to review key concepts

- Clear explanations with visual illustrations

- Include various Excel exercises that you can complete to practice your skills

- 30-day money-back guarantee + Lifetime Access

- Inexpensive ($20 or lower when on sale)

Cons

- Several students noted that some sections are pretty repetitive.

- Some Excel spreadsheets may be excessively detailed to students.

2. Options Trading Basics (3-Course Bundle)

If you are an absolute beginner in options trading, I suggest taking this Udemy course from Hari Swaminathan since it goes over the fundamentals in detail. Upon completion, you will have sufficient knowledge to kickstart your trading and smoothly proceed to more advanced training.

Course Content

Below are the topics that you will learn from this 11.5-hour course.

Call and Put Options – This section will explain both types of options and options trading basics in general. You will perceive how each option works (from the buyer’s and seller’s perspectives) and how to use it in your trading strategy properly.

Options Theoretical Foundations – To trade options like professional traders, you will need to understand all the terminologies and relevant theories.

Thus, this section will go over the theoretical foundation of options trading, including the concept of time decay and options Greeks (Delta, Gamma, etc.)

Options Market Mechanics – This section will delve into how the options market functions. Later, you will perceive the role of market makers and understand basic options strategies.

Options Strategies – This final section will drill deep into more advanced option trading strategies. In other words, you will learn how to implement options in your trading or investment portfolio to enhance gains or hedge against massive losses.

I like this course because it includes several case studies that you can study to grasp how to position options trades in real life. This would help prevent beginners from making unintentional mistakes that can cost them hundreds of dollars or even more.

Reviews: 4.4/5.0, Students: 48700+

Pros & Cons

Pros

- Taught by a founder of an options mentoring company

- One of the most beginner-friendly option trading courses

- Comprehensive, easy-to-follow curriculum

- Clear and informative explanations of fundamental concepts

- Include multiple case studies

- 30-day money-back guarantee + Lifetime Access

- Inexpensive ($20 or lower when on sale)

Cons

- The lessons are not bite-sized, making them difficult for students to review specific sections.

- Do not cover advanced concepts + Several parts are repetitive to some students.

3. Options Trading for Rookies Series

Suppose you want an options trading course that delves more into advanced concepts. You may want to consider this series by Kal Zurn, a veteran options trader with more than a decade of experience.

Course Content

This series contains six short Udemy courses. You will need to buy each separately since Udemy does not implement the bundle pricing.

3.1) Understand Options Completely

The first course will give you a general idea of how the options market works. You will understand the difference between stocks and options and grasp the way traders can gain or lose from buying and selling call and put options.

I appreciate how the instructors use multiple scenarios to explain the probability of profit and loss for each type of option and visualize all the abstract stuff. Hence, this approach is exceptionally beginner-friendly and can help you understand critical concepts in no time.

Course Duration – 2.5 hours, Reviews: 4.6/5.0, Students: 25500+

3.2) Basic Options Strategies

This online course will explain foundation options strategies, including buying or selling verticals and Iron Condors. Unlike the first course in the series, this one will delve into tips and techniques that you can implement in your actual trading to improve your performance.

Course Duration – 2.5 hours, Reviews: 4.7/5.0, Students: 16500+

3.3) Make & Manage Profitable Trades

The third course will provide insights on how to manage options trades. You will learn to choose the optimal position sizing, manage winning and losing trades, and diversify risks.

The topics in this part appear dull. Undoubtedly, very few instructors choose to cover them. However, I can say that they are crucial for your trading success. This is because these will prevent you from making the most dangerous trading mistakes, overtrading.

Course Duration – 2 hours, Reviews: 4.8/5.0, Students: 8600+

3.4) Complete Guide to Stock Options

The fourth course will drill deep into advanced options trading strategies, such as covered calls, naked calls and puts, and iron condors.

Subsequently, the instructor will introduce you to fundamental and technical analysis concepts related to options trading. Upon completion, you will become familiar with the Greeks and be able to identify profitable options trades on your own.

Course Duration – 3 hours, Reviews: 4.8/5.0, Students: 16200+

3.5) Advanced Iron Condor Strategies

This course focuses entirely on six types of iron condor strategies. You will understand when to implement different variations of iron condors to maximize profit at controllable risk levels.

Course Duration – 1.5 hours, Reviews: 4.8/5.0, Students: 4400+

3.6) Technical Analysis and Options Trading

This course will teach you how to interpret stock charts, which all traders use to find trade ideas. Specifically, you will learn about chart patterns, indicators, and profitable trading setups.

Course Duration – 1.5 hours, Reviews: 4.8/5.0, Students: 1600+

Pros & Cons

Pros

- Taught by an experienced options trader with more than a decade of experience

- Straightforward curriculum, presenting each topic in a logical manner

- Beginner-friendly in general

- Include a section on managing options trades, which can be extremely useful to new traders

- Each course is equipped with various visual illustrations, which can help beginners understand all the complex stuff in no time.

- Lifetime Access + 30-day money-back guarantee

Cons

- Students need to purchase all six courses to access the entire curriculum, which can cost as high as $120 in total, even buying them on sale.

- Several students believe some lessons should be more informative.

Options Mentoring Services

The following section will not feature options trading courses. Instead, it will discuss an options mentoring service, which provides new traders with trade ideas, mentor access, and real-world tips and techniques.

I find this service an excellent addition to the options trading courses above. Such courses will already equip you with theories and foundational information. However, to be successful in options trading, you need to implement them flawlessly in real life as well. This is where an options mentorship service can be beneficial.

Important Note: This service will offer you numerous tradable opportunities, which you can trade right away, even without conducting your own research. However, I do not recommend doing so.

In trading, you should not blindly believe your mentor (and anyone else). Based on my observations, every expert’s performance has ups and downs. There could be a year when his recommended ideas or strategies do not perform well.

Furthermore, these strategies may not match your risk profile. In a losing trade, you may not be able to handle considerable losses to your portfolio (even if it is short-term). It is thus vital to use your judgment to evaluate every trade idea before executing an order.

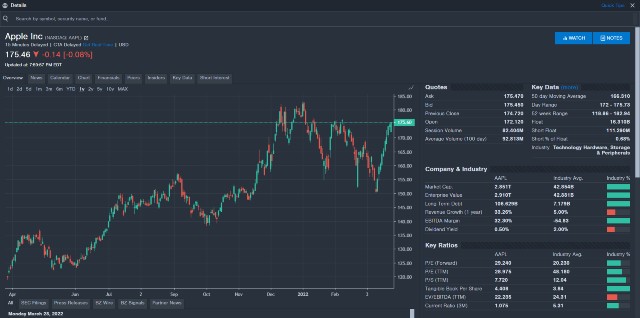

4. Benzinga Pro’s Options Mentorship

Benzinga Pro’s Options Mentorship is the ultimate solution for stock and options trading. Unlike others on the list, this mentorship will provide not only educational resources but also actionable trade ideas and the tools you can use to trade options in real life.

Key Services

Below is what you will get from this service:

Live Day Trading Room – Nic Chahine, a veteran trader with more than two decades of experience, will be your mentor. During every trading day (Mon-Fri, 9 AM-4 PM ET), you can connect with Nic through the live trading room, where you can ask him about any trading opportunity.

In addition, Nic will also call out actionable trading opportunities that you can trade right away. Hence, you will never run out of trade ideas.

Daily Trade Picks – You will receive a 10-15 minute video, which will provide a trade idea and a detailed analysis of the trade. Hence, you can learn more tips, techniques, and grasp how to perform a comprehensive analysis, and develop a mindset like a professional trader.

Regular Market Overview – Nic will analyze the stock market and provide you with comprehensive insights in the most logical manner.

Weekend Strategy Sessions and Charting Review – During the weekend, you can access a special session where Nic will analyze the charts of specific stocks and set up a game plan for the next trading week.

If you already have the stock that you are interested in, you can send a request to Nic to cover it in a weekend session.

Unusual Options Activity – One of the most profitable options trading strategies is to identify smart money moves early before they cause a sharp movement in price. Hence, you can get in the position on time and make huge profits.

However, spotting such moves is not easy. Upon subscribing to this mentorship, you will be notified once these hidden activities occur, allowing you to leverage them.

Benzinga Pro Platform – This mentorship provides complete access to the Benzinga Pro platform, which unarguably offers one of the best investment research tools available to individual traders.

Therefore, you will not need to subscribe to another technical analysis or stock research software.

If you are interested, you can sign up for a free intro session.

Pricing

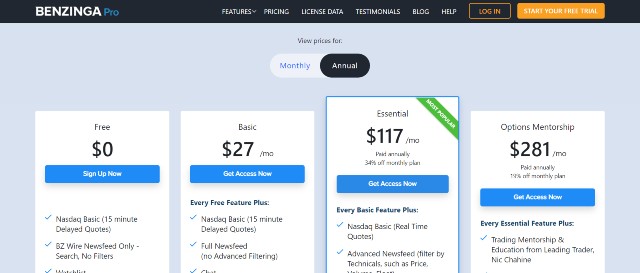

The subscription starts at $281 per month (paid annually). Even though the price tag may appear expensive, I think it is an excellent investment for beginner traders.

This is because you will get a reliable mentor that can help you mature as a trader. You will learn to have the right attitude and other trading skills that no other online courses can teach. All of which is vital for success in options trading.

The subscription also provides access to an excellent trading platform without additional fees. This platform alone is worth more than $150 per month.

In other words, the mentorship only costs $130 monthly. Trade ideas that you get from this mentorship can quickly pay you back many times this amount. You can also switch to a more affordable technical analysis platform once you can perform a trade analysis on your own.

[sc name=”bgpro” ][/sc]Useful Tools and Related Courses for Options Trading

Options Screeners – These screeners help you find options trading opportunities or identify unusual options activities. I recommend subscribing to one of them if you are new to options trading.

AI Stock Trading Software – AI and machine learning are revolutionizing the world. You can also use its power to improve your trading performance or find more opportunities.

Financial Markets – If you are new to trading in general, you may want to learn more about the nature of the financial markets. These courses will help you understand how modern financial markets function so that you can get a foothold shortly.