Are you looking into management consulting, investment banking, equity research, or a similar career? If yes, it would be wise to develop some skills in financial modeling beforehand.

Financial modeling deals with the quantitative side of corporate finance and investment analysis. It delivers accurate predictions of a company’s financial position and allows analysts to determine its intrinsic value of equities.

Thus, financial modeling is required for anyone who wants to break into Wall Street. If you want an investment banking internship or a full-time offer from leading firms such as Goldman Sachs or J.P. Morgan, mastering financial modeling is 100% necessary.

Though you may have learned financial modeling in college as I did, you still need to adapt that knowledge to real-life usage, which is unsurprisingly not easy.

I always remember how I felt when I was “bombarded” with extremely complex financial modeling questions and ended up being rejected by top investment banks.

Therefore, it makes sense to consider taking up real-life or practical financial modeling training online before applying for an internship in Finance, especially investment banking positions.

As of early 2023, many financial modeling courses have been launched. Some are more beneficial than others. You might not know which one works best, so I decided to separate the wheat from the chaff for you.

This post will feature the best financial modeling courses to learn online. I can ensure that each course will provide you with the skills and knowledge essential for your job application success and will be an excellent investment of time and money.

Disclaimer: This post from Victory Tale contains affiliate links. We will receive a commission if you purchase financial modeling courses through our links. We will use this income to improve the website and create better content for all visitors.

As always, we put our audience’s interests above all else. Hence, you can rest assured that the courses recommended by us will be of high quality.

Criteria

Below are the criteria for the best financial modeling courses:

1. Wall Street Prep’s Premium Package

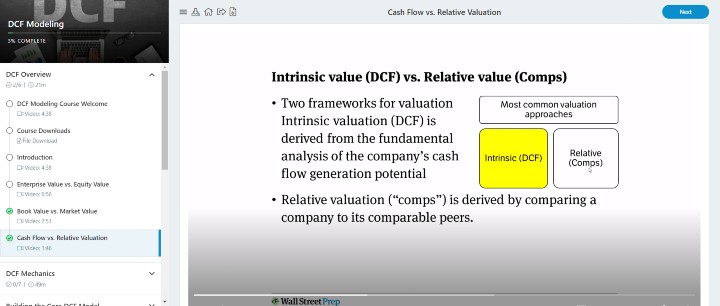

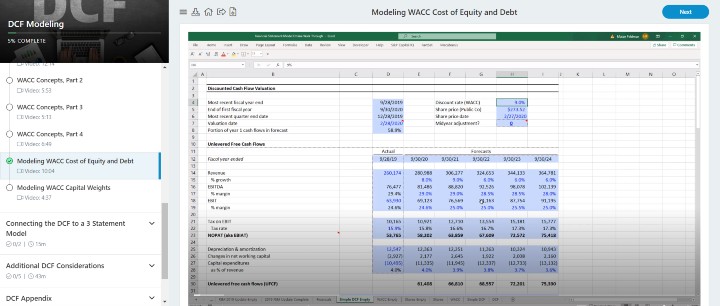

Wall Street Prep is a company that exclusively provides excellent finance courses for students. Designed by experts, the Premium package will help you develop and strengthen your financial modeling skills in no time.

Course Content and Pricing

The Premium package is the flagship product of Wall Street Prep. In this package, you will learn everything necessary for building professional financial models.

The package comprises six minor courses for self-studying as follows.

- Financial Statement Modeling

- DCF Modeling

- M&A Modeling

- Trading Comps Modeling

- Transaction Comps Modeling

- LBO Modeling

Within one package, you will understand how finance professionals build and utilize these models. The entire course length is 46 hours, which is more than enough to understand these topics thoroughly.

Furthermore, you can access other 36 mini-courses, which will drill deep on several miscellaneous topics such as hostile takeovers, commercial real estate modeling, or project finance. Each course is 1-2 hours long.

This package also includes a 30-minute session where you can meet with your instructor online. You can ask him about the course or any other questions and upload your resume and cover letter to get feedback.

The pricing for the Premium package is $499 one-time.

Besides the Premium package, Wall Street Prep also has industry-specific financial modeling courses such as real estate, oil & gas, or restructuring modeling. Nonetheless, these are separate courses, so you need to pay more to access them.

Use the code ‘VICTORY’ after clicking the link below to get 15% off

Pros and Cons

Pros

- Unarguably one of the best financial modeling courses available

- Highly informative video lessons

- Equip learners with real-world, on-the-job skills plus practical hands-on experience

- Include numerous mini-courses to expand your knowledge of the financial industry

- Top-notch course materials

- Self-paced learning

- Offer excellent support from instructors

- Generally speaking, the program provides a good value for money

Cons

- This package requires background knowledge in accounting (such as understanding cash flow statements) and proficiency in Excel. There will be no detailed introductory courses in the package. You have to pay extra to enroll in supplementary courses from Wall Street Prep or learn elsewhere.

2. Certified Financial Modeling & Valuation Analyst (FMVA)

The FMVA Certification by the Corporate Finance Institute (CFI) is unarguably one of the most comprehensive financial modeling courses available online.

This program will not only teach real-life financial modeling skills but also evaluate your progress very carefully. If you manage to pass the final exam, the institute will grant you an FMVA certification.

You can then add it to your resume to showcase your skills and passion for your potential employer.

Course Content

Unlike financial modeling courses in college that emphasize theories, these online courses for the FMVA would focus more on practical skills. You will learn to create financial modeling from scratch professionally as financial analysts and investment bankers at top firms.

Thus, the program will help you close the skill gap, a difference between what you learn in college and what investment banks expect from their new hires.

You can learn at your own pace by watching video lectures created by industry experts who have trained thousands of employees at top Wall Street institutions. Furthermore, there will be hands-on exercises, quizzes, assessments, and exams to test your skills.

To complete the entire program, you should spend at least 100 hours learning. According to CFI, most students usually finish it in 4-6 months.

Below are the courses included in the FMVA program:

Prep Courses (Free)

Prep Courses are optional courses that help build the knowledge grounds needed for creating professional financial modeling. These are optional because you do not need to take them to get a certification.

- Accounting and Reading Financial Statements – You will understand how to perform basic financial statement analysis

- Excel Crash Course

- Intro to Corporate Finance

- Math for Corporate Finance

- Capital IQ Fundamentals (Learn to use a platform for financial professionals)

You will need approximately 7-10 hours to complete this section of the program.

Note: In fact, you don’t need to enroll in the program to take these courses. CFI allows everyone to take it for free. You should treat them as free courses to experiment with CFI’s teaching style.

Core Courses

Core courses will teach you the essence of financial modeling, business valuation, and other modeling techniques. If you aim to get the designation, you have to complete all of these 11 courses.

The knowledge and skills that you will learn from these core courses are as follows.

- Financial Analysis Fundamentals

- Accounting Principles and Standards

- Building a financial model (Income Statement, Balance Sheet, Cash Flow Statement)

- Business valuation modeling

- Budgeting and Forecasting

- Cash Flow Forecasting

- Scenario & Sensitivity Analysis

- Dashboard and Data Visualization

- Powerpoint and Pitchbooks

- Professional Ethics

All courses will be in-depth. You will learn financial modeling by doing and getting hands-on experience from actual case studies.

After you finish this section, you will be able to build a discounted cash flow model (DCF Model), perform comparable analysis, visualize the data, and many more on your own.

Elective Courses

Elective Courses will improve your financial modeling and business valuation skills even further. You will understand advanced modeling techniques used in particular industries or business models. The difficulty level of each course is higher than core courses.

There are as many as ten elective courses to take (The Corporate Finance Institute has recently added some.) Those who aim for a designation will need only three of them. However, I suggest taking them all, as they could be beneficial for job interviews.

Below are some of the key elective courses.

- The Amazon Case Study

- Advanced Excel Formulas

- Real Estate Financial Modeling

- Startup/eCommerce Financial/Valuation Model

- M&A Modeling

- Leveraged Buyout Modeling

- Business Strategy

After you finish these courses, there will be a final exam. You will need to score at least 80% in all assignments and the final exam to get the FMVA designation, which is not easy but not excessively difficult.

The best part is that you will be ready for the toughest of investment banking interviews. Your employer will be impressed with your knowledge and skills and would be very willing to grant you an internship or full-time offer.

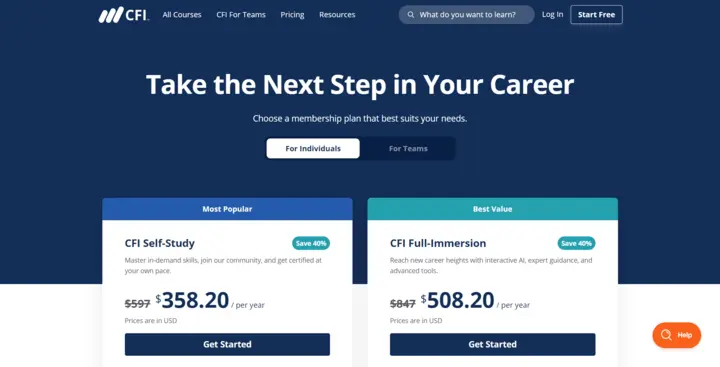

Pricing

CFI has a very flexible pricing plan. First of all, you can choose between these two options.

- Basic/Self-study – $597 per year

- Full Immersion – $847 per year

However, CFI typically offers a 40% discount to both. Thus, the real subscription fees are way lower.

The self-study option will grant access to all courses and materials on the platform. This includes not only the FMVA program but also three other programs: CMSA (Financial Markets), CBCA (Credit Analyst), and BIDA (Business Intelligence).

With a single annual subscription, you can learn all skills that significantly improve your career readiness in finance and obtain up to four highly recognized certifications.

At this pricing rate, I think the self-study plan provides excellent value for money, especially for college students who will enter the job market soon.

The full immersion plan will add more case studies, premium templates, model review & feedback, AI Chatbot support, better email support, job application review, access to premium tools (i.e., Macabacus), and other features.

Although the full immersion option is excellent, it is undoubtedly pricey. I think most students should stick with the self-study option, as all of CFI’s course materials are well-crafted. You can understand the essence of financial modeling easily by self-studying.

Pros and Cons

Pros

- Excellent online financial modeling courses

- The program is all-inclusive. There is no need to pay for add-ons.

- Learn in-depth practical skills, not theories, from top industry experts

- High-quality course materials

- Obtain a noteworthy designation after finishing the program

- No background knowledge is necessary.

- 30-day money-back guarantee if you choose a one-time payment.

- Once you subscribe to the self-study plan, you can take more than 100 courses and potentially obtain as many as four certifications, thus providing excellent value for money.

Cons

- CFI does not offer monthly subscriptions

Although the FMVA from CFI is more expensive than most competitors, I believe the program is 100% worth the price. You can master financial modeling by taking this program without looking further elsewhere.

3. The Investment Banker

The Investment Banker is a complete program for an investment banking career by Financial Edge, a UK-based training provider that offers complete financial training worldwide.

Course Content and Pricing

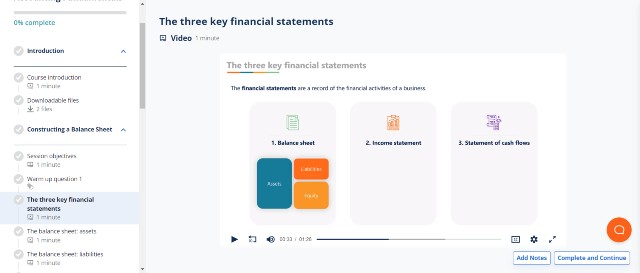

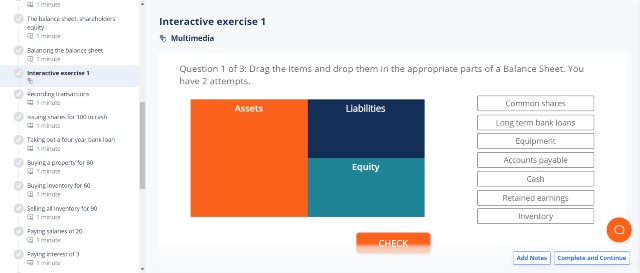

Like FMVA and Wall Street Prep, The Investment Banker is a comprehensive program that will teach you all the necessary knowledge and skills needed for a financial analyst career.

The entire program is self-paced. You will learn mostly from video lectures. However, there are also Excel exercises and assignments that you should complete to enhance your financial modeling skills.

The entire program comprises five parts as follows.

- The Accountant (13 Hours) – You will learn about the three financial statements in this section, including income statements, balance sheets, and cash flow statements. You will also understand how to interpret and evaluate each metric and be able to write high-quality reports.

- The Modeler (9.5 Hours) – Your instructors will teach you how to build excellent financial models quickly, error-free, and professionally. Furthermore, you will receive helpful suggestions, tips, and techniques to implement on your models to prevent errors.

- The Valuer (12 Hours) – This part of the program will focus on building company valuation models. You will know the methodologies that professionals use to find the intrinsic value of any business.

- The Dealmaker (8.5 Hours) – This part will explain how to apply financial modeling to mergers and acquisitions, which is essential for investment banking careers.

- Breaking into Banking interview (30 Minutes) – This short session will provide answers that future analysts may have on job applications or banking careers.

The pricing for this program is £333 or approximately $462. You can choose to purchase each part separately. However, it will be more expensive.

Once you purchase the course, you will get lifetime access to all the course content.

Pros and Cons

Pros

- Taught by experts who work at the most prestigious financial institutions on the planet

- Beginner-friendly curriculum

- Excellent video classes and exercises

- Downloadable course materials

- Lifetime Access

- Available in Mandarin Chinese

- All courses are CPD accredited.

Cons

- No money-back guarantee or refunds

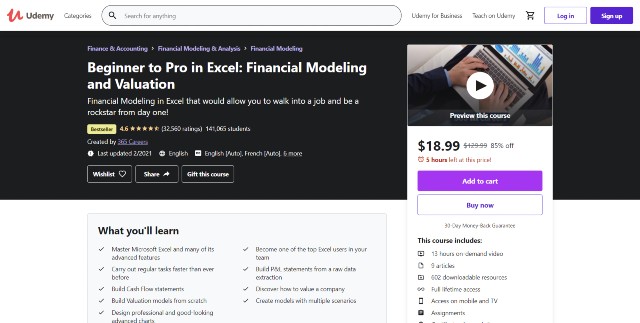

4. Beginner to Pro in Excel: Financial Modeling and Valuation

This Udemy course by 365 Careers is an affordable alternative to expensive financial modeling courses.

If you want to learn financial modeling but do not want to invest hundreds of dollars in expensive programs, I suggest you pick up this course at a discount ($18.99 or even less) and start learning right away.

Course Content

This course is essentially a combination of an Excel for Finance tutorial and an introductory online Financial modeling course. Hence, you do not need to have any background knowledge at all.

What you will learn from the course is as follows.

- Introduction to Excel (Useful Tips, Keyboard Shortcuts)

- Excel key functions

- Financial functions and Pivot Tables

- Building financial statements from scratch in Excel

- Excel charts and data visualization

- Introduction to Financial Modeling

- Introduction to Company Valuation and Mergers & Acquisitions (M&A)

- Building a discounted cash flow model in Excel

- Capital Budgeting

Like other Udemy courses, you will learn most from watching video lectures (13 hours long) and completing exercises and projects. 365 Careers has provided numerous quizzes, practices, and a cumulative project to help you develop financial modeling and business analysis skills.

Based on the reviews, the course is well-received. It scores 4.6/5.0 from 32,000 ratings and 141,000 students.

Pros and Cons

Pros

- Costs only $10 (Udemy courses are usually on sale.)

- No background knowledge is necessary.

- Excel tutorial provided

- Tons of exercises and quizzes

- Lifetime access

- 30-day money-back guarantee

Cons

- Each class touches only the basics of financial modeling.

- Lacks professional support

5. Financial Modeling Mastery

Financial Modeling Mastery is a program by Breaking into Wall Street. This exclusive training provider offers comprehensive training for those who want to pursue various careers at investment banks, private equity firms, or even hedge funds.

Course Content

This program is designed to prepare all candidates for successful job applications. You will learn from 261 high-quality videos created by experts.

The content included in the videos are

- Key Financial Accounting and Finance Concepts

- Create financial statement models

- Equity Value and Enterprise Value

- Discounted Cash Flow Model

- Utilize valuation in stock pitches, pitch books, and equity research reports.

- Find public comps and precedent transactions.

- Create a model for mergers & acquisitions

- Build Leveraged Buyout Models (LBO Models)

- Private companies, IPOs, and Reverse Mergers

- Debt, Equity and Convertibles

Unlike other financial modeling courses, you will learn to build professional financial models from more than a dozen case studies. Therefore, you will gain experience in data analysis of real-world data and an understanding of the global perspective.

This comes with notes, written guides, and word transcripts to assist you in the journey.

Furthermore, the program provides numerous quizzes, exercises, and other problems for you to solve. Experts have already prepared Excel solutions for each excel exercise, so you can check whether your work is on the right track.

Pricing

The pricing of the Financial Modeling Mastery program is $297 as a one-time payment. You don’t need to subscribe to any service.

However, if you want to add Excel and Powerpoint training to the program, you can buy the BIWS Premium, which costs $497. This bundle will be cheaper than buying each program individually.

It is important to note that the Financial Modeling Mastery program will not include industry-specific financial modeling courses. If you want in-depth training on bank, oil & gas, and real estate modeling, you have to pay $497 for each one or purchase the BIWS Platinum, which costs $1,497.

Thus, course fees for the complete financial modeling training from Breaking into Wall Street will top this list. I think BIWS Platinum is too expensive, so you should stick with the Financial Modeling Mastery program.

Otherwise, if you still want a complete program, you might find better alternatives elsewhere, such as CFI’s FMVA.

Pros and Cons

Pros

- Excellent financial modeling courses for job applications

- Learn practical skills from numerous global real-world case studies

- Excellent support from instructors

- Certification is provided after completion of the course and passing the final quiz.

- Generous 90-day money-back guarantee

Cons

- Need to pay add-ons for industry-specific financial modeling content and Excel/Powerpoint training. If you want all of these, the pricing will be higher than other Financial modeling courses.

Quantitative Modeling Courses

Unlike the financial modeling courses above that focus on building 3-statement and discounted cash flow models, below are courses that teach quantitative modeling, another type of financial modeling that utilizes advanced statistics and mathematics.

Therefore, they are suitable for those who want to apply to quant roles such as a quantitative analyst, risk manager, or financial engineer.

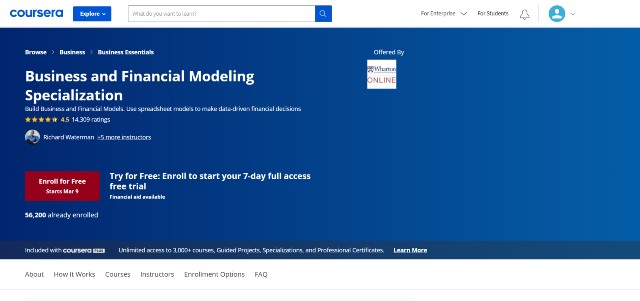

6. Business and Financial Modeling Specialization

Created by the Wharton School of the University of Pennsylvania, this specialization on Coursera is unarguably one of the best financial modeling courses available online, especially for those who want to learn in an MBA-like environment.

You will learn with Richard Waterman and other faculty members from the Wharton School.

Course Content

The Business and Financial Modeling specialization comprises four minor courses and one minor capstone project as follows.

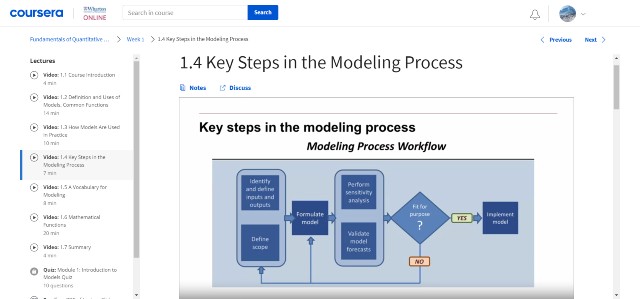

1. Fundamentals of Quantitative Modeling – This course will provide the fundamental knowledge of how finance professionals use past and present numbers to predict the future. The instructor will introduce you to several popular models and their building blocks, so you can start building one on your own

2. Introduction to Spreadsheets and Models – You will understand how to get the most from the spreadsheet models and their usage in data analysis. The instructor will introduce useful spreadsheet tools to map your present data and predict future ones.

3. Modeling Risks and Realities – The third course will teach you how to create quantitative models to reflect possible risks and uncertainty. You will understand how to control and manage them effectively and make suitable decisions.

4. Decision Making and Scenarios – This course will focus on using models to assist decision-making processes. You will understand how to create models based on business and financial scenarios and use them to ensure optimal business performance.

5. Capstone Project – You will recommend a business strategy based on the quantitative model you build. To complete this project, you will use all knowledge and skills you earned from previous courses

The university suggests you should spend 2 hours a week for six months on the course.

In terms of pricing, you can audit the entire specialization for free. However, if you want a complete learning experience, including graded assignments and feedback on projects, you need to pay $79 per month.

You can start a 7-day free trial to try the entire course.

Pros and Cons

Pros

- Learn from top experts from one of the most prestigious business schools in the world

- Well-structured curriculum

- Excellent real-world capstone project to review and test your skills

- The transcripts are easy to read.

- Receive a certificate after completing a course

Cons

- Pricey (You can mitigate this by subscribing to Coursera Plus, details below.)

Coursera Plus

If you are interested in this specialization from the University of Pennsylvania, I suggest subscribing to Coursera Plus instead.

Why?

Subscribing to Coursera Plus is considerably cheaper ($33.25 vs. $79) per month. Furthermore, you will gain full access to this entire specialization and other courses, specializations, and guided projects on the platform. This is more than 3,000 in total.

To be specific, if you spend six months on the specialization as suggested, it will cost you $474 in total. However, Coursera Plus’s one-year plan is only $399 and grants unlimited access to everything on the platform.

Thus, it’s apparent that Coursera Plus provides better value for money.

You can also try Coursera Plus for free for 14 days

[sc name=”coursera” ][/sc]Is Studying for the CFA Good for Learning Financial Modeling?

Unfortunately, the answer is no.

As a CFA test-taker, I would say the CFA curriculum will barely help you learn financial modeling.

First, the CFA curriculum is too broad, focusing on many aspects of finance. The course materials on CFA Level 1 and Level 2 explain some financial modeling and corporate finance. However, there is almost none on CFA Level 3, as the focus shifts toward investment management.

Second, the CFA curriculum focuses more on theories. You will receive no practical training, unlike the financial modeling courses recommended above. The curriculum never teaches how to build a financial model on Excel professionally as bankers do in real life.

Indeed, you can take the CFA as it is the most credible financial designation and is recognized globally.

However, if we talk about developing real-world financial modeling skills for financial careers at an investment bank or a hedge fund, these courses and programs recommended above are much more beneficial.